Super Mario Draghi:

With China still on holidays in observance of Victory over Japan Day, we’re expecting a quiet Asian session in the lead up to Non-Farm Payrolls later tonight. Yesterday it was interesting to see markets such as the Australian SPI200 print a long red daily candle without having a Chinese lead to blame!

Last night saw ECB President Mario Draghi deliver a largely dovish press conference following the ECB’s board meeting. The Euro sold off hard as Draghi delivered some changes to the ECB’s quantitative easing program, expanding it slightly and ensuring the market that it would be continued into the near future. This was a tweak to the previous ECB rhetoric, hinting at a stronger willingness to prolong their bond purchasing program.

“Stimulus will continue until the end of September 2016. Or beyond if necessary.”

Europe hasn’t escaped the more subdued global outlook and Draghi spoke of a reduction in growth and deflation concerns, pushing the Euro back to swing lows.

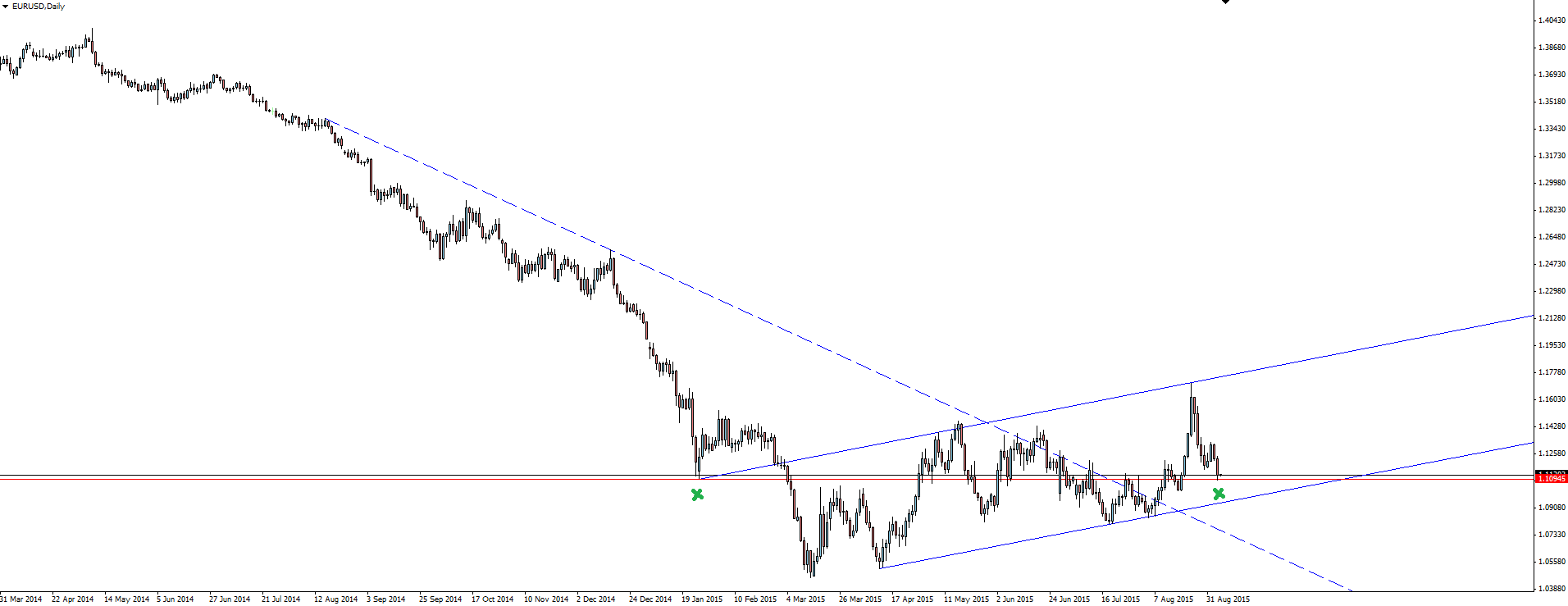

EUR/USD Daily:

From a technical viewpoint, EUR/USD sits at an important support level as it tries to move through a change of trend.

NFP Friday:

Looking at where price sits on the above chart and considering the global economic uncertainty surrounding the Fed right now, there is definitely more risk in playing for a drop. We also have to consider the possibility of a clear ‘no’ being signalled tonight before the NFP number has even been printed, with the Fed’s Lacker speaking 20 minutes before the NFP release in a speech titled ‘The case against further delay’. Sounds pretty ominous to me.

