The GBP/USD pair rebounded on Friday to a high of 1.4987, despite of a weak UK Gilt yields. The rebound could have been the result of short covering ahead of the weekend as the weakness in the Gilt yields indicate the bets of delay in the interest rate hike in the UK are still very much intact. Apart from the moves in the Gilt yields, the pair would also be influenced by the UK CBI trends total orders data for March. The data is seen inching lower to 9 from the previous figure of 10.00. A weaker-than-expected print could weigh over GBP/USD. On the other hand, a positive figure is unlikely to result in a significant appreciation of Pound, mainly due to speculation of delay in the interest rate hike and election uncertainty.

Meanwhile, the USD could strengthen as the markets appear unsure regarding the timing of interest rate hike in the UK. Gold prices declined in the Asian session, which could be a sign that the USD could be bough on fears that a rate hike in June is still possible.

On the 4-hour chart, we see the pair has failed for the second time at the 38.2% retracement (of 1.5550-1.4633) located at 1.4984 levels. Both, the hourly and the 4-hour RSI, have turned lower, while the daily RSI stays bearish at 44.21 levels. The pair could drop to 1.4907 (5-DMA). Moreover, the sell-off could be more intense below 1.4907, which would push the pair down to 1.4850 (23.6% retracement). On the other hand, a failure to break below 1.4907 could push see the pair bounce back towards 1.5 levels. However, the pair is likely to be sold on rallies so long as it trades below 1.5.

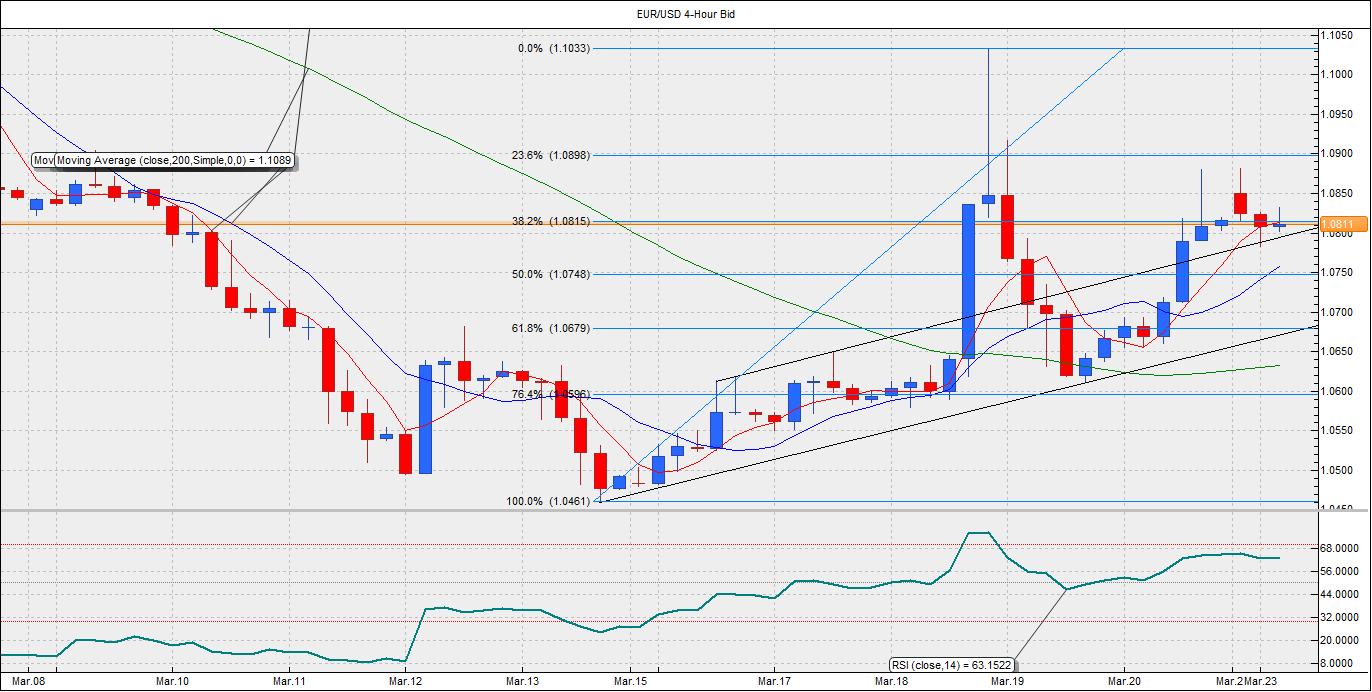

EUR/USD Forecast: Bearish below 1.08

The EUR/USD pair rose to a high of 1.0881 on Friday amid a broad based sell-off in the US dollar ahead of the weekend. Amid the absence of a fresh economic data out of the EUrozone today, the pair is likely to take cues from the developments in Greece. The Merkel-Tsiparis talks are likely to take the center stage today. Till then the technical forces are likely to reign supreme.

