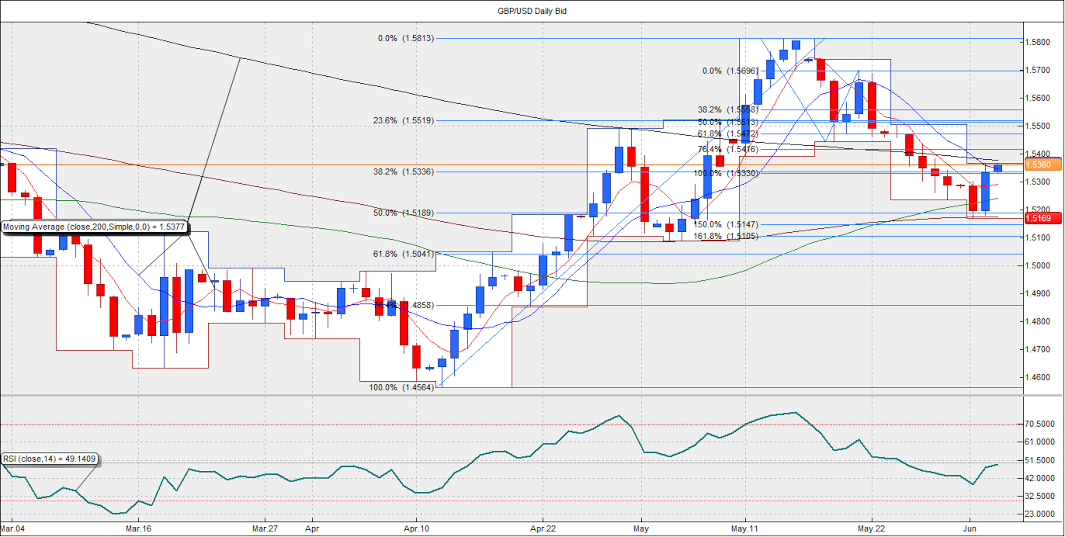

The GBP/USD pair rose to an intraday high of 1.5364 on Tuesday before falling back to the critical support level at 1.5336-1.5330. The early break above the strong resistance of the hourly 50-MA was a result of a sharp rally in the EUR/USD over and above 1.11 levels. The pair clocked a high of 1.5324 before falling back below 1.53. However, it ran into fresh offers at 1.5270-1.5280 after the US factory orders contracted in April.

The sharp rally witnessed in the previous session is now at a risk of a weaker-than-expected UK services PMI data. Off late the macroeconomic data out of the UK has consistently disappointed consensus estimates. Thus, doors are open for a downside surprise (exp: 52.9, prev: 59.5). Services activity forms a major part of the UK economy. Hence, the bearish reaction in case of a weaker print is likely to be more than the 100-pip fall witnessed after the release of a weaker-than-expected manufacturing PMI on Monday.

The pair currently trades at 1.5350; above the critical support of 1.5336 (38.2% Fib R of 1.4564-1.5813). The immediate resistance is seen at 1.5365 followed by resistance at 200-DMA located at 1.5377. Only a break above 1.5377 could see the pair rise to its 1.5417 (76.4% Fib expansion of 1.5813-1.5445-1.5698). On the downside, a break below 1.5336-1.5330 (100% Fib expansion of 1.5813-1.5445-1.5698) could shift risk in favor of a fresh sell-off to 1.5260 (hourly 50-MA). However, the bullish RSI on intraday timeframe and a break above strong resistance of hourly 50-MA in the previous session, indicates the pair is more likely to extend the gains to 1.5417 today.

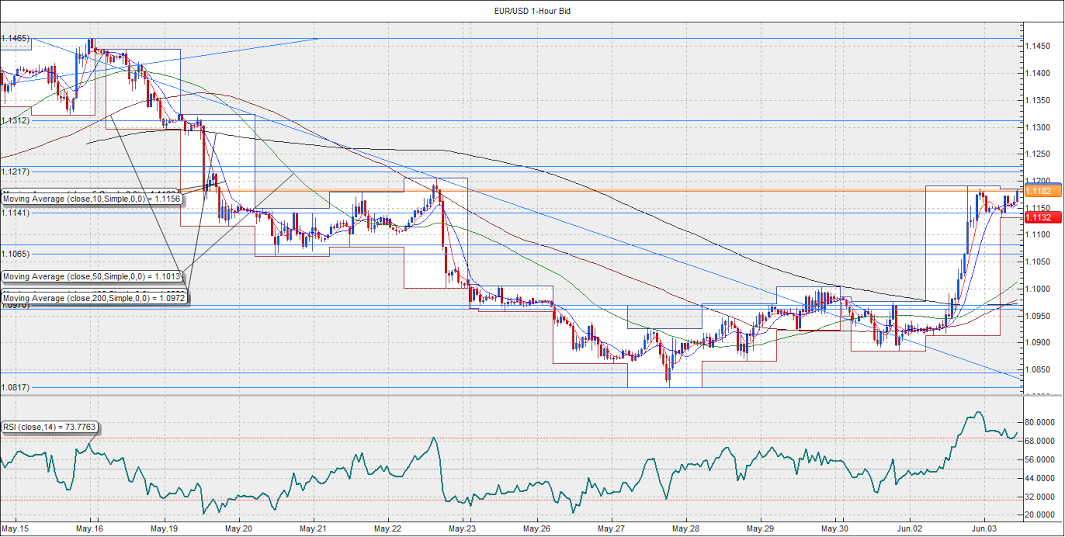

EUR/USD Analysis: EUR rallies ahead of the ECB

The single currency rallied to as high as 1.1193 due to optimism for Greek deal together with the release of unexpectedly weak US factory orders which slipped 0.4% after a slightly upwardly revised 2.2% increase in March.

A monetary policy announcement from the European Central Bank (ECB) is due later today. A change in policy is highly unlikely. However, markets would watch out for Greece-related commentary by the ECB President Mario Draghi. The President is also likely to sound upbeat on the positive impact of the QE on the economic growth. Meanwhile, the services PMI data due for release ahead of the ECB event could trigger minor moves in the pair.

The pair now trades at 1.1180, after having bounced from 1.1141 (50% Fib R of 1.1465-1.0817) during the overnight trade. A break above the previous session’s high at 1.1190, could open doors for 1.1217 (61.8% Fib R of 1.1465-1.0817). However, an overbought RSI on the intraday time frame tells me the pair could run into fresh offers anywhere between 1.12-1.1217. In such a case, the pair could make its way back to 1.1141, under which the pair could drop to 1.1082 (38.2% Fib R of 1.0461-1.1465). Only an hourly close above 1.1228 (23.6% Fib R of 1.0461-1.1465) could bring in fresh buying interest.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

The EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 on Monday during the early Asian trading hours. The softer US Dollar provides some support to the major pair.

Gold holds below $2,300, Fedspeak eyed

Gold price loses its recovery momentum around $2,295 on Monday during the early Asian session. Investors will keep an eye on Fedspeaks this week, along with the first reading of the US Michigan Consumer Sentiment Index for May on Friday.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.