Another quarter down and following last week’s Fed remarks on October being in play, tonight’s NFP number takes on added significance.

The September jobs report number is expected to show that the US economy has managed to shrug off external concerns and a recent stock market price action roller-coaster, and continue to print numbers keeping the average moving in the right direction for the Fed to act on.

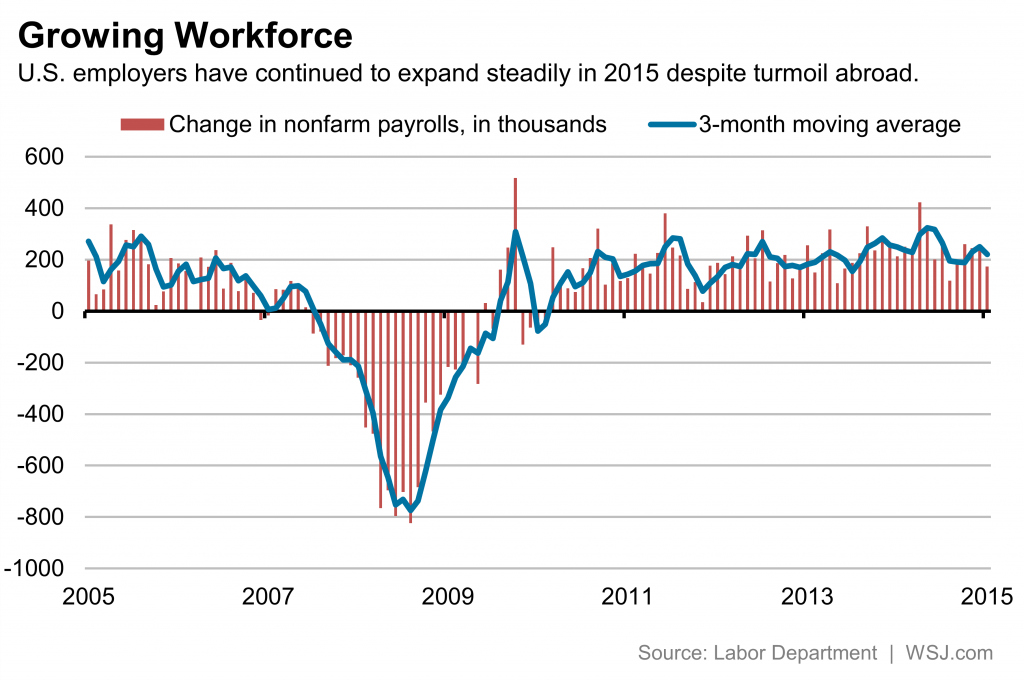

The Wall Street Journal has a brilliant little fundamental preview featuring the 5 things to watch in the September jobs report. I’ve featured the following chart showing an overview of the NFP numbers month to month with the average in question:

The September USD Non-Farm Employment Change number is expected to come in at 202K, an improvement on August’s 173K. The Unemployment Rate is also expected to hold steady at 5.1%.

With August’s print being the second weakest month of job creation for the calendar year, the above average is sure to attract some attention.

Trading Scenarios:

