Countdown to Liftoff:

Although the Federal Reserve didn’t give a clear signal on the timing of liftoff, the rhetoric of improving housing and labour markets shows that the countdown has at least begun.

Fed officials have indicated that a September rate hike is now a real possibility after citing that the economy has overcome its first quarter slowdown and despite external factors and energy market worries, that the economy has actually expanded moderately.

Here are a couple of key quotes indicating that confidence in the labour market is improving:

“On balance, a range of labor market indicators suggest that underutilization of labor resources has diminished since early this year.”

“The labour market continued to improve, with solid job gains and declining unemployment.”

This definitely indicates an improved outlook on the economy from the Fed, with last month’s statement saying that ‘some slack still remained’ in the labour market.

“Need to see “some” more improvement in the labor market.”

As always, it’s the little things that have a huge impact on traders mindsets. In today’s statement, by adding the word ‘some’, markets are interpreting the hurdle to a September rate hike as being lowered.

10… 9…. 8….

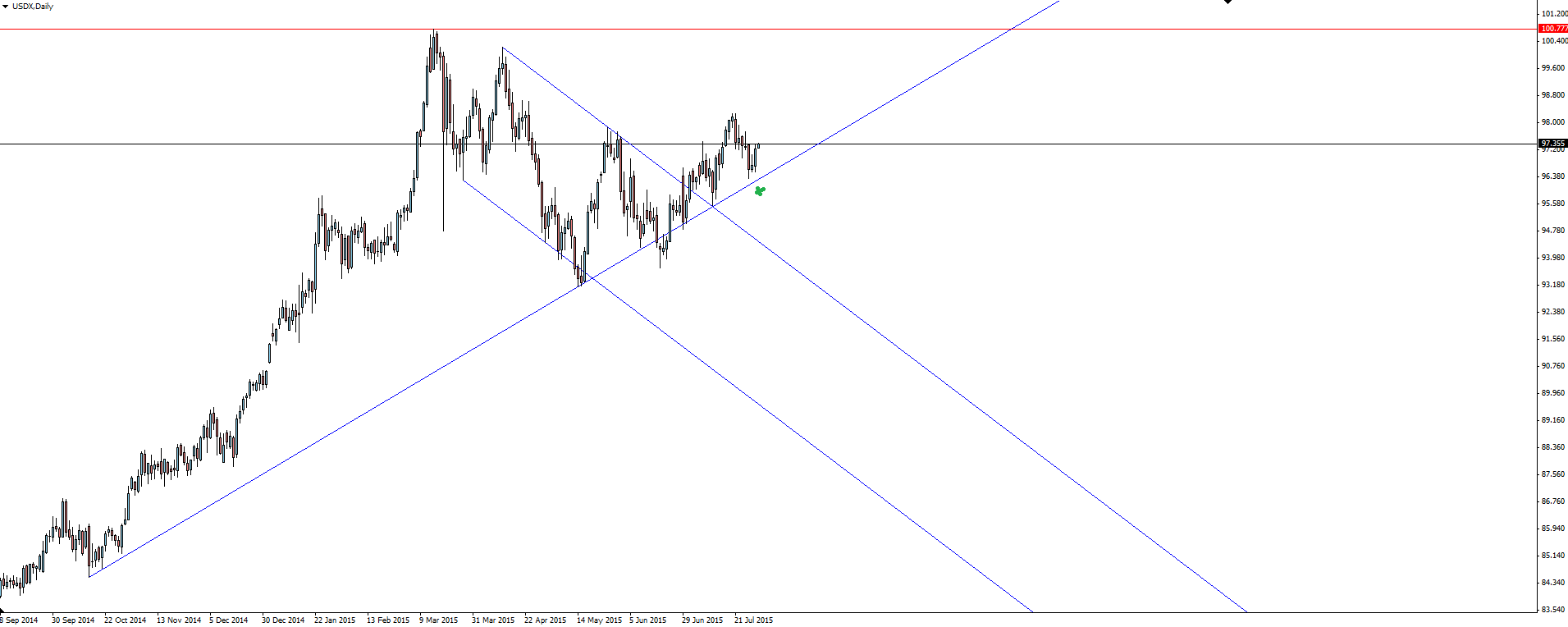

USDX Daily:

The US Dollar Index rallied on the release, pushing out of trend line support and targeting new highs.

