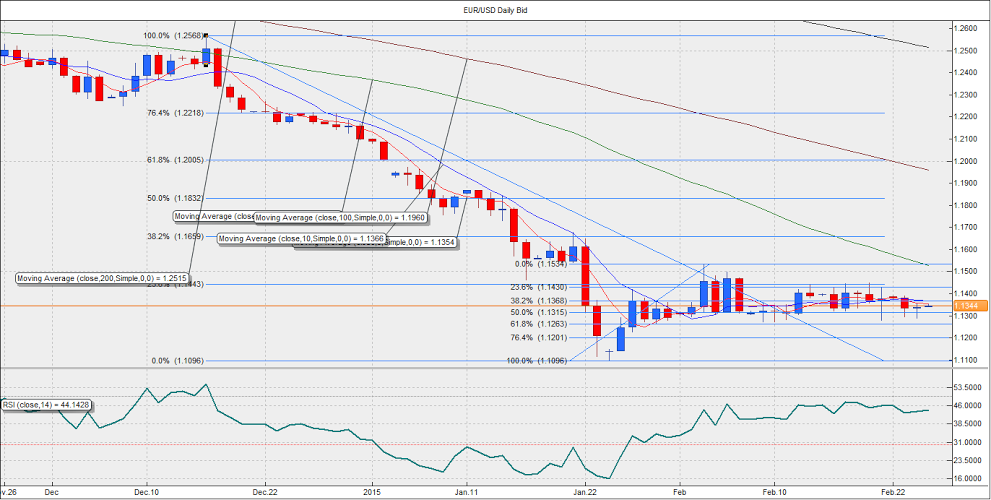

The EUR/USD pair ended largely unchanged in the previous session after the European commission accepted the Greek reform proposal and granted a 4-month bailout extension to Greece, while Fed chairwoman Janet Yellen indicated policymakers are in no rush to raise interest rates. The EUR/USD pair could not rally despite 4-month bailout extension for Greece, which indicates the markets are either worried about the Grexit talks returning four months down the line or await ECB President Draghi’s testimony before the European Parliament.

The pair is moving in a range of 1.1260 and 1.1443 (23.6% Fib retracement of 1.2568-1.1096) for almost two-weeks now. With no major economic data due out of the Eurozone today, the focus is solely on Draghi’s comments on the monetary policy and the economy. Given the 4-month solution to Greece’s debt issue and slightly dovish Yellen, the EUR/USD could see a break above 1.1430 if the ECB president Draghi turns optimistic over the recent improvement in the economic data. The German economy is clearly the bright spot, while aggregate Eurozone data were also impressive in the last few days. Though prices continued to deflate in January, Draghi is likely to put the onus on falling energy prices. With a very less scope for hinting at more aggressive measures than the one already announced, the EUR/USD stands to gain on Draghi’s optimistic outlook. In such a case the pair could rise above 1.1430 to test 1.15 levels. On the flip side, a gloomy outlook could send the pair down to 1.1260. However, it would take a daily close below 1.1260 to see further weakness towards 1.12 levels.