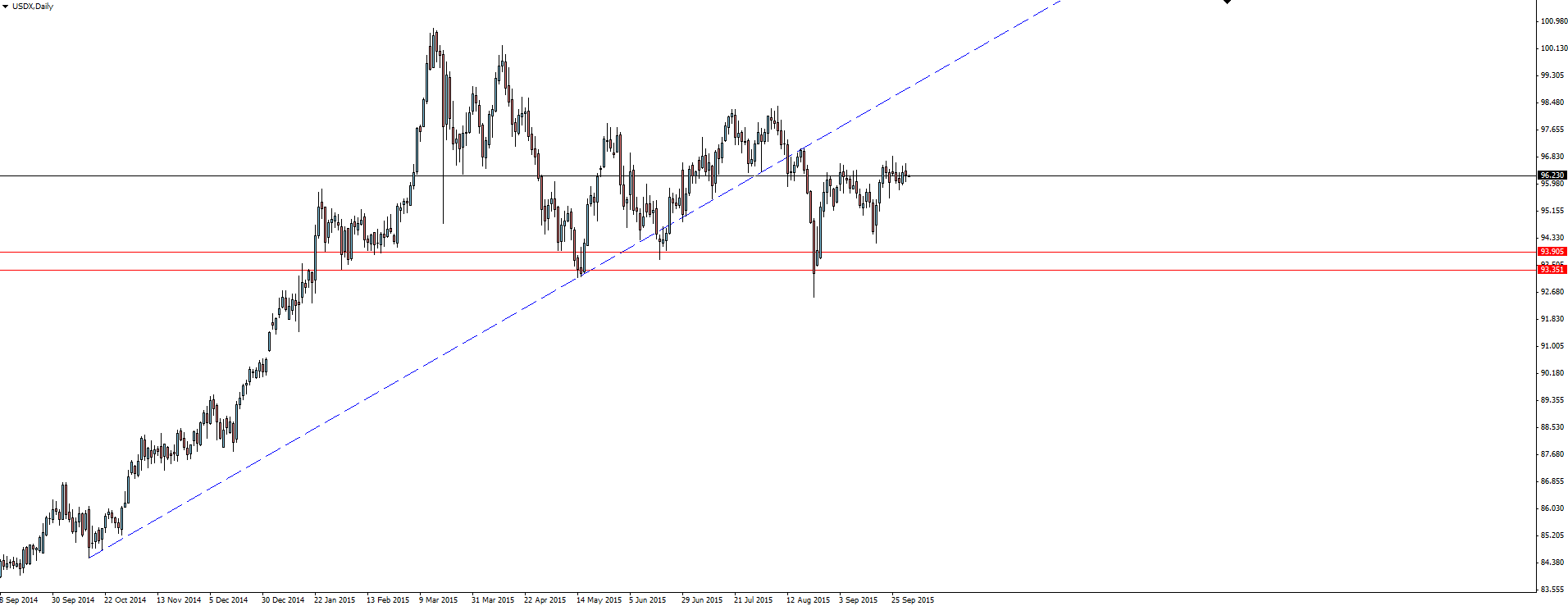

1. If Non-Farm Payrolls print greater than 200K + the Unemployment Rate stays steady as expected, the USD is expected to rally as the likelihood of a rate hike in 2015 will rise.

2. If Non-Farm Payrolls print less than 200K + the Unemployment Rate stays steady, or worse falls, the USD is expected to drop or more likely plateau as expectations on a 2015 Fed hike are already quite low.

With futures markets pricing in only a 16% chance that the Fed hikes in October and an equally dismal 43% that they move in December, anything that beats expectations is likely to have a greater impact on the USD than a miss.

USDX Daily:

Stay safe out there.

On the Calendar Friday:

CNY Bank Holiday

AUD Retail Sales m/m

EUR ECB President Draghi Speaks

GBP Construction PMI

USD Average Hourly Earnings m/m

USD Non-Farm Employment Change

USD Unemployment Rate

Chart of the Day:

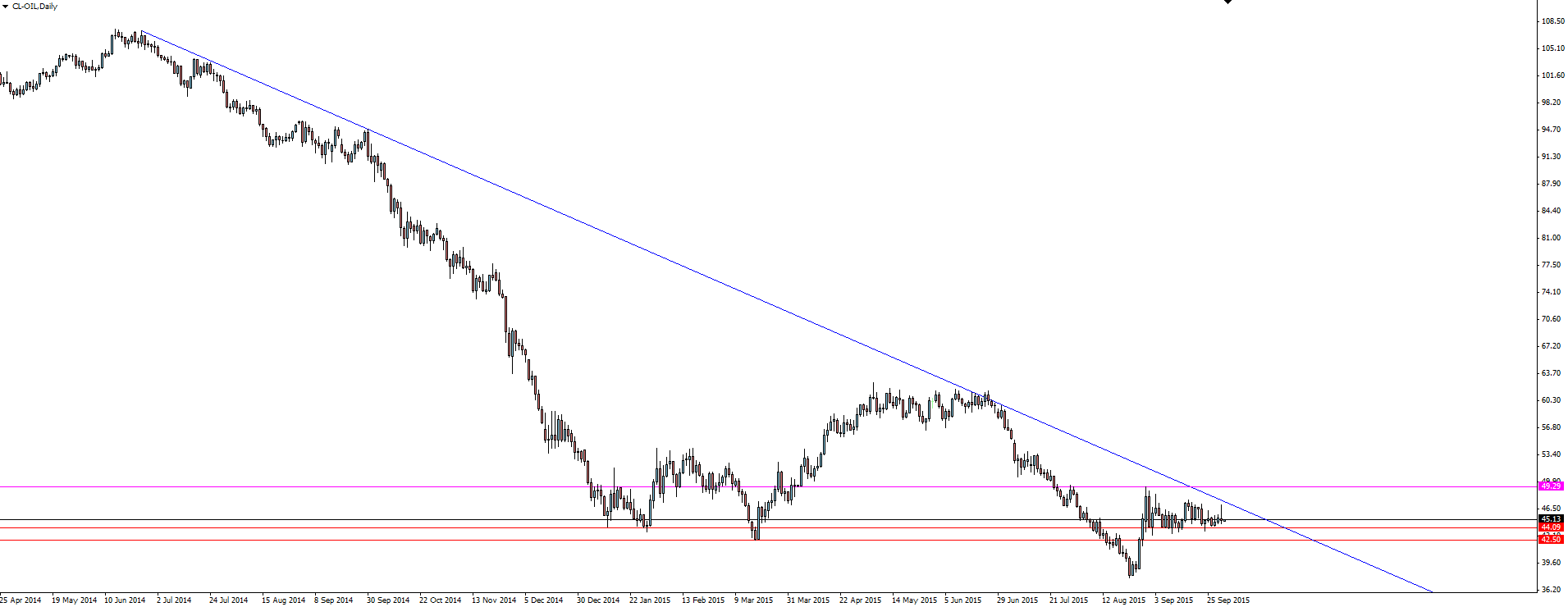

Across into the realm of Commodities Trading for today’s chart of the day.

Oil Daily:

After speaking about oil last week, one week later and price is still capped by the descending trend line. We were looking for the market to find some sellers as price approached trend line resistance and then to find an opportunity to short as it fell through the marked zone.

The setup has now reached its now or never moment. Trade the reaction or let it go with sideways chop expected if the trend line isn’t able to break or hold with a momentum type move from here.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

Bitcoin price reclaims $59K as Fed leaves rates unchanged

The market was at the edge of its seat on Wednesday to see whether the US Federal Reserve (Fed) would cut interest rates during the Federal Open Market Committee (FOMC) meeting.

The market welcomes the Fed's statement

The market has welcomed the Fed statement, and the S&P 500 is higher in its aftermath, the dollar is lower and Treasury yields are falling. There is still only one cut priced in by the Fed.