GBP/USD Analysis: rebound in UK inflation could push the pair to 1.5

The gains in the GBP/USD were capped on Monday after the Confederation of British Industry data showed, industrial trend orders dropped to its lowest level in 2 years. The weak data triggered speculation that the Bank of England would have to delay policy tightening. However, the speculations did not weaken Pound, mainly because of the broad based weakness in the USD and the fact that the speculations of delay in the rate hike by the BOE have been there in the markets since last ten odd sessions. Thus, at least in the short-run the rate hike delay in the UK appears to have been priced-in by the markets. On the other hand, the markets are still digesting the surprisingly dovish Fed statement released last week.

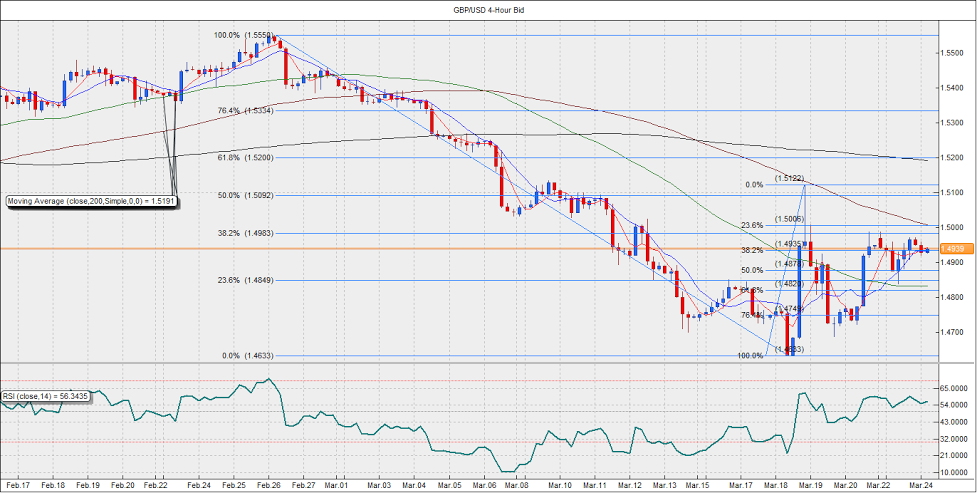

Hence, the GBP/USD could rise to 1.5 levels today if the UK CPI for February, due for release today, beats the estimates. The inflation is seen rebounding to positive territory month-on-month, while year-on-year a slight decline in expected. If the CPI meets estimates, the gains are likely to be capped around 1.4980-1.4987. A better-than-expected CPI could push the pair well above 1.5 levels.

On the charts, the pair has repeatedly struggled to sustain gains above the 38.2% Fib retracement (1.5550-1.4633) located at 1.4983. The 4-hour RSI and the hourly RSI remain in favor of a further upside in the pair. An upbeat CPI could drive the pair higher to 1.5, however, further upside is contingent on the pair closing above 1.4983 on the 4-hour chart. On the other hand, a weaker-than-expected CPI could push the pair below 1.49 (hourly 50-MA).

EUR/USD Forecast: Eyes 1.10

The shared currency gained on Monday as the markets continued to digest the dovish Fed statement released in the last week. The currency may have also found support from the comments from the ECB officials that the QE program could end earlier. However, the EUR turned out to be the biggest gainer mainly because the sentiment was overtly bearish going into the Fed meet last week. The surprisingly dovish Fed triggered short covering, which has brought the EUR/USD pair above 1.09 levels.