August has historically been a month of disappointment for employment numbers with economists overestimating the month’s NFP print over the past four years by an average of 50,000. The old August curse!

Keep in mind that this is also the final NFP print before the Fed’s September policy meeting. Bloomberg’s Michelle Jamrisko gives an excellent ‘Jobs Day Guide’ here.

On the Calendar Friday:

CNY Bank Holiday

USD FOMC Member Lacker Speaks

CAD Employment Change

CAD Unemployment Rate

USD Average Hourly Earnings m/m

USD Non-Farm Employment Change

USD Unemployment Rate

CAD Ivey PMI

Chart of the Day:

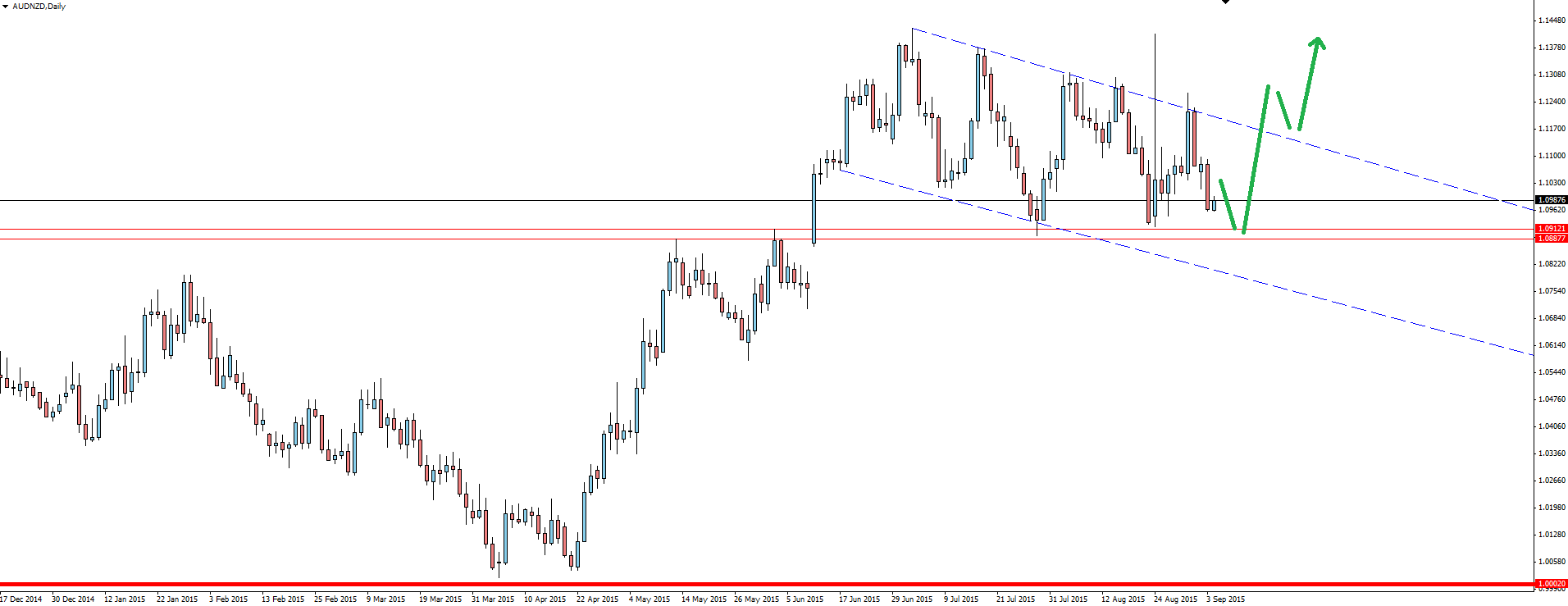

Today we head back to the world of Forex trading with a look at a flag pattern on the AUD/NZD daily chart. We also take a look at the how price reacts to previously significant levels after unnatural spikes.

AUD/NZD Daily:

The above chart shows a flag pattern forming with clear support at a retest of broken horizontal resistance that could possibly be retested as support. This level provides a clear area to manage your risk around and to play for the breakout to the upside.

When talking about how to draw trend lines, it’s worth noting how the market treated Black Monday’s spike from a technical point of view. The market treats unnatural spikes differently to regular rejections. Unnatural being thin liquidity such as Monday, unpredictable events and even some news candles.

As you can see, the Black Monday spike pushed through the upper trend line of our flag channel but the very next test obeyed the original line cleanly. Don’t ever remove trend lines or levels that have been breached by price action that could be deemed unnatural.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Asian trading hours on Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.