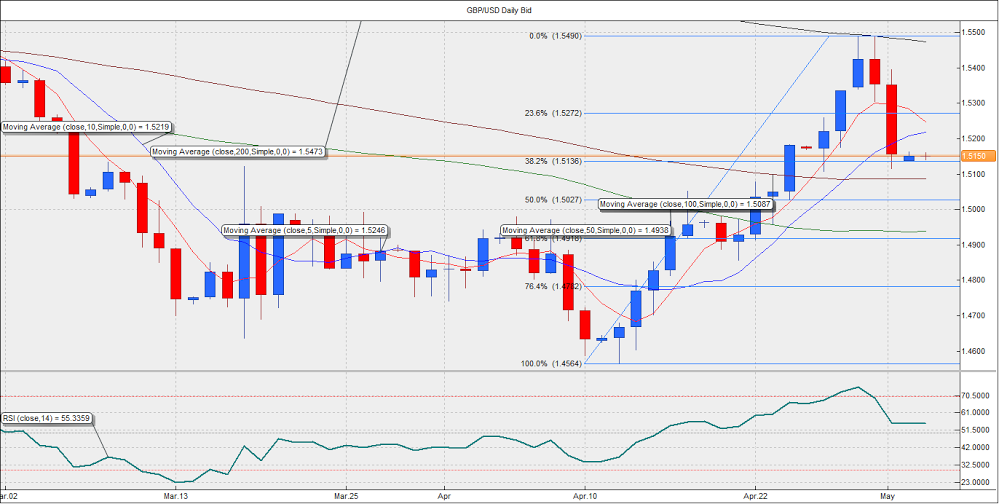

The GBP/USD pair fell to an intraday low of 1.5113 on Friday on a weaker-than-expected UK manufacturing PMI. The PMI fell to 51.9 in April from 54. Mortgage approvals also dropped to 61.3k from 61.5k. The onus now falls on UK’s services PMI report, due for release this week, to show that the economic slowdown is not as sharp as indicated by the manufacturing activity. In case, the services PMI is weak, the GBP/USD pair could drop to 1.5. As for today, no major data is due for release out of the UK. However, the pair could remain under pressure ahead of May. 7 elections. Reuters reported earlier today British PM David Cameron's Conservative Party took a one-point lead over the opposition Labour Party.

At the moment, the pair is trading at 1.5150, after having bounced-off from the 38.2% Fib support of 1.4564-1.5490 located at 1.5136. The sharp sell-off on Friday pushed the intraday RSI indicator to oversold region, thus helping the pair recover slightly to 1.5163 from the low of 1.5113. Fresh offers could be seen so long as the pair trades below its hourly 200-MA located at 1.5166. A break below 1.5113 could exposes 1.5087 (50-DMA) and 1.5027 (50% Fib retracement of 1.4564-1.5490). On the upside, area around 1.5120 (+20pips/-20pips) is likely to act as a strong resistance. Rejection at the same could trigger a fresh sell-off to 1.5027 levels.

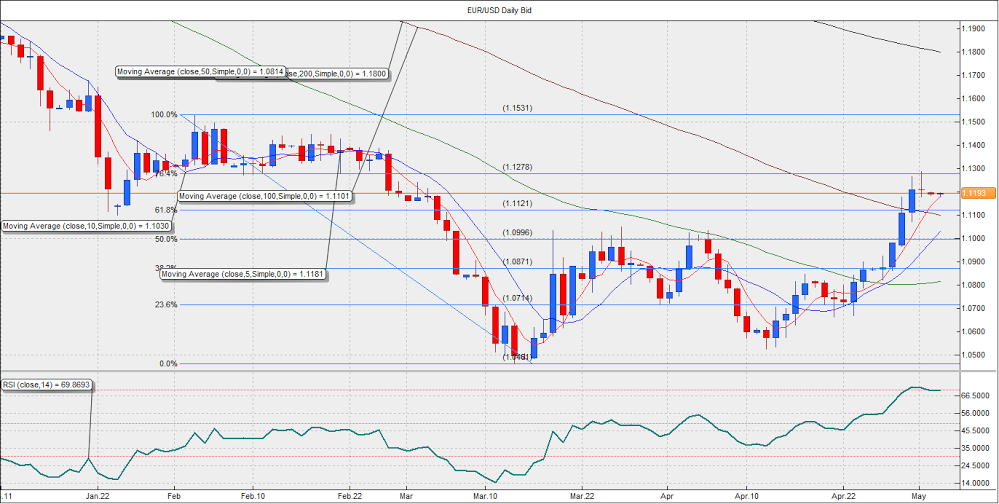

EUR/USD Analysis: Could extend the drop to 1.1124

The EUR/USD pair ran into offers around 1.1278 levels for the second consecutive session on Friday, as the US dollar rallied across the board despite softer than anticipated manufacturing ISM and University of Michigan consumer sentiment reports. The dollar recovery begun on Thursday after the jobless claims printed at a 15-year low. Meanwhile, the Germna and the Eurozone manufacturing PMI reports are due for release today. A weak print could drive the pair lower to 1.1120-1.1130 levels since it would underscore the fact that the ECB’s current QE program is failing to have a desired impact. A slight support could come from the possible rally in the EUR/GBP pair on account of the election uncertainty in the UK.

The pair currently trades at 1.1191, with the daily RSI having turned lower from the overbought region. The rejection faced around 1.1278 indicates a temporary top could have been made, which shifts risk in favor of a decline towards 1.1120-1.1130 levels. However, the sell-off could resume once the pair breaks below its 5-DMA located at 1.1181. On the upside, a break above 1.1201 (hourly 200-MA) could lead to a minor rally to 1.1250-1.1270. However, the EUR is likely to be offered on rallies, until we see a daily close above 1.1278.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.