Australian Employment Data Wrong? What Matters to Traders

Australian Employment Data Wrong? What Matters to Traders: Yesterday’s Employment figures out of Australia were what can only be described as marvellous! …if taken on face value that is. As Peter Martin of the SMH hilariously pointed out, our stubborn Minister for Employment had no problems doing.

“The minister was asked whether she had concerns about the reliability of the figures. She said she did not.”

With the Employment Change printing a whopping +71.4K v the -10.0K expected, on the back of the +58.6K in November, I think it is fair to at least ask the question whether the figures are entirely correct. Add the Unemployment rate falling to 5.8% v an expected rise to 6.0% and you have one amazing set of numbers which surely are too good to be true.

So why the issue you ask? 1/8th of the 26,000 households surveyed each month by the Bureau of Statistics must be rotated from time to time. It is the fact that the newly surveyed households are sometimes very different to the old ones surveyed which is being blamed for the occasional jumpy nature of Australian unemployment data.

But what does that mean for us as traders? To be honest, it really doesn’t matter whether the figures, or the way they’re gathered, are right or wrong for us. The only thing that matters is price, and the perception of where price should actually be.

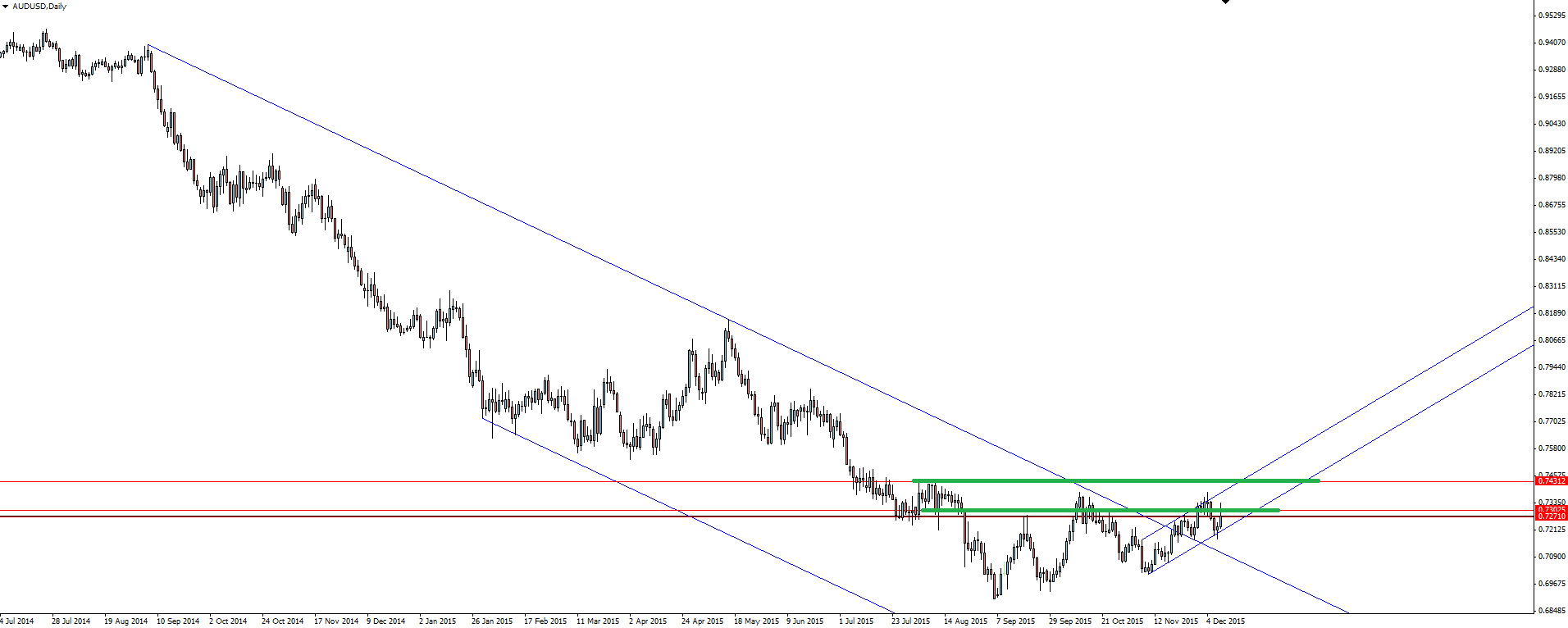

AUD/USD Daily:

The market has interpreted the figures as beating expectation, but not by the record amounts being reported and that’s all that matters. It’s a quality narrative and hugely beneficial for your overall view on the Australian Dollar, but if you’re trading just remember to always take that step back and remember what really matters in the trading game. Price.

