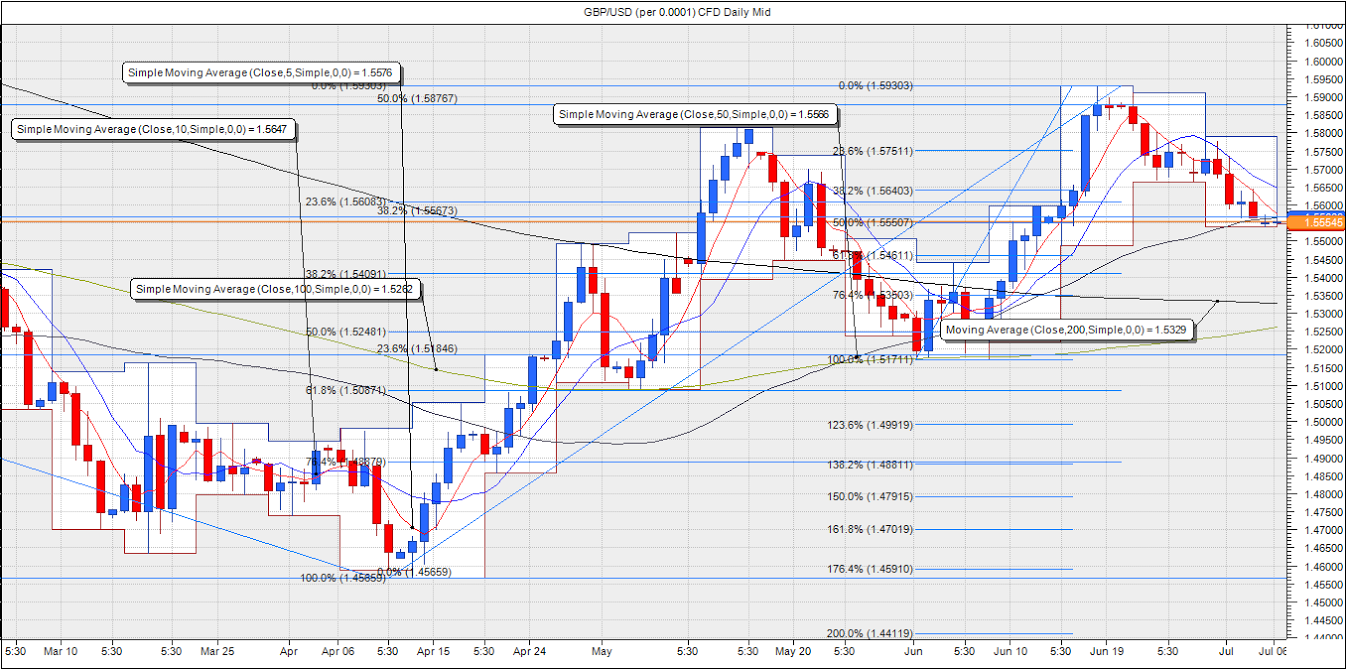

The GBP/USD pair opened lower at 1.5549 after a ‘No’ vote in Greek referendum sharply raised the prospect of Grexit. The resulting demand for the safe haven US Treasuries strenghthened the US dollar. A minor recovery is being witnessed ahead of the European morning, with pair struggling to rise above 1.5568 (38.2% R of July 2014-April 2015 plunge). With no major UK data scheduled for release today, the pair is at the mercy of the overall market sentiment.

Fresh offers could be witnessed in the early European session in response to Sunday’s referendum result. The risk aversion may not be severe as the European bigwigs are expected to be on wires, calming market nerves by verbal assurances. Ahead in the US session, the pair could be influenced by the US services PMI figures.

On the daily chart, the pair is struggling to take out the 50-DMA resistance at 1.5566 and 1.5568 (38.25 Fib R of July 2014-April 2015 plunge). The daily close on Friday (at 1.5588) was bearish; below 1.5606 (23.6% Fib R of Apr-June rally). The daily RSI has also turned bearish. However, the pair is being supported by 200-MA on the 4-hour at 1.5545 and 50% Fib R of June rally at 1.5550. A repeated failure to take out 1.5566-1.5568 could push the pair below 1.5545 and open doors for a drop to 1.5461 (61.8% Fib R of June rally). On the higher side, a break above 1.5568 could see the pair re-test 1.56-1.5638; although such a rally could see fresh selling pressure as the outlook stays bearish so long as the pair fails to close above 1.5638.

