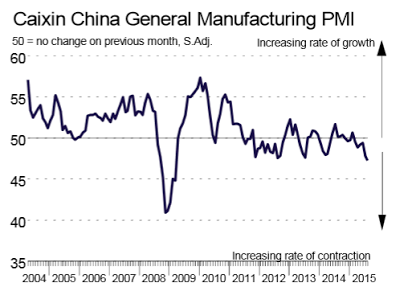

China manufacturing and services are both in contraction at the fastest rate since early 2009.

The Caixin China General Manufacturing PMI shows operating conditions deteriorate at fastest rate since March 2009.

Chinese manufacturers saw the quickest deterioration in operating conditions for over six years in August, according to latest business survey data. Total new orders and new export business both declined at sharper rates than in July, and contributed to the most marked contraction of output since November 2011. Lower production requirements prompted companies to reduce their purchasing activity at the fastest rate since March 2009, while weaker client demand led to the first rise in stocks of finished goods in six months. Meanwhile, softer demand conditions contributed to marked falls in both input costs and output charges in August.

Key Points

Output contracts at quickest rate in 45 months as new business falls solidly

Purchasing activity declines at sharpest rate since March 2009

Input costs and output charges both fall at marked rates

China Manufacturing PMI

Composite Contract Most Since February 2009

The bad news in China does not stop with manufacturing. Markit reports the Caixin China General Services PMI has the fastest contraction of output seen since February 2009.

Key points

Composite output and new orders both contract for the first time in 16 months

Job shedding intensifies at manufacturers, while employment rises only fractionally at service providers

Composite input costs and output charges continue to fall

By now it should be perfectly clear to everyone that the entire global economy is cooling and the US will not decouple from that slowdown. Nonetheless, most economists, including those at the Fed, still do not see the obvious.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.