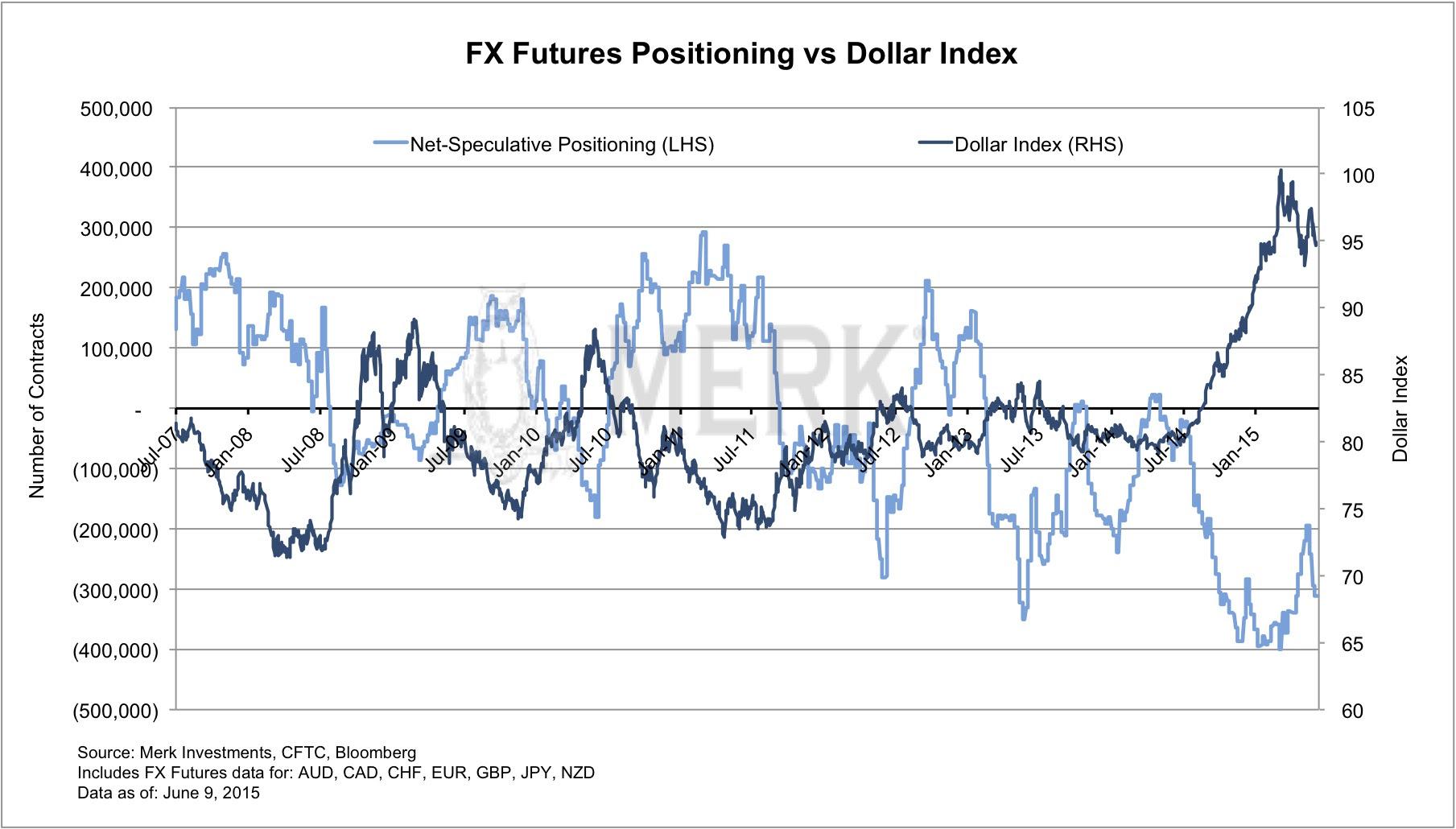

Positive sentiment on the dollar is very high (a potentially contrarian indicator)

The chart below shows net speculative positions based on CFTC data of the U.S. dollar versus other major currencies. While there's a long for every short in the futures market, the CFTC differentiates between "hedgers" and "speculators." The chart below suggests speculators are short currencies versus the U.S. dollar. "Net speculative positioning" aggregates contracts in the Australian Dollar (AUD), Canadian Dollar, Swiss Franc, Euro, Pound Sterling (GBP), Japanese Yen (JPY) and New Zealand Dollar (NZD). The dollar index is a measure of the value of the United States dollar relative to a static basket of currencies with Euro (EUR) 57.6% weight, Japanese yen (JPY) 13.6%, Pound Sterling (GBP) 11.9%, Canadian dollar (CAD) 9.1%, Swiss franc (CHF) 3.6% and Swedish krona (SEK) 4.2% weight. An investor cannot invest directly in an index.