On the Calendar Thursday:

AUD RBA Gov Stevens Speaks

AUD Building Approvals

USD Advance GDP

USD Goods Trade Balance

USD Unemployment Claims

Chart of the Day:

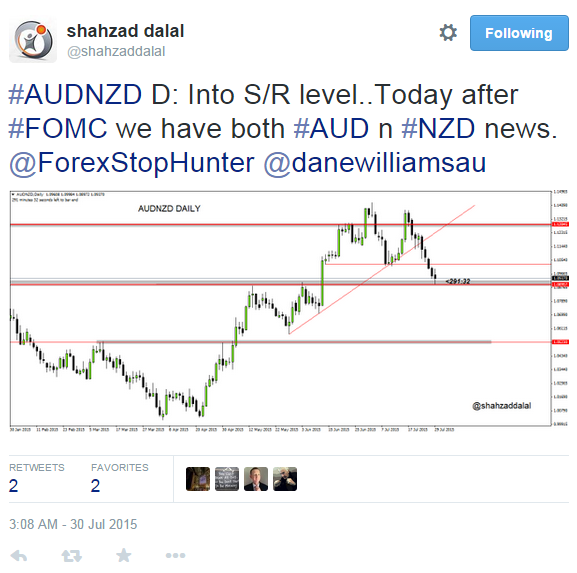

With FOMC now in the rear view mirror, we this morning turn our attention to AUD/NZD and this chart from @shahzaddalal on Twitter shows the zone of interest perfectly.

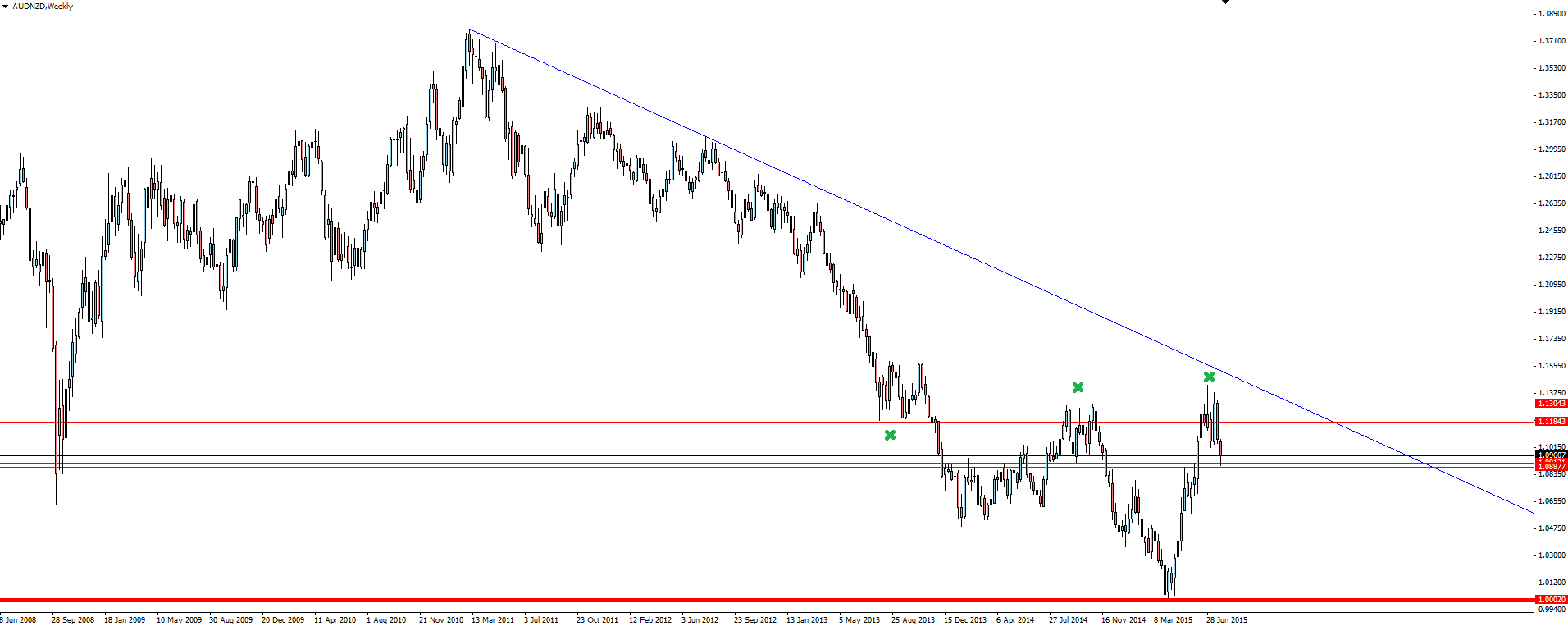

With the overall trend strongly bearish, the level I’ve highlight on the weekly chart shows price retesting broken support now as resistance. This is normal trend resumption price behaviour. The long term trend line resistance also gives extra insurance to a bearish trend trade.