On the Calendar Friday:

USD Core Retail Sales m/m

USD PPI m/m

USD Retail Sales m/m

USD Prelim UoM Consumer Sentiment

CNY Industrial Production y/y

Chart of the Day:

With last night’s other major piece of news being the interest rate decision out of Switzerland, the SNB left rates on hold and maintained the now hollow pledge of intervening when needed to possibly weaken a currency they still see as overvalued. Today’s chart of the day takes a deeper look at the Swissy.

USD/CHF Daily:

The daily shows a juicy fake-out above resistance, before the USD squeeze and Draghi’s relative inaction sent price on a one way ticket toward major trend line support.

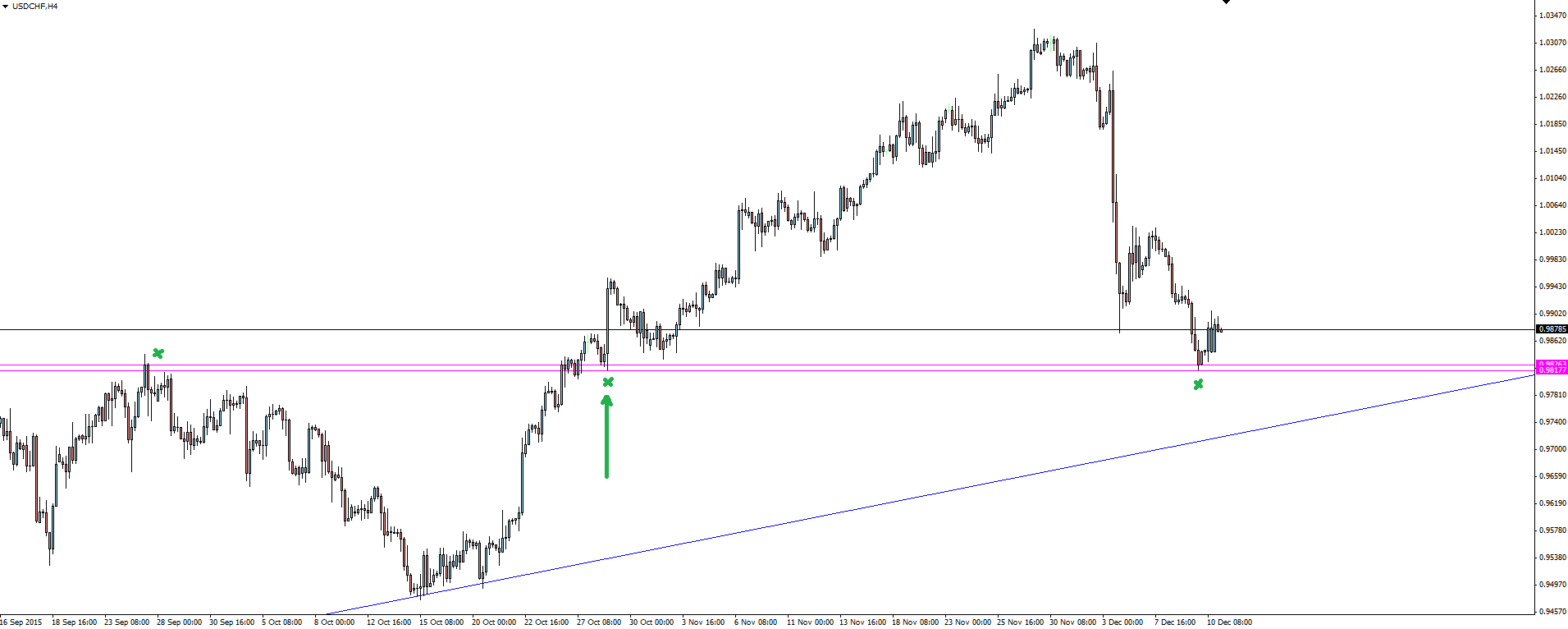

USD/CHF 4 Hourly:

But it’s the 4 hour chart that I wanted to highlight, starting with the beautiful bounce off the 0.9817 level and look at why it stopped there. First of all we have seen the level tested both on the support and resistance sides, with the major reactions marked on the chart above.

But look at the candle above the arrow. Price didn’t just bounce off the level, price BOOSTED off the level. One of the most important aspects of determining the strength of support/resistance levels is in how hard price has moved off the level in the past. As you can see, buyers previously dominated this level and when price came back to re-test, combined with confluence, this was just too much not to bounce.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.