Is the part-time hiring binge that has inflated job numbers for at least two years about to come to an end?

I think so. More importantly, so do CEOs of large corporations.

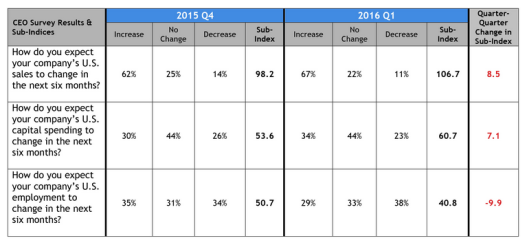

In December, a quarterly survey of large corporation CEOs showed a minuscule net of 1% (35% to 34%) of corporations expected an increase in hiring. 31% expected no change.

The latest quarterly survey shows nearly 10% (29% to 38%) of large corporation CEOs expect to reduce headcount. The remaining 33% expect no change.

CEO Economic Survey Details

Let’s dive into the Business Roundtable First Quarter 2016 CEO Economic Outlook Survey for more details.

Key Survey Results

Mixed Bag?

For the fourth quarter in a row, CEO expectations on the economy remain mixed.

CEO expectations for sales over the next six months increased by 8.5 points, and their plans for capital expenditures increased by 7.1 points, relative to last quarter. Hiring plans declined by nearly 10 points from last quarter.

Mixed Bag Not

Is that an ominous report or a mixed bag?

On the surface one can make a claim either way. The business outlook is up huge as are capital spending expectations.

However, CEOs are clueless about where the economy is headed.

CEO Outlook

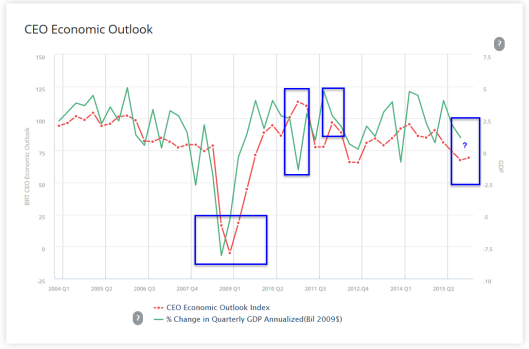

Notice the perpetually lagging nature of the CEO Economic Outlook.

GDP is a lagging indicator. The aggregate CEOs’ economic outlook is even more lagging. That’s quite a pathetic under-performance.

Jobs are also a lagging indicator.

Battle of Lagging Indicators

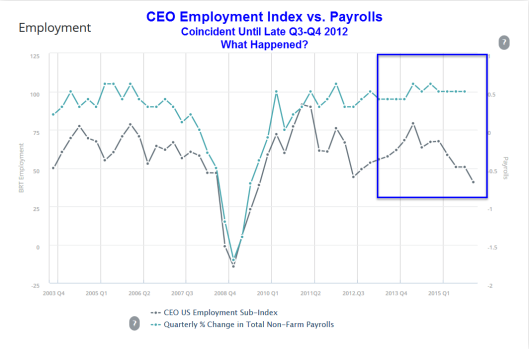

In the battle of lagging indicators, results show the CEO hiring index was amazingly coincident with nonfarm payrolls from 2003 until late 2012.

What happened?

Obamacare!

The newly created Obamacare health insurance marketplaces opened for enrollment on October 1, 2013.

Starting 2014, citizens were required to have insurance.

Businesses with 50 or more full-time employees had to offer insurance benefits to their employees.

Obamacare reduced the number of hours to 30 that it took to be considered a full-time employee.

Employers cut hours and hired more part-time workers.

Five Consequences

The hiring binge associated with Obamacare is finally over.

US job growth will “unexpectedly” slow dramatically now that CEO hiring plans have weakened to the point of contraction.

Talk of rate hikes will morph into talk of easing.

The US dollar will sink further.

Gold, not the stock market, will be the big beneficiary of this “unforeseen” jobs weakness.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.