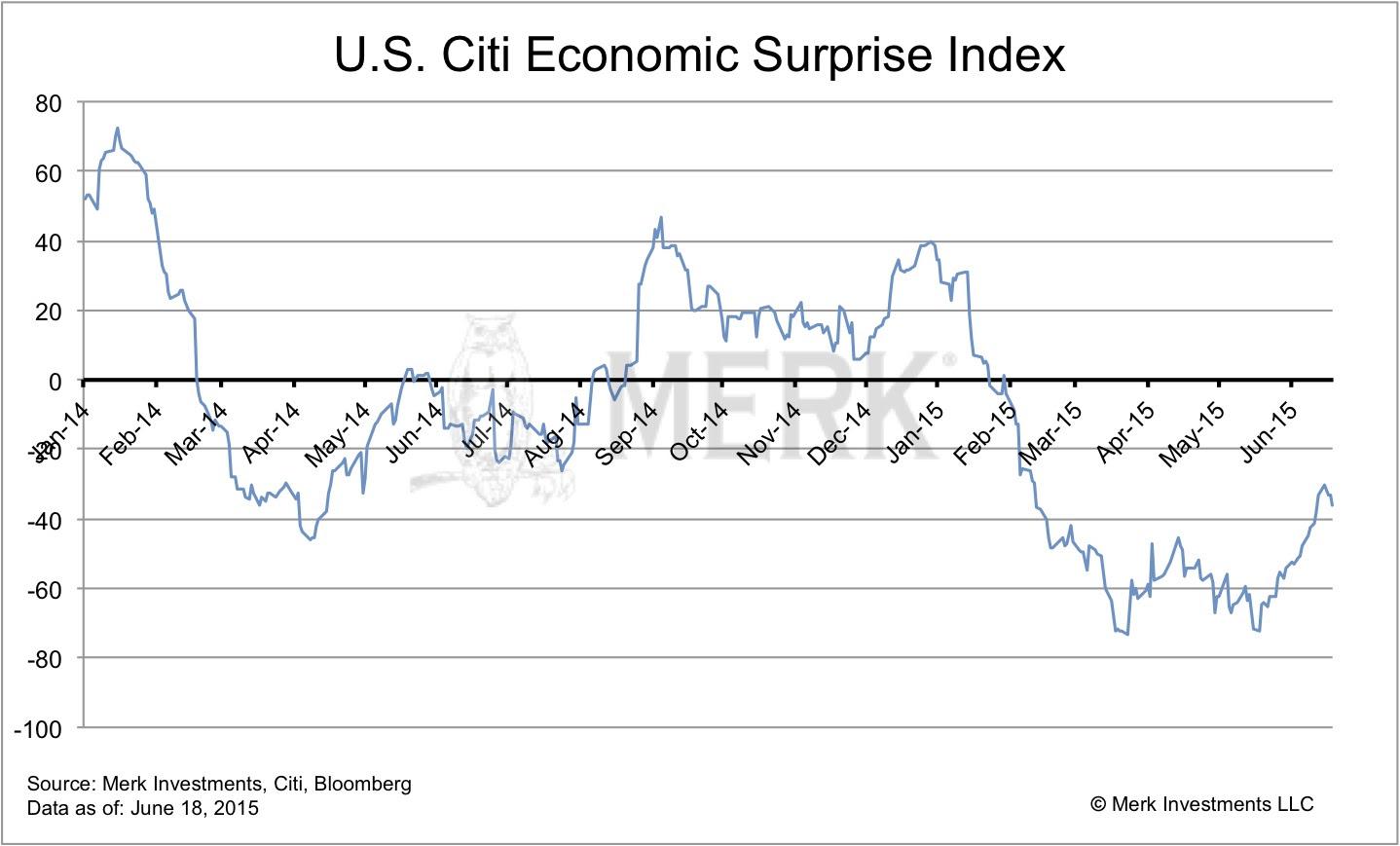

"Too much good news" may be priced into the U.S. Dollar

Please see the Citi economic surprise index for the U.S., an index showing how economic indicators have come in relative to expectations.