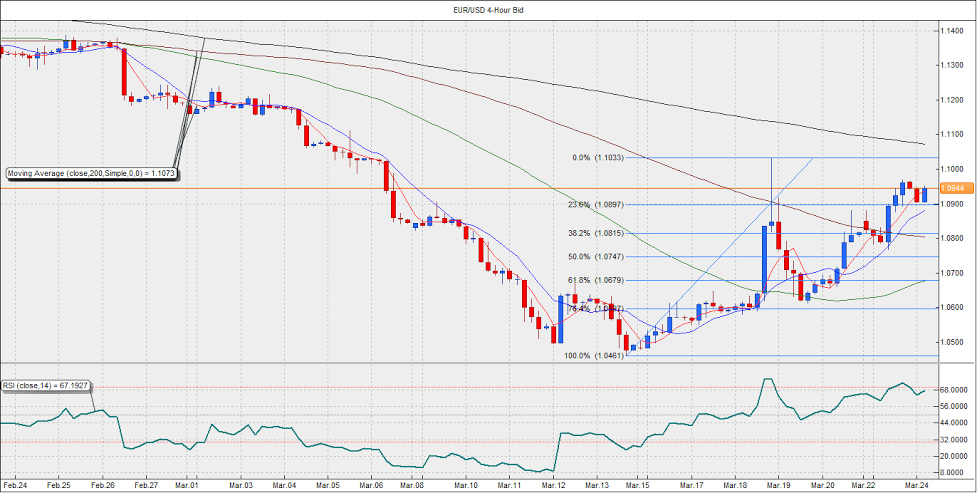

The EUR/USD pair could test 1.10 levels as the flash PMI reports due for release today are likely to support Draghi’s view that the Eurozone economy is gaining momentum. The gains could be capped by fresh signs of friction between Greece and its creditors.

On the charts, the pair finished the previous session well above the 23.6% Fib retracement of the post Fed up move from 1.0461 – 1.1033 located at 1.0897. The daily RSI has also turned bullish. Thus, with the upbeat PMI numbers, the pair could easily rise to 1.10 levels from the current level of 1.0940. In case the Greece issue flares up or the PMI reports disappoints, we could see the pair re-test 1.0897 levels. However, the technical outlook would stay bullish so long as the pair does not confirm a breach of 1.0897 on the hourly charts.

USD/JPY Forecast: Breaks short-term rising trend line

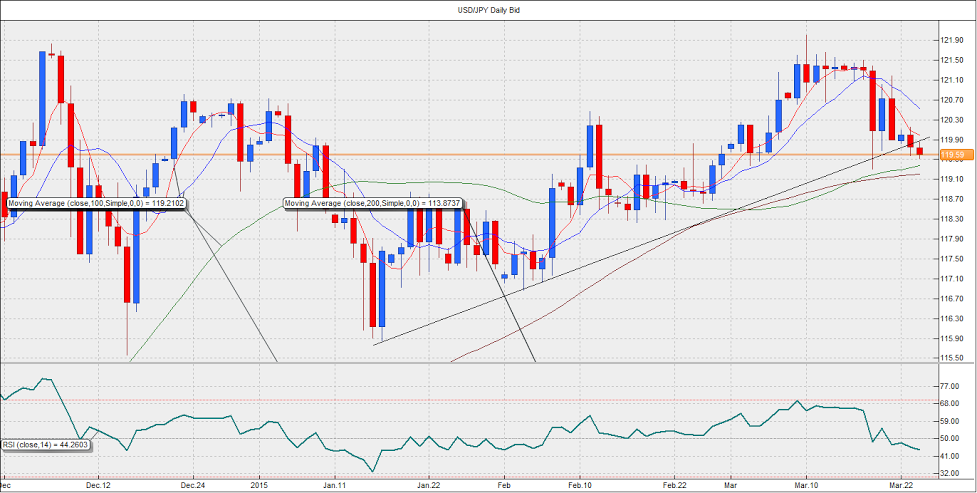

The USD/JPY pair ended weak on Monday, leading to a breach of the short-term rising trend line support on the daily charts. The weak Treasury yields continued to support the Japanese Yen. The 10-year Treasury yield in the US is hovering close to 1.9%. With a weaker-than-expected US CPI data today, we could see the 10-year yield dip below 1.9%. In such a case, the USD/JPY pair could fall to the 100-DMA at 119.21. On the other hand, a rebound in US inflation could see the pair re-test the rising trend line resistance at 119.88. However, it would take an all-out stronger-than-expected US inflation print to push the pair well above 119.88 levels.

On the charts, as said earlier, the pair has breached the rising trend line and currently trades at 119.60 levels. This, coupled with the bearish daily RSI could push the pair down to 119.21-119.00 levels. Moreover, the pair is likely to be sold on rallies so long as it trades below 119.88 levels. The bearish view faces the risk of a daily close above 119.88 levels. However, as mentioned earlier, a daily close above 119.88 levels looks possible in case the US CPI beats the expectations by a wide margin. The probability of such strong data is low. Hence, the pair appears more likely to dip towards 119.00 slow and steady.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY crashes nearly 450 pips to 155.50 on likely Japanese intervention

Having briefly recaptured 160.00, USD/JPY came under intense selling to test 155.00 on what seems like a Japanese FX intervention underway. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD rallies toward 0.6600 on risk flows, hawkish RBA expectations

AUD/USD extends gains toward 0.6600 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.