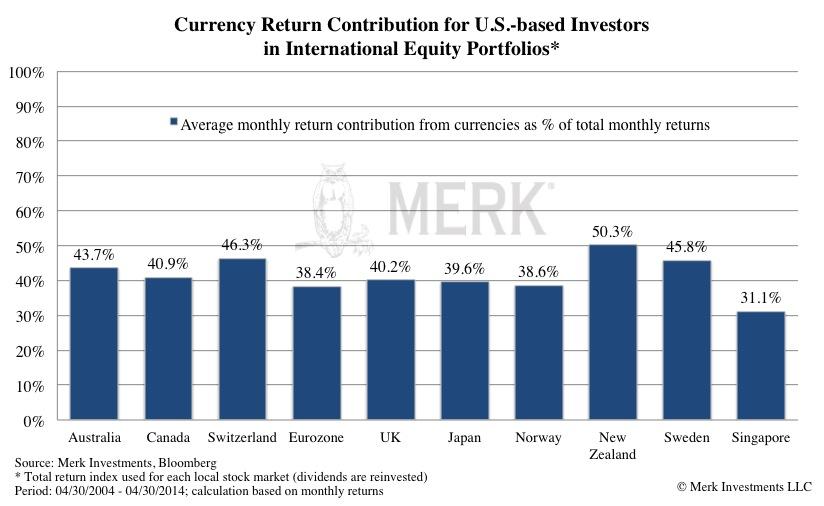

When investing in international equities, the return stream generated can be broken into equity returns and currency returns. As the chart below shows, between 30% and 50% of monthly equity index returns, when measured in U.S. dollars, were attributable to currency fluctuation:

The contribution works on the upside, as well as on the downside. In a month where the local country’s stock market moved up, it is possible a good portion of the gain may be attributed to currency appreciation. Similarly, in a down month, a good portion of the loss may be attributed to currency depreciation.

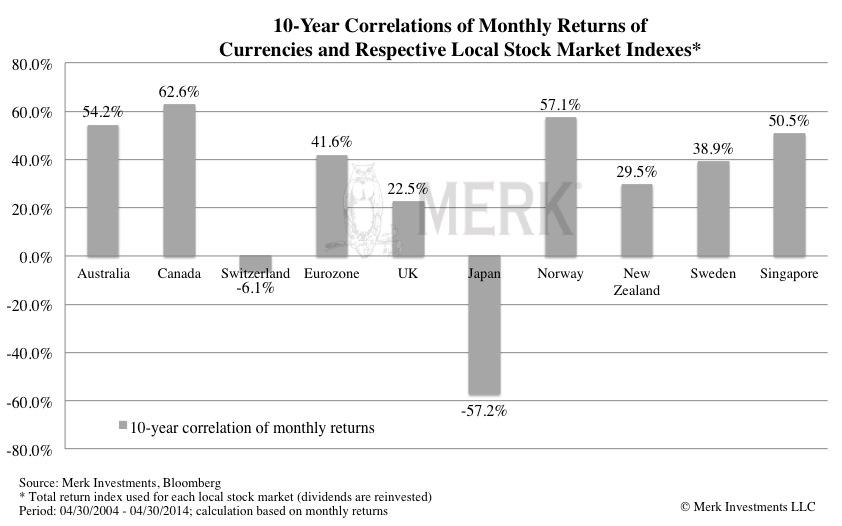

Let’s look at the correlation2 between the currency moves and these markets. For a currency-hedged international equity investment to enhance returns, one would want a rising equity market and a negative correlation between equities and the exchange rate:

For currencies with positive correlation with the local stock market (e.g., euro), hedged investors may get a buffer when European stocks go down (by avoiding the double loss from both stocks and the euro), but lose the upside when European stocks go up (in which case the euro usually goes up).

For currencies with negative correlation to the local stock market (e.g., Japanese yen), hedged investors may get higher returns when the Japanese stock market goes up (by avoiding the loss in the yen) but lose the buffer when Japanese stock market goes down (in which case the yen usually go up).

If the yen continues to have a negative relationship with the Japanese stock market and the Nikkei rises, then it might make sense to hedge out the currency risk. However, note that this trade hasn’t worked well this year with a falling Nikkei and a rising yen.

One of the reasons that investors may want to hedge the local currency exposure is because they feel they have an edge on making directional calls on broad equity markets in various countries but don’t understand the currency markets or don’t have a directional view on a given local currency. It would be frustrating to get the equity market call right and still lose money in U.S. dollar terms because of local currency fluctuation.

Rather than hedging or not hedging, investors may want to consider actively managing currency risk. Not hedging and taking a leap of faith on up to half the returns on a return stream appears imprudent to us. But conversely, eliminating the potential value that currencies may bring provide can lead investors to leave returns on the table.