On the 4-hour chart, we see the pair, at 1.0812, is trading just above the rising channel support at 1.08. Moreover, the pair has already dipped below the 38.2% Fib retracement (of 1.0461-1.1033) located at 1.0815 levels. The failure to rise above the same during the early European session could lead to a break below 1.08. In such a case, the pair could drop to 1.0748 levels. On the other hand, a rise above 1.0815 could see the pair re-test Friday’s high of 1.0881.

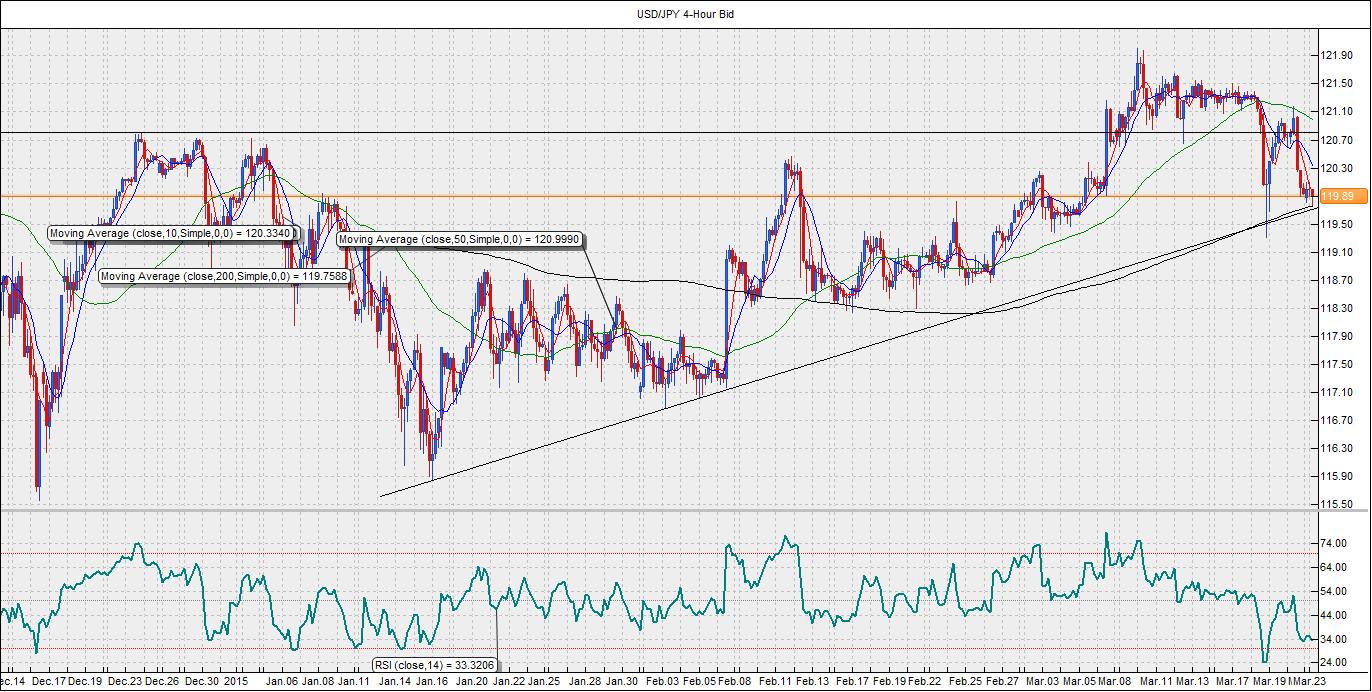

USD/JPY Forecast: Rising trend line support under threat

The USD/JPY pair clocked a low of 119.88 on Friday, tracking the weakness in the US Treasury yields. The pair continues to trade around the same today. A couple of factors could be responsible for the strength in the Yen this week. The financial year end repatriation flows could strengthen Yen. Furthermore, increasing number of investment banks are now predicting that the US would not raise interest rates till late 2015 or early 2016. Thus, Treasury yields could remain under pressure, leading to a strong Yen. Meanwhile, a disappointing US CPI and durable goods data could also help strengthen the Yen. The Abe-Kuroda talks concluded today, failed to have any major impact on the pair.

On the 4-hour chart, we see that the pair tested the 200-MA at 119.75. The pair also has a strong rising trend line support currently located at 119.70. The daily, hourly and the 4-hour RSI is bearish, thus, the pair could test the trend line support today. A break below 119.70 could see the pair fall to 50-DMA at 119.34. Meanwhile, the immediate upside in the pair appears capped around 120.20-120.40 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.