Jobless Claims:

Overnight’s Unemployment Claims number out of the US smashed expectation. The 255K print beat the 279K expectation, meaning the number came in at its lowest level since 1973! What were you doing in 1973?

“USD Unemployment Claims 255K v 279K expected.”

This means that since March, unemployment claims have been well below the 300K magic number that is seen as par for an improving labour market. We all know how much human beings, and especially the special types who trade, love round numbers.

Back in early July, Janet Yellen made the following comment on the labour market, highlighting what she saw as remaining slack:

“It is my judgment that the lower level of the unemployment rate today probably does not fully capture the extent of slack remaining in the labour market – in other words, how far away we are from a full-employment economy,”

This number can be viewed as a tightening of that slack. Picture the job market as a loose, coiled up piece of rope and this print meaning employers are pulling it tighter with each month.

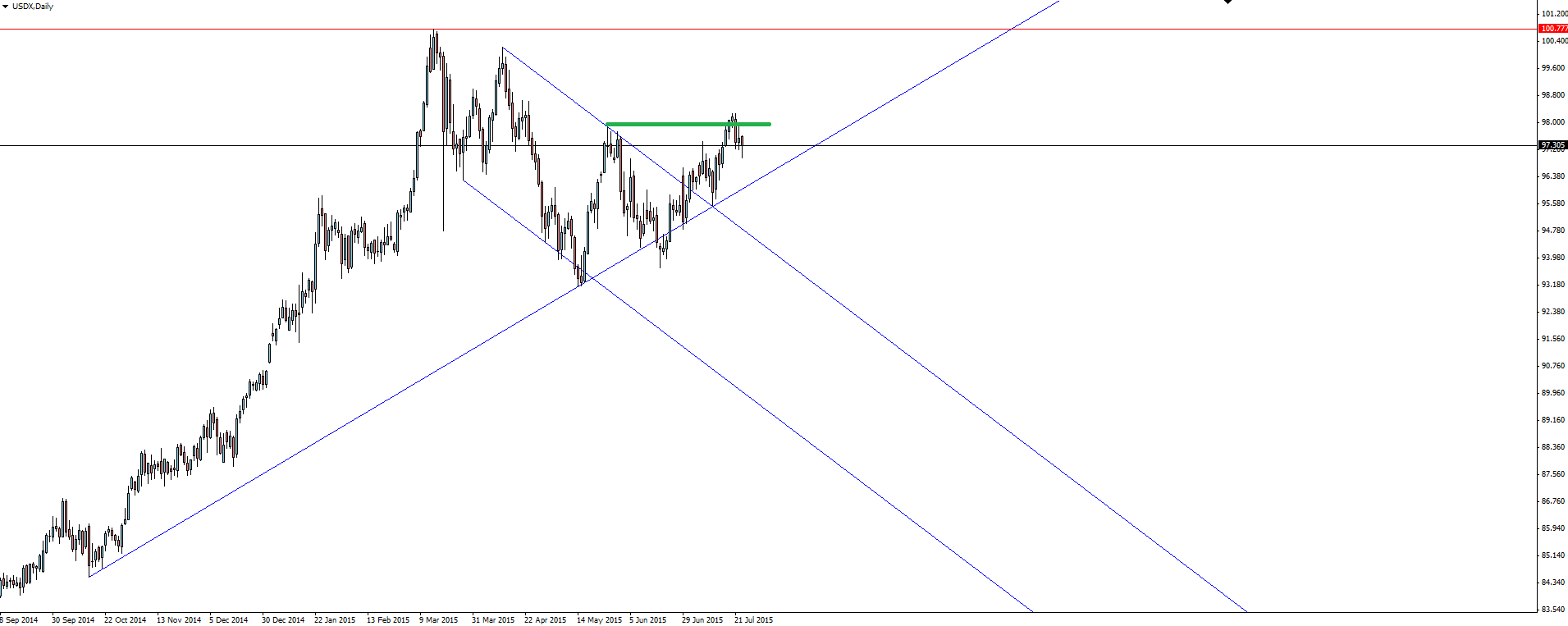

USDX Daily:

With this excellent print, I have to say that I expected more from the USDX. But the fact that the daily candle left that long wick into previous resistance now being tested as support tells me that the buyers are still in charge of this market.

Next week we have FOMC and US GDP which will he HUGE catalysts for the Fed to possibly pull the trigger on a rate hike in September. Let’s just say that I’d much rather be long USD going into these releases than short anyway.

On the Calendar Friday:

NZD Trade Balance (-60M v +100M expected)

CNY Markit Flash Manufacturing PMI

EUR French Flash Manufacturing PMI

EUR German Flash Manufacturing PMI

EUR Flash Manufacturing PMI

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.