What does it mean to actively hedge the currency risk? At risk of sounding self-promotional, this is what we do at Merk. We either zoom in on the currency risk, such as in our Merk Absolute Return Currency Fund (MABFX) where we trade in and out of currencies on either side of the dollar and possibly earn a modest rate on our collateral (i.e., no underlying equity exposure). In other words, the returns come primarily from the currency trading activity. In doing so, investors stay away from equity risk. But for those that have taken out the currency risk from their international equities through hedged international equity funds, we argue investors should consider managing the currency risk separately. The strategy pursued in MABFX is a “long/short” strategy, i.e., it does not have an ex-ante bias for or against the dollar. We can take a positive or negative position on any currency we invest in relative to the dollar at any time. To learn more, please download a fact sheet and read the prospectus.

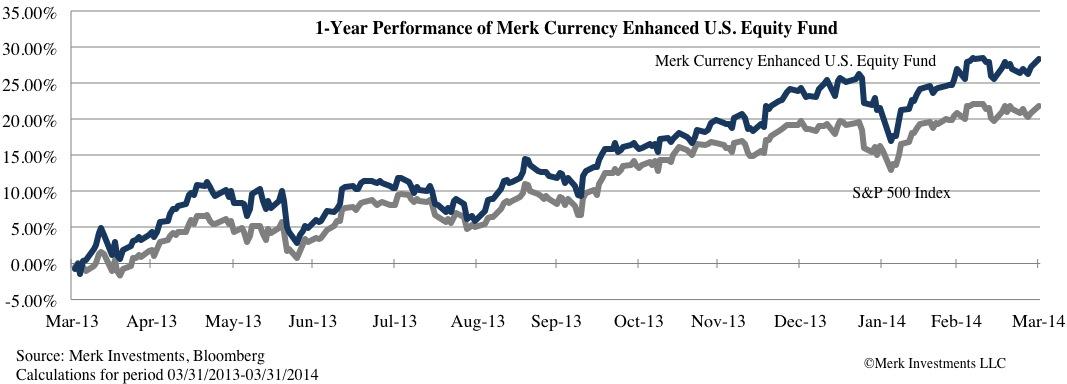

In our opinion, there’s no need to eliminate the currency risk for an equity investment. In our Merk Currency Enhanced U.S. Equity Fund (MUSFX), we are adding actively managed currency risk to U.S. equities with what is called a “currency overlay”. In doing so, the Fund adds a return stream that has historically had a low correlation with traditional asset classes and aims to generate positive active returns (i.e., alpha3). The Fund has beaten both the S&P 500 Index and the MSCI EAFE (an international equity benchmark) since inception:

Below is a visualization of the equity and currency components of the Merk Currency Enhanced U.S. Equity Fund (MUSFX). It is meant merely as an illustration of the concept of a currency overlay as described above.

The reason we mention this Fund here is to show that active currency management can add value to an equity portfolio. As this isn’t the place of extensively discuss this Fund, to learn more, please download a fact sheet and read the prospectus.

To summarize: international investors may either be taking on unnecessary risk if they leave their foreign equity positions un-hedged from a currency standpoint, or they may be leaving attractive uncorrelated returns on the table by passively hedging. As a result we encourage investors to consider finding a way to actively managing currency risk.

Don’t miss another Merk Insight: sign up for our free newsletter where we discuss how the U.S. dollar, gold and currencies impact investors’ portfolios.

1. Stock indexes used in this analysis: Australia: S&P/ASX 200 Net Total Return Index; Canada: S&P/TSX Composite Total Return Index; Switzerland: Swiss Market Gross Total Return Index; Eurozone: Euro Stoxx 50 Total Return Index; UK: FTSE 100 Total Return Index; Japan: Nikkei 225 Total Return Index; Norway: Oslo Stock Exchange OBX Index (It became a total return index since April 2006); New Zealand: NZX 50 Total Return Index; Sweden: OMX Stockholm 30 Total Return Index; Singapore: FTSE STI Total Return Index. All stock market indexes are in local currency terms and all include reinvested dividends.

2. Correlation is a statistical measure of how two securities move in relation to each other.

3. Alpha is a measure of risk-adjusted return. The excess return of the fund relative to the return of the benchmark is the fund’s alpha.

S&P 500 Total Return Index (SPXT): a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. Performance figures assume that all dividends are reinvested.

MSCI EAFE (Europe Australasia Far East) Index: a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. As international equity investment returns are a combination of equity returns and currency returns, the MSCI EAFE provides a useful comparison to a strategy including U.S. equities and currencies, like the Merk Currency Enhanced US Equity Fund. An investor cannot invest directly in an index.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold gathers bullish momentum, climbs above $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.