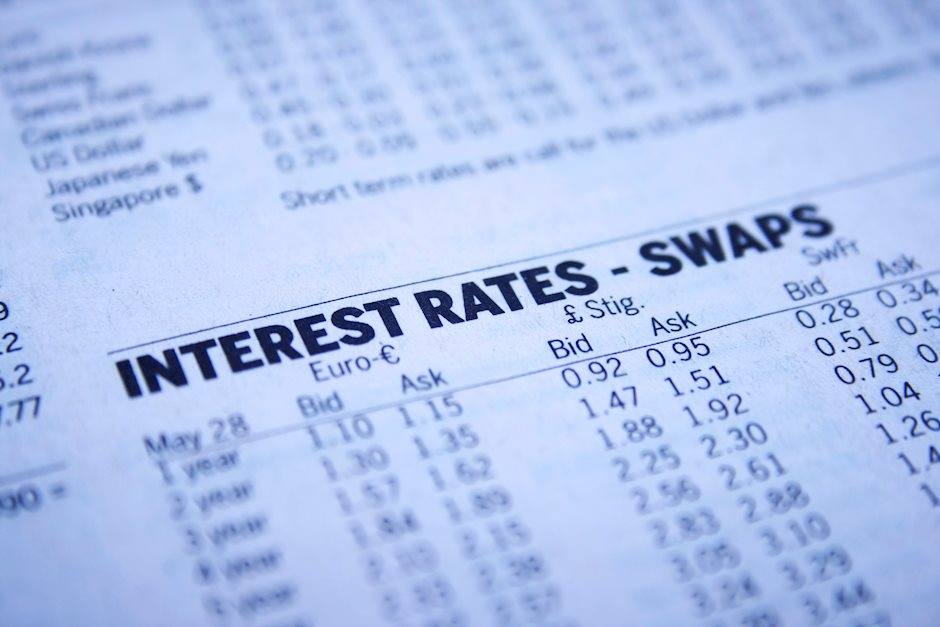

Markets are entirely in thrall to interest rates

Markets

US stocks slid for the second day as Fed hawks continued to circle the wagons, repeatedly emphasizing their fight against inflation is far from done. So with investors beginning to question the validity of the post-CPI market moonshot, it effectively pushes out the process of getting constructive for next year.

If the Fed raises Funds to 5% and then holds through the expected H1 2023 recession, that's hardly a good signal for equity markets.

Broader markets are entirely in thrall to interest rates. Air pockets lower were evident in virtually every asset class as US 10-year Treasury yields climbed after St. Louis Fed President James Bullard said policymakers should increase interest rates to 5% to 5.25% to curb inflation.

The S&P 500 and the tech-heavy Nasdaq 100 declined for the second consecutive session as the falling tide grounds all ships.

Price actions suggest investors lack the necessary conviction above 4000 on the S & P 500. Things can turn on a dime, primarily when the fear of missing drives sentiment. However, the odds of a pre-Thanksgiving rally are giving way to the hawkish Fed drumbeat and pushback on China reopening plays.

Oil

Oil prices plummeted as traders dumped the China reopening play's and headed for the exits en masse as a confluence of bearish market forces bore down on the oil complex.

China's covid concerns are on everyone's mind, and with local surges giving rise to protracted lockdowns, oil prices are moving tangentially lower to that increasing probability.

China's inflation threat, which suggests higher interest rates in the offing, is also a worrying signpost for the commodity space, particularly oil markets. The experiences of western economies won't be lost on the PBOC. And this is one of the rationales for markets to defer to a slower reopening, as it will mitigate the inflation angst suffered by western economies.

The Fed's determination to fight inflation at all costs will increase the odds of a hard landing and could support the US dollar negatively for the oil markets for longer than expected.

Forex

The dollar snapped a two-day drop while reminding investors of its Jekyll and Hyde persona regarding its correlation with risk assets framed by higher US yields.

Still, unless market pricing for the next three meetings steps up from the 100bp currently priced, given the time of year, it is hard to envision the EURUSD heading for parity again despite the pushback in the China reopening, which would have paid the Euro off in spades via the growth-inflation trade-off.

Author

Stephen Innes

SPI Asset Management

With more than 25 years of experience, Stephen has a deep-seated knowledge of G10 and Asian currency markets as well as precious metal and oil markets.