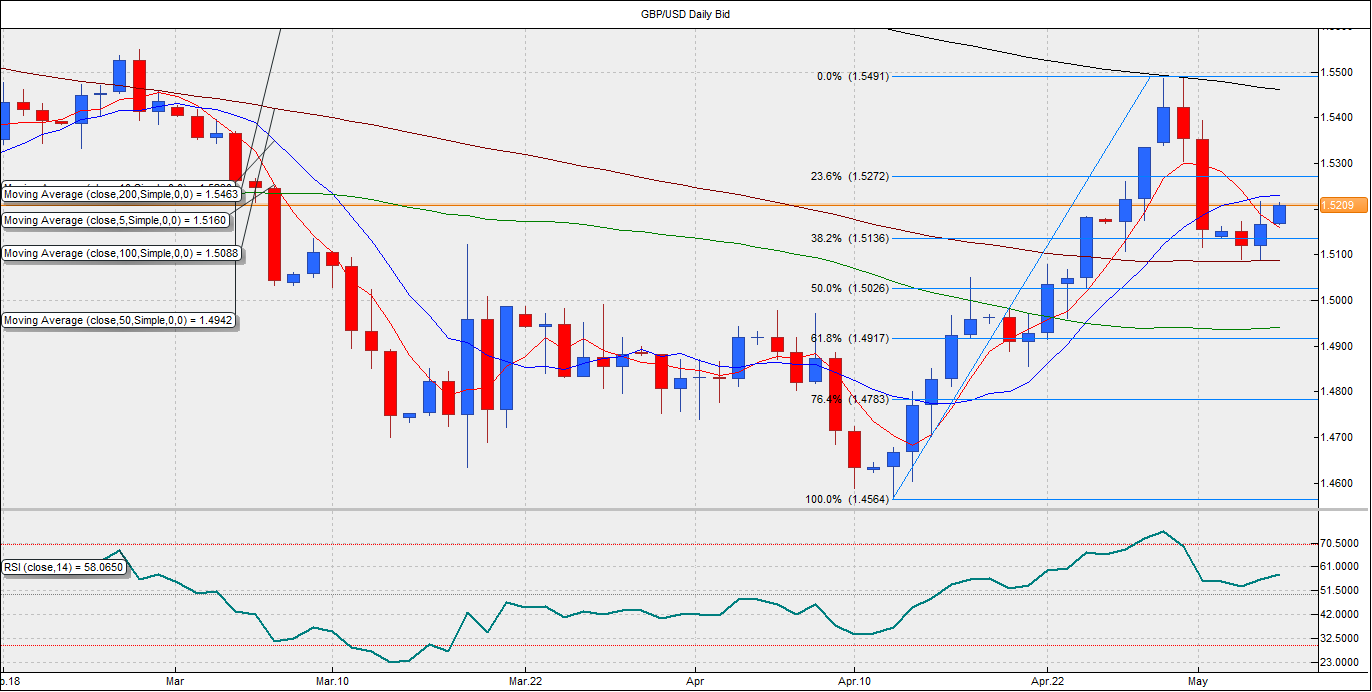

The GBP/USD pair bounced-off from its 100-DMA to clock an intraday high of 1.5217 on Tuesday. The gains contradicted the sharp slowdown in the construction activity highlighted by the PMI data. The election uncertainty is still failing to have any effect on the pair. Back in 2010, the currency pair had weakened in the run up to elections. However, the pattern is not being followed in 2015 amid a high possibility of a hung parliament. Still, it is worth noting that GBP/USD fell 400 pips on election day in 2010. Apart from that, the investors would watch out for the Services PMI data due for release later today. A weaker-than-expected print is likely on account of election uncertainty and a drop in the new business due to a strong GBP/EUR exchange rate. A weak print could push the GBP/USD pair down to 1.5136. On the other hand, aa better-than-expected services PMI could push the pair to 1.5270-1.5280 levels.

The pair currently trades at 1.5210, after having managed to sustain above its 100-MA at 1.5088 in the previous two sessions. The immediate upside appears capped at 1.5231 (10-DMA). Fresh bids are seen above the same which could take the pair higher to 1.5272 (23.6% Fib retracement of 1.4564-1.5490). Meanwhile, failure to sustain above the hourly 200-MA at 1.5208 could see fresh offers pushing the pair back to 1.5165-1.5136 (38.2% Fib retracement of 1.4564-1.5490). A break below 1.5136 could shift the risk in favor of further declines to 1.5026 levels. The short-term outlook stays bearish so long as the pair trades below 1.5272.

