The GBP/USD pair was the best performing major currency on Wednesday after the UK ONS reported the unemployment rate at multi year lows and a slight uptick in the wage data. Heading into the report, the sentiment was weak; courtesy of Tuesday’s weak inflation figure. Hence, the positive reaction was intense after upbeat labor and wage data. The gains were extended further after the US retail sales printed lower than expected.

Get ready to bid adieu to March rate hike

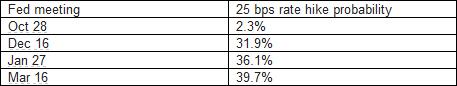

The US CPI for September, due later today, is seen dropping into negative territory. The core CPI is seen unchanged at 1.8%. The rate hike bets have already taken a hit after the dismal US retail sales report. As of now the CME fed probability of a 25 basis point rate hike stands as follows –

March 2016 also shows a 9% probability of a move in the Fed funds rate to 0.75%. So the total rate hike probability is at 50%. In case, the CPI prints in the negative, we can forget about March 2015 rate hike leading to further rally in the GBP/USD pair. It is worth noting that, more the Pound rallied, closer we move towards a weaker UK data and a possible delay in the BOE rate hike.

Technicals – Bullish above 1.5484

Sterling’s break above 1.5387, followed by a break above 1.5405 (50-DMA) indicates the spot is poised to extend gains today. However, further gains could be seen only above the falling trendline and 100-DMA resistance at 1.5484 levels. A break above 1.5484 could open doors for 1.5608 (23.6% of Apr-Jun rally). On the other hand, a failure to take out 1.5484 in early Europe could trigger a minor dip to 1.5409 (38.2% of Apr-Jun rally) – 1.5405 (50-DMA).

EUR/USD Analysis: Bullish above 1.1475

The EUR/USD pair rose to an intraday high of 1.1489 and closed the NY session around the same on the back of a broad based USD sell-off.The stage appears set for a further rally in the EUR/USD pair. The Fed rate hike bets have taken a hit as discussed above and a negative inflation figure could only delay rate hike further.

Consequently, the USD weakness is here to stay. Even if the markets turn risk averse, the safe haven appeal of the treasuries could keep USD upbeat against the risk assets, but the EUR is likely to continue its rise.

Technicals – Trades above 161.8% expansion level

Euro currently trades above 1.1475 (161.8% expansion of March low-March high-April low). The spot could extend its run to 1.1560 (Aug 26 high) in case it manages to sustain above 1.1475 in early Europe. On the other hand, a failure to sustain above 1.1475 could trigger a technical correction to 1.14 levels. Moreover, an hourly close above/below 1.1475 could decide the intraday trend today.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold gathers bullish momentum, climbs above $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.