AUD/NZD Weekly:

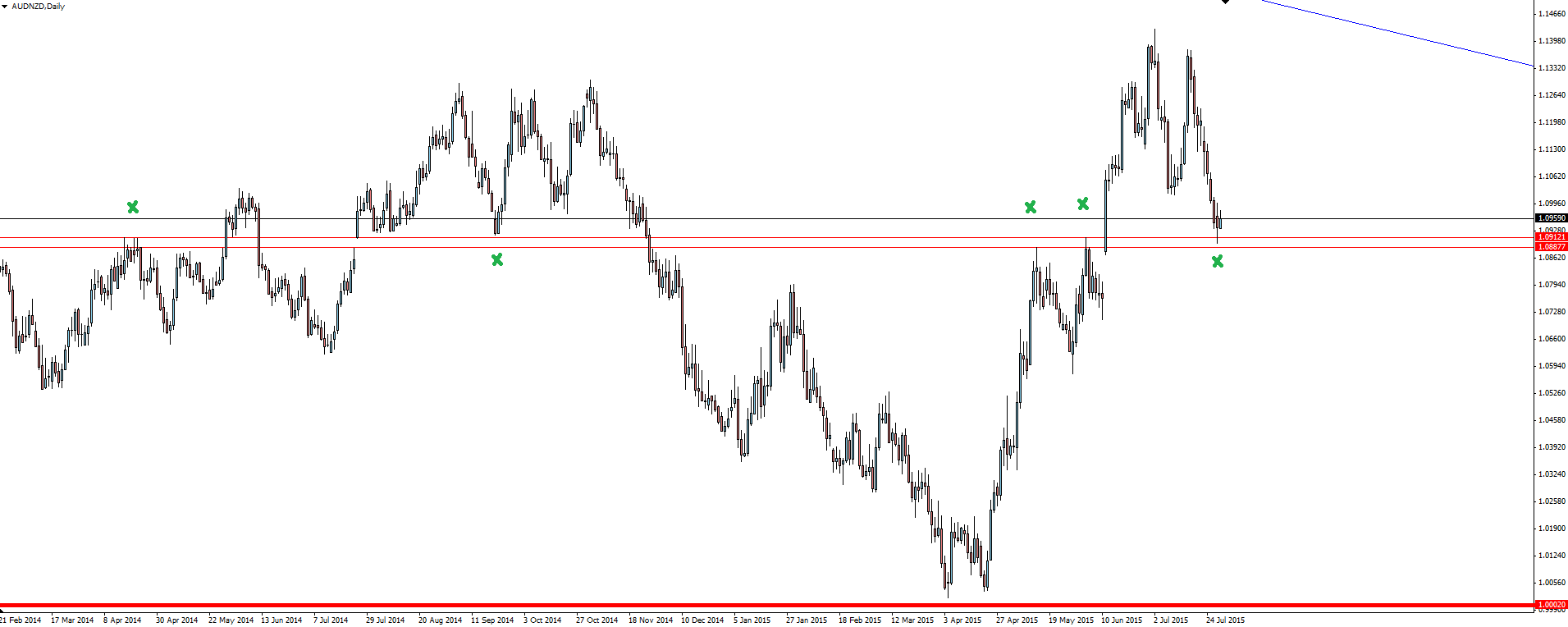

However, the daily chart that Shahzad posted above, shows price hitting an important short term support/resistance level that has been tested and retested on multiple occasions over the last couple of years.

AUD/NZD Daily:

Trading from the bottom side of this level is obviously the safer trade but with yesterday’s daily candle providing a long wick into the zone and then bouncing today, an argument could easily be made to trade the opposite direction.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the early Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

Ethereum traders show uncertainty following huge whale sale, Robinhood Crypto Wells notice

Ethereum holdings on centralized exchanges continue to decline despite recent whale sales. With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.