EUR/USD Analysis: Weak services PMI could derail the rally

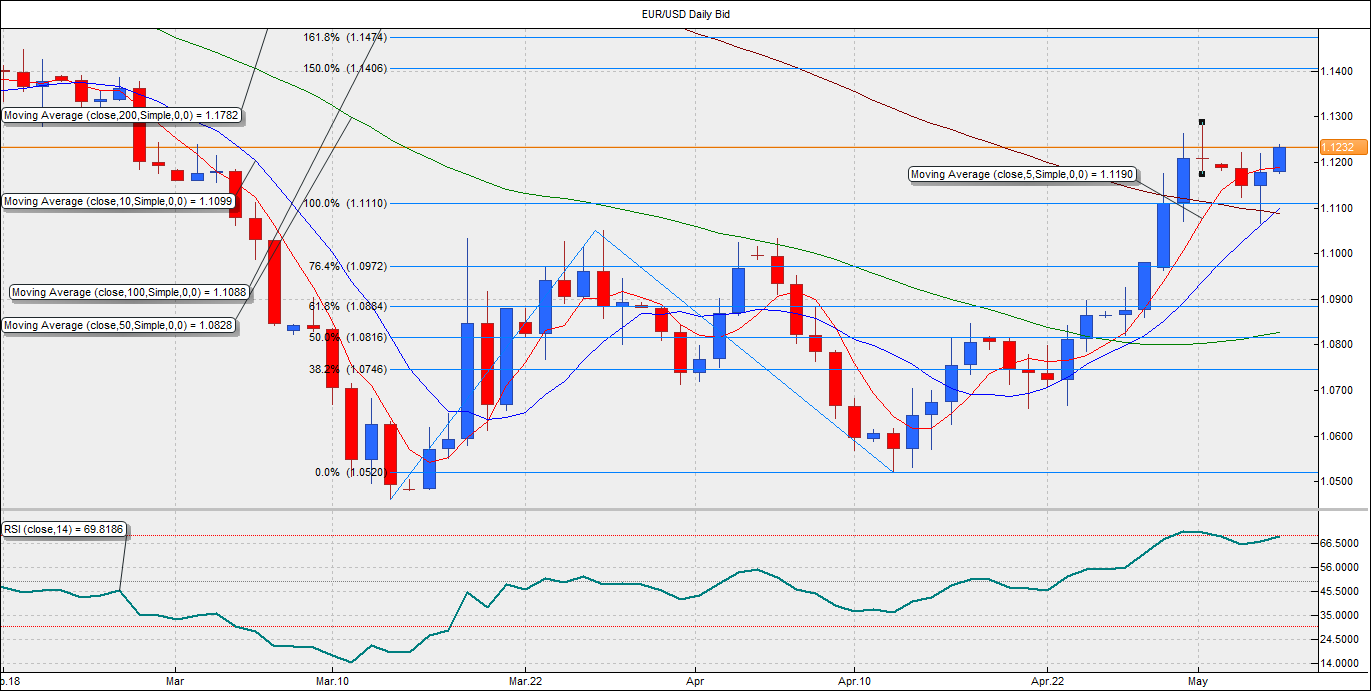

The EUR/USD pair recovered from the low of 1.1065 to print an intraday high of 1.1220 on Tuesday. The shared currency continued to rise as the bond yields across the Eurozone rose sharply. German 10-year Bund yield rose 6bp, French 10-year yield rose 9bp. Meanwhile, the 10-year Treasury yield in the US rose only 2bps. Consequently, the EUR rose on a favorable German-US yield spread. However, there are indications that the rally could derail. The EUR is negatively correlated with the rally in the Greek and other periphery bond yields. The Spanish and Italian bond yields rose 25 bp on Tuesday, while Greek yields rose more than 40 bps. The latest development surrounding Greece is the major disagreement between the IMF and EU over the conditions Greece needs to meet to receive its next bailout payment. It is highly unlikely that we see a breakthrough deal at the May 11 Eurogroup meeting. Thus, a rally in Greek yields could weigh on Euro. Meanwhile, a weaker-than-expected services PMI numbers could also weigh over the single currency.

At the moment, the pair is trading at 1.1232, after having bounced-off from 1.1173 in the early Asian session. The pair has repeatedly run into fresh offers in the range of 1.1250-1.13 in the past few sessions. With the intraday RSI hit overbought region, fresh offers could be seen around the current level as well. In such a case, the immediate losses appear restricted around 1.1190 (5-DMA). A break below the same could invite more selling pressure, taking the pair down to 1.1110 levels. On the other hand, a break above 1.1288 could drive the pair higher to 1.1350 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price (XAU/USD) struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.