The GBP/USD pair was offered after the domestic data showed the UK public debt worsened in October. The pair took out support at 1.4865 and fell to 1.4807 levels in the NY session. The upward revision of the US Q3 core personal consumption expenditure figure added to the bearish pressure on the pair.

Eyes UK data

The UK third quarter GDP release due for release today growth rate unchanged at 2.3% y/y and 0.5% q/q. Meanwhile, the current account deficit is seen widening to GBP 21.50 billion.

The GDP number could turn out to be a non-event unless the figure is revised higher/lower. A downwardly revised figure could weigh over Sterling and vice versa. Meanwhile, a widening of the Q3 current account deficit could easily overshadow an upbeat GDP figure and push sterling lower. The UK current account to GDP ratio has hit record lows for last three years and may hit another record low this year as well since the goods trade deficit with EU and non-EU countries has been on the rise

Technicals – intraday bias is sideways to negative

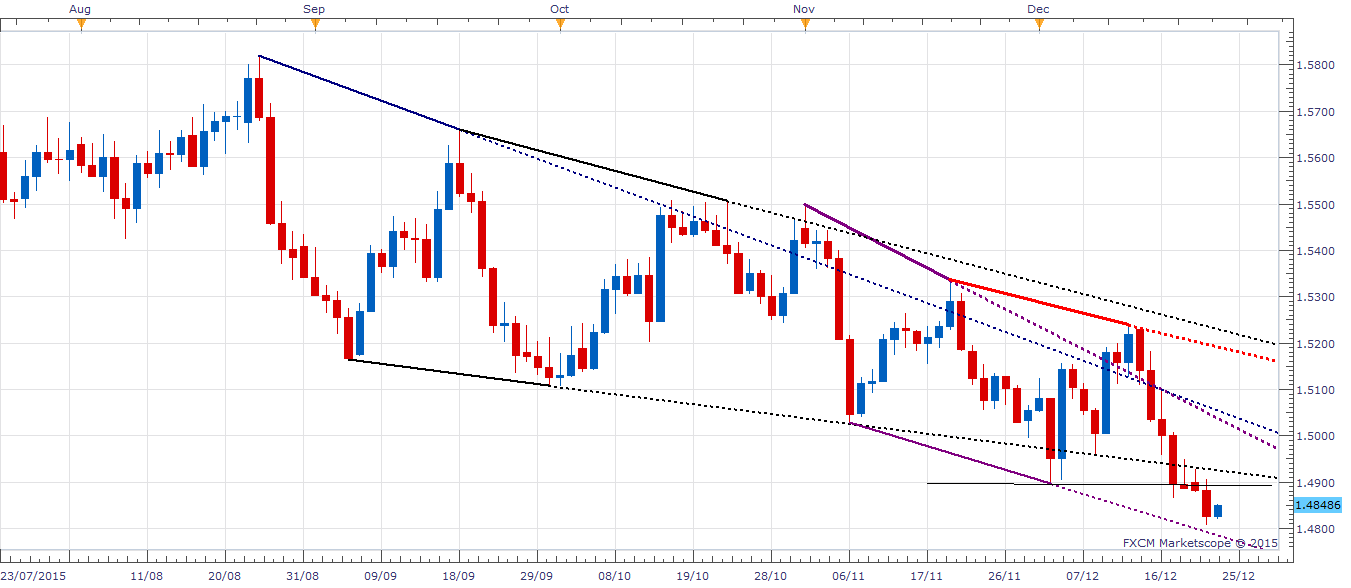

Sterling has recovered to 1.4850 levels, but a bearish break below 1.4865 has opened doors for a drop to falling channel (violet line) support now seen at 1.4784.

However, the 4-hour RSI hit the oversold territory, hence a minor correction to 1.4865-1.4888 (76.4% of Apr-Jun rally) & 1.4895 (Dec 2 low) cannot be ruled out.

The trend stays bearish and a failure to take out/sustain above 1.4865 could see the pair drop to 1.4784 levels.

Only a daily close above 1.4925 (falling channel resistance) could increase the possibility of a sideways action to bullish action in the short-term. The pair is likely to be offered on rallies so long as it trades below 1.4925 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Ethereum plunges outside key range briefly as US Dollar Index gains strength

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.