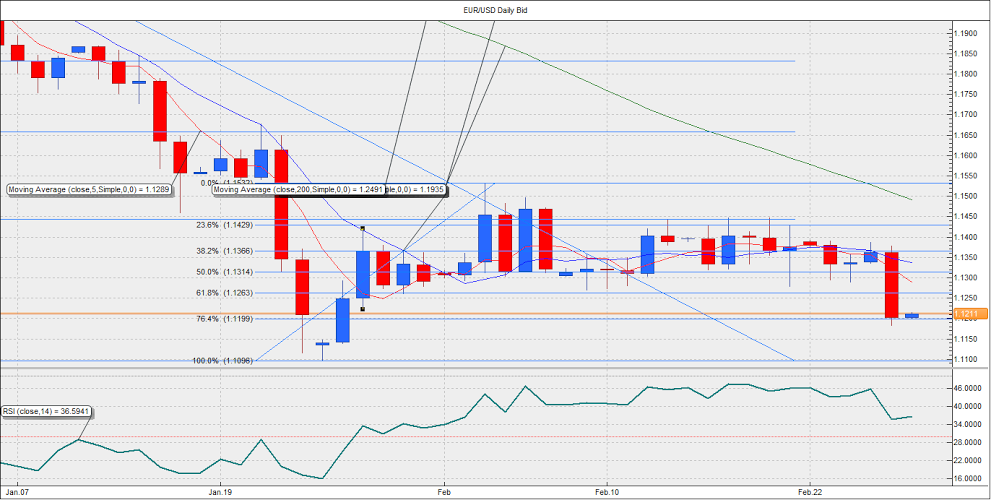

EUR/USD - At risk of a weaker-than-expected German CPI

The EUR/USD pair fell to a low of 1.1182 in the previous session on the stronger than expected US core inflation data as well as hawkish comments from Fed officials. The initial sign of weakness was evident during the European session, after the pair failed to strengthen on an upbeat German employment data. The early failure to sustain above 1.1366 (38.2% retracement of 1.1096-1.1532), coupled with failure to reposing to German data had opened doors for a sell-off towards 1.1314 levels.

A sticky core inflation number in the US, along with the upbeat durable goods data pushed the pair below 1.1263 (61.8% retracement) leading to a sharp sell-off towards 1.1182 as stops were triggered. The hawkish comments from San Francisco Fed’s John Williams and St Louis Fed’s James Bullard further added to the bearish pressure. The pair currently trades 1.1212, after having bounced-off from 1.1199 (76.4% retracement). The preliminary German CPI in Feb is seen falling 0.3%. The pair could dip below 1.1199 and extend losses to 1.1150 if the preliminary reading prints well below the expected fall of 0.3%. Meanwhile, a positive surprise could provide some scope for technical recovery, however, gains are expected to be capped around 1.1263.