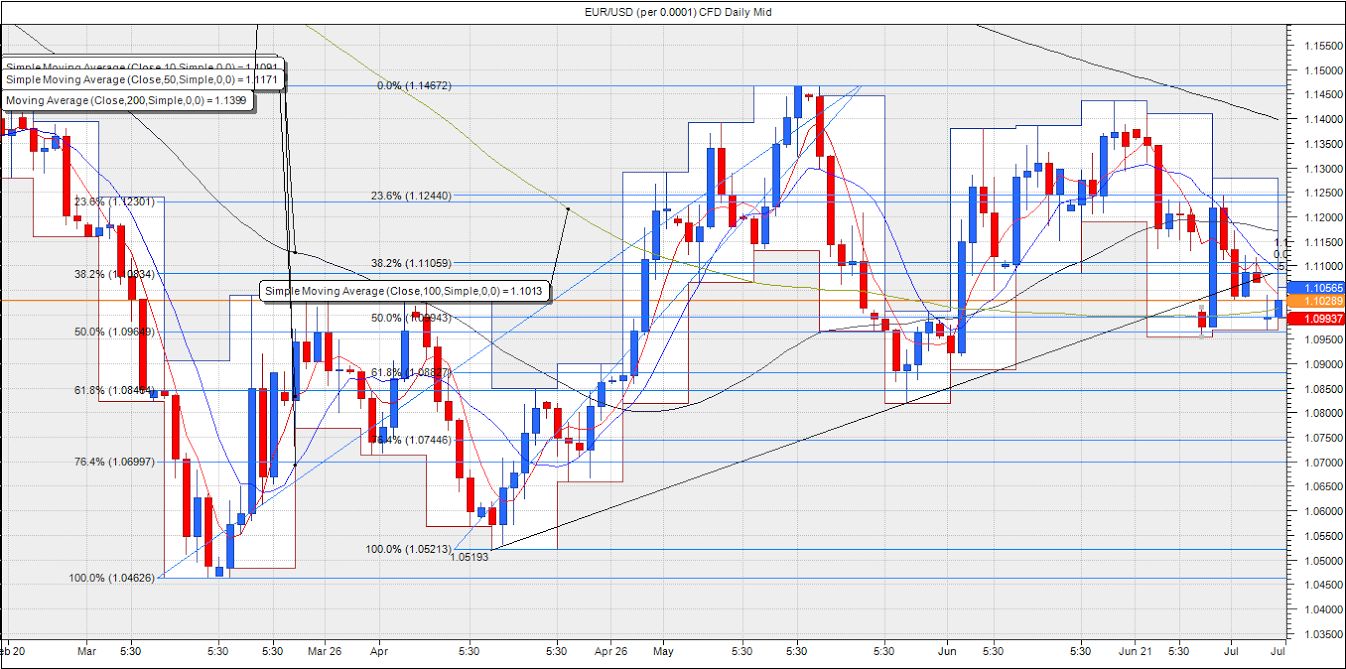

EUR/USD Analysis: Bearish below 1.0994

The EUR/USD pair opened lower on Monday after a ‘No’ vote in Greek referendum sharply raised the prospect of Grexit. The pair fell to a low of 1.0969 following Greek 'No' vote, but recovered above 1.10 levels ahead of the European morning. France and Germany have called for an emergency summit of euro zone leaders to discuss the Greece's stunning referendum vote on Sunday to reject bailout term.

With no major European data due for release, the attention would be entirely on how things unfold between Greece and its international creditors after Sunday’s ‘No’ vote. The volatility is likely to remain high as the Eurozone bigwigs are expected to be on wires in order to calm market nerves with verbal assurances. The most important piece of assurance could be heard from the European central Bank (ECB) members, who are likely to indicate readiness to do more (QE) if the Grexit situation worsens. The initial reaction to such statement could be Euro positive, however, the pair could be sold eventually. Meanwhile, a tough stance from Germany and EU could push the pair well below 1.09. At the current juncture, a new deal with a new government or Grexit appear as the most likely scenarios. A talk of deal with the new government could trigger a minor rally, but Grexit talks would be highly euro bearish.

On the daily charts, the pair has bounced-off from 1.0994 (50% Fib R of Apr-May rally) to trade above the 100-DMA at 1.1013. The daily RSI has turned bearish, while the weekly RSI also stays bearish after struggling for the couple of weeks to rise above the mid line at 50.00. The recovery could extend upto 1.1083 (38.2% Fib R of Mar to May rally). However, the bearish view remains intact as the pair breached rising trend line resistance on the daily. Consequently, the pair could be offered on the rise below 1.1083. On the other hand, a break below 1.0994 (50% Fib R of Apr-May rally) could push the spot lower to 1.0955-1.09.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.