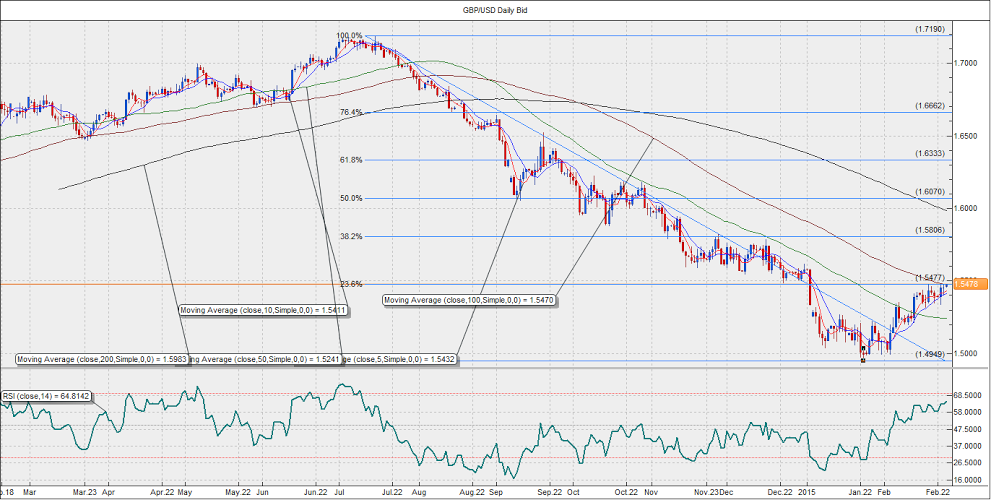

GBP/USD – on its way to +1.55 levels

The GBP/USD pair ended largely unchanged in the previous session after having bounced-off from the 10-DMA located at 1.54 levels. The hawkish comments from the Bank of England (BOE) governor Mike Carney failed to push the Gilt yields higher. However, carney did indicate that the next move is likely to be a rate hike as the weak inflation is likely to be transitory. Other policymakers – Forbes and Weale- added that wages were picking up fast with a limited slack in the economy and that moderate rate hikes are necessary to achieve inflation targets. Meanwhile, the Fed chairwoman Janet Yellen indicated policymakers are in no rush to raise interest rates.

Consequently, the GBP/USD pair stands to rise above 1.55 levels. The 10-year Treasury yield in the US fell below 2%, It remains to be seen how the 10-year Gilt yield performs today. An uptick in the Gilt yields could easily push the GBP/USD pair to 1.55 levels. Such a move could be expected around the opening bell in London. The pair has already taken out the 100-DMA at 1.5470 and hovers at the 23.6% retracement (of 1.7190-1.4949) located at 1.5477 levels. An hourly close above the same could see the pair rise sharply to 1.55-1.5540 levels. On the flip side, a break below 1.54 could push the pair down to 1.5334 levels.

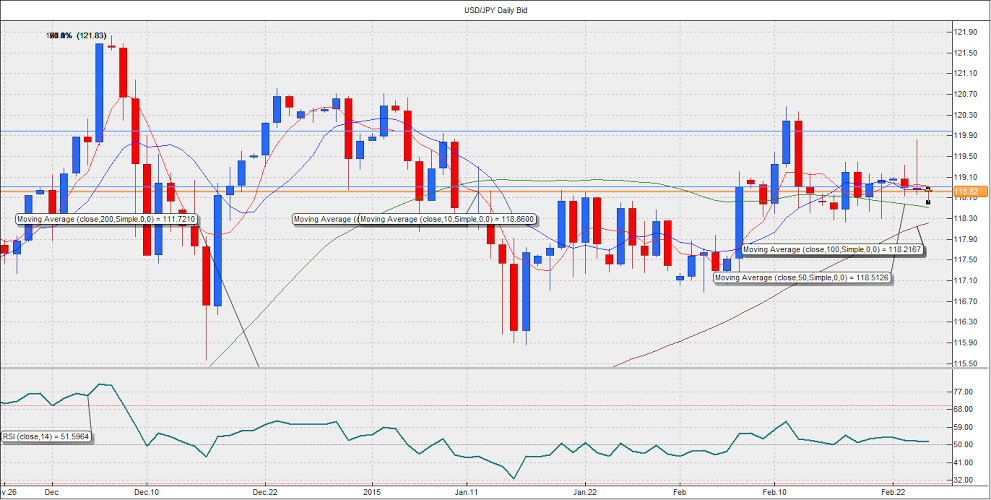

USD/JPY – 118.20 in sight

The pair finished the previous session lower at 118.85 after having clocked a high of 119.82. The Japanese Yen gained as the Treasury yields declined after the Fed chairwoman Janet Yellen indicated the policymakers are in no hurry to interest rates. Yellen said that the Fed would change its forward guidance before raising interest rates in order to prepare the markets for the move, while stating that the word “patient” would be dropped. So long as the word “patient” is retained, it would mean that rate hike can be ruled out for the next couple of meetings.

Yellen’s comments pushed the 10-year Treasury yield below 2% level, indicating the June rate hike is now off the table. The weakness in the yield pushed the USD/JPY pair below 150% Fib expansion level of the move from 100.81 to 110.06 to 105.18 located at 118.89. The pair currently trades at 118.79 levels with the 10-year yield in the US hovering at 1.99%. An upbeat Chinese PMI data helped pair recover slightly from the low of 118.61 levels. However, disappointing New home sales figure in the US could drive the pair down to the 50-DMA located at 118.51, under which the pair could fall to 118.21 levels. However, further losses are unlikely especially if Draghi turns optimistic on the Eurozone economy. In such a case, the pair could bounce back from the 50-DMA to 119.20 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.