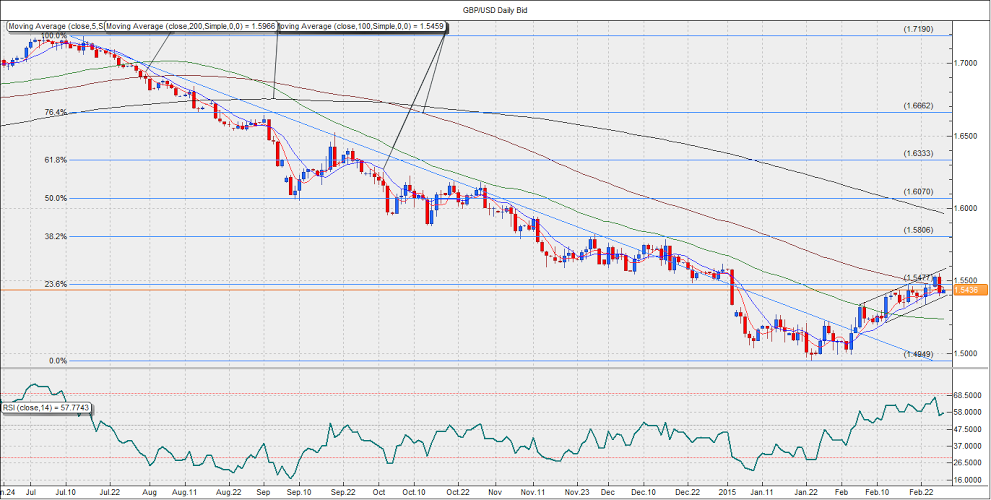

GBP/USD – Could drop to 1.5386

The GBP/USD pair fell sharply to a low of 1.5392 in the previous session, after a break below 1.5477 triggered stops leading to a sharp sell-off. A minor recovery of sorts is in process today as the pair trades 1.5447, with eyes on the 100-DMA located at 1.5459. With an empty UK economic calendar, the focus is likely to remain during the European session on the relative performance of the UK Gilt yields and UIS Treasury yields. In the last few sessions, the rally in the GBP/USD pair lacked support from the 10-year Gilt yields which remained negative and under performed the US treasury yields. The story could continue today as the hawkish comments from the Fed officials shall keep the Treasury yields higher.

The pair could dip to 1.5386 levels; rising channel support on the daily chart, if the second estimate of the US Q4 GDP prints higher than the expected growth rate of 2%. In such a case the benchmark bond yield spread could tilt further in favor of the US dollar, leading to a fresh sell-off in the GBP/USD pair. On the other hand, a weaker-than-expected print could help the pair recover to 1.5477 levels. However, it would take a daily close above 1.5477 (23.6% retracement of 1.7190-1.4949).

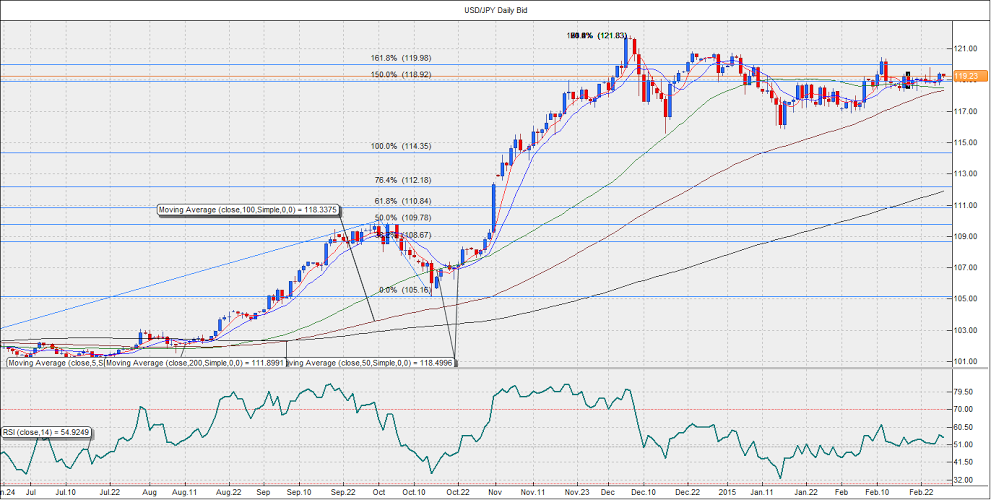

USD/JPY – Eyes 120.00 levels

The sharp recovery seen in the US Treasury yields post the releases of a sticky core inflation data in the US and an upbeat Durable goods orders pushed the USD/JPY pair to a high of 119.48 in the previous session. The hawkish comments from the Fed officials also supported gains in the Treasury yields and the USD/JPY pair. The 10-year Treasury yield in the US currently trades at 2.014%, while the USD/JPY pair hovers around 119.25 levels.

Given the recovery in the Treasury yields, the pair is likely to rise above the immediate resistance at 119.40. In such case, it could rise to 120.00 levels. A better-than-expected second estimate of the US Q4 GDP could help the pair rise to 120.00 levels. On the other hand, a surprisingly weak GDP print could reverse gains in the Treasury yields and push the USD/JPY pair below 118.90 levels, under which losses could be extended to the 50-DMA located at 118.50 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY crashes nearly 450 pips to 155.50 on likely Japanese intervention

Having briefly recaptured 160.00, USD/JPY came under intense selling to test 155.00 on what seems like a Japanese FX intervention underway. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.