The GBP/USD revisited 1.5360 area on Wednesday after Fed’s Yellen said rates could rise in December and the economy does not see a need for negative rates. The USD also gained momentum from the sharp rise in the US ISM non-manufacturing PMI in October. The employment index under the ISM figure was also the second highest in almost a decade. The ISM services data overshadowed a not so impressive ADP figure and thus managed to push the USD broadly higher. The cable clocked to a high of 1.5445 in the European session after the UK services PMI printed higher than estimates.

Focus on BOE events

The BOE rate decision, minutes and the quarterly inflation report (QIR) is due for release today.

A 7-2 vote count would be a hawkish development that could push the cable higher to 1.5470 (100-DMA) and 1.55 levels. A daily closing above 1.55 would need 7-2 vote count plus a slightly higher revision of GDP forecasts or unchanged/higher revision of inflation forecasts.

On the other hand a neutral stance - an 8-1 vote count and a largely unchanged stance of the BOE would leave Sterling at the mercy of Us non-farm payrolls due tomorrow.

An ultra dovish development - 8-1 vote count/8-0 vote count with a downward revision of GDP and inflation forecast, coupled with negative commentary on Sterling rate could push the cable to 1.5277 (support of the rising trend line Oct1 low-Oct 29 low).

Technicals – Strong support at 1.5350

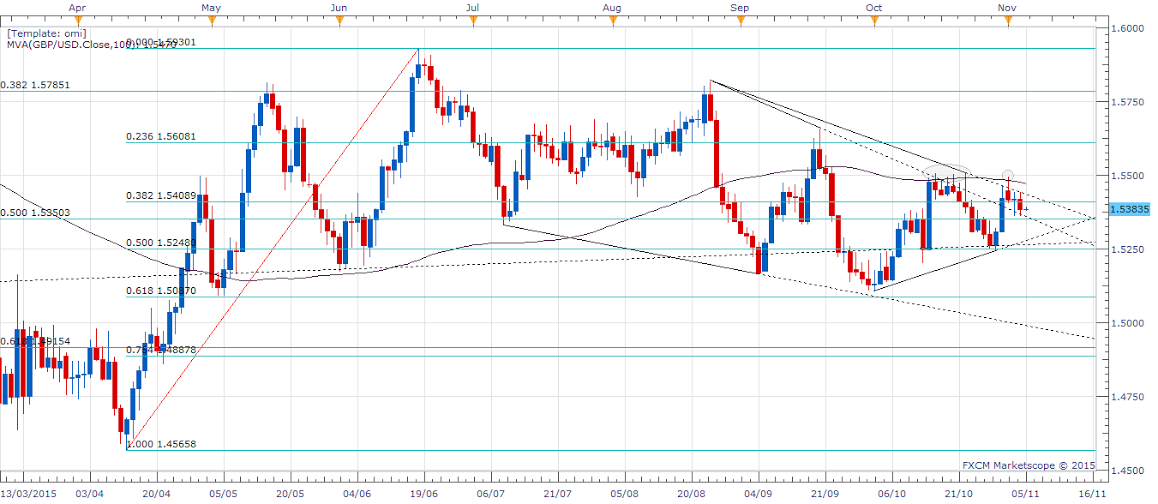

The charts could change quickly after a major event like the one due today. Hence, it is advisable to jot down just key support and resistance levels, that may be breached/tested depending on the outcome –hawkish/dovish.

Support is seen at - 1.5350 (50% of Jan 2009 low-July 2014 high), 1.5277 (support of the rising trend line Oct1 low-Oct 29 low), 1.5248 (50% of Apr-Jun rally). A break below 1.5248 would expose 1.5163 (Sep 4 low).

Resistance is seen at - 1.5433 (resistance of the falling trend line Aug 25 high-Oct 22 high), 1.5470 (100-DMA), and 1.55 levels. A break above 1.55 would expose 1.5568 (38.2% of July 2014-Apr 2015 plunge), which will be followed by a resistance at 1.5608 (23.6% of Apr-Jun rally).

EUR/USD Analysis: Bears in control

The EUR/USD pair fell to a low of 1.0844 on the back of a strong US ISM non-manufacturing figure and 'hawkish' comments from Fed's chair Yellen also helped to boost the demand for the US dollar. Both things further highlighted the growing divergence between the Fed and the ECB, which weighed heavily over the EUR making it one of the worst performing major currency yesterday.

The Eurozone retail sales due for release could be easily overshadowed by the BOE events today. Even Draghi’s speech in Milan may receive lukewarm attention until and unless the President’s comments are more dovish or slightly hawkish (marking a U-turn from last month’s December easing hint). During the European session, the EUR/USD pair could take its cues from the action in the EUR/GBP cross.

Technicals – Support at 1.0808

Euro’s failure to take out the trend line (Aug 24 high-Sep 18 high) resistance followed by a sharp drop to 1.0844 levels indicated the bears remain in control and the doors are open for a drop to 1.0808 (July 20 low). However, the oversold RSI on the Intraday charts and with the daily RSI around oversold levels, the pair could witness a technical correction to 1.0897 (last week’s low). A break above the same could lead to a re-test off 1.0940 (61.8% of Mar-Aug rally).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD gains ground on hawkish RBA, Nonfarm Payrolls awaited

The Australian Dollar continues its winning streak for the third successive session on Friday. The hawkish sentiment surrounding the Reserve Bank of Australia bolsters the strength of the Aussie Dollar, consequently, underpinning the AUD/USD pair.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.