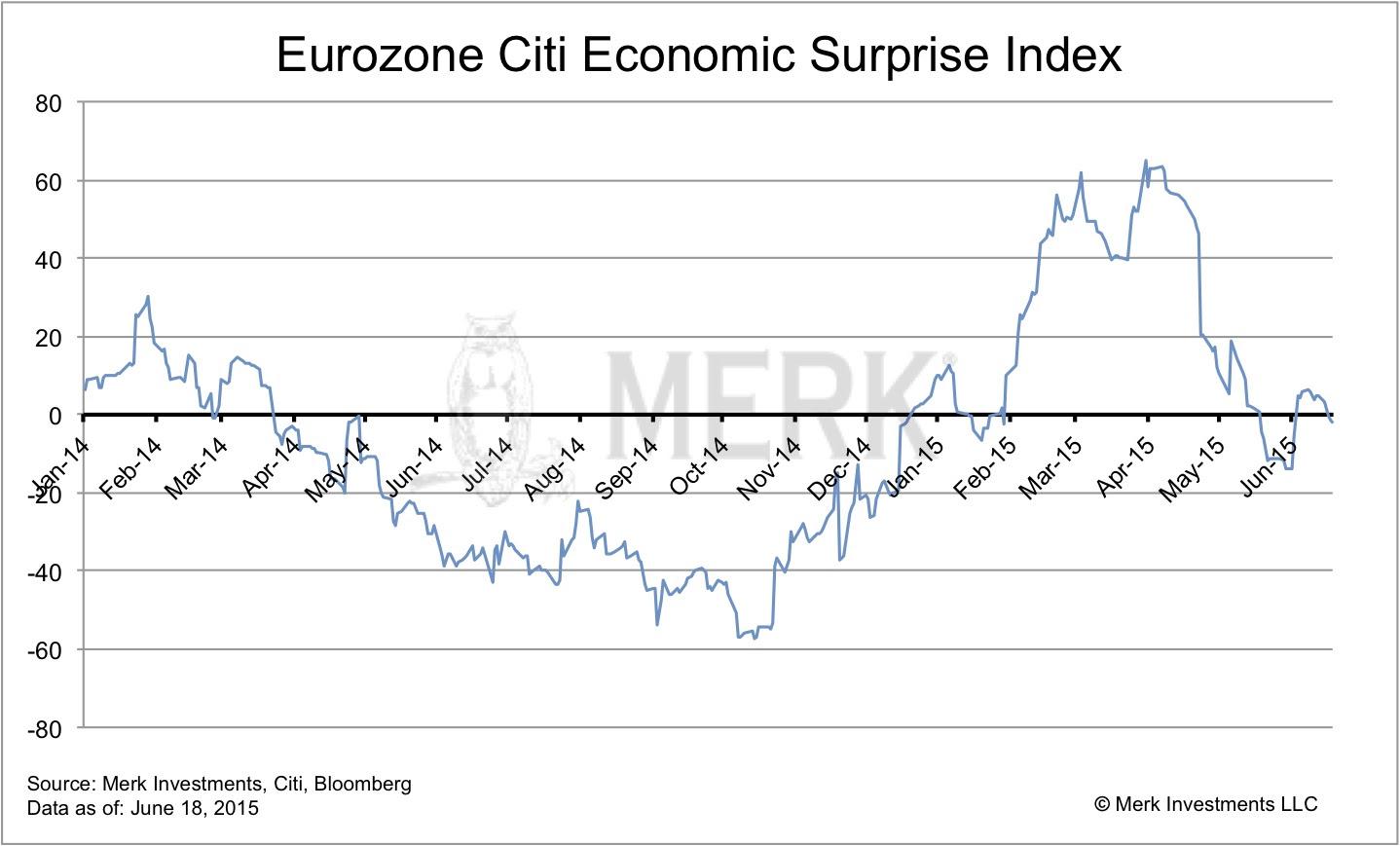

"Too much bad news" may be priced into hard currencies

As an example, please see the Citi economic surprise index for the Eurozone, an index showing how economic indicators have come in relative to expectations.

The Fed all but promises to be "behind the curve"

The Federal Open Market Committee (FOMC) has used the following sentence in their Statements since March 2014: "The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run." We interpret this as a commitment to be "behind the curve," i.e. to be late in raising rates relative to what would be warranted.Central banks, such as the Sweden's Riksbank may have to do a U-turn on their ultra-loose monetary policy

Many central banks outside of the U.S. put a heavier emphasis on headline rather than core inflation. Headline inflation includes food and energy prices. The plunge in energy prices was cited by various central banks as a reason interest rates were lowered. Starting in a few months, the year-over-year comparison on energy prices may no longer show deflationary pressures. As a result, some central banks may be inclined to reverse their highly accommodative policy, i.e. raise interest rates or reduce/eliminate quantitative easing.We define hard currencies as currencies backed by sound monetary policy. We define sound monetary policy as providing an environment fostering long-term price stability. We consider gold to be the only currency with intrinsic value and, as such, qualifying as a hard currency.

Since the Funds primarily invest in foreign currencies, changes in currency exchange rates affect the value of what the Funds own and the price of the Funds’ shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, emerging market risk, and relatively illiquid markets. The Funds are subject to interest rate risk, which is the risk that debt securities in the Funds’ portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities, such as forward contracts, which can be volatile and involve various types and degrees of risk. If the U.S. dollar fluctuates in value against currencies the Funds are exposed to, your investment may also fluctuate in value.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.