Morning View: The big European story out of Greece? Not this morning, as IMF head Christine Lagarde weighed in on US monetary policy during a press briefing in Washington overnight.

“The inflation rate is not progressing at a rate that would warrant, without risk, a rate hike in the next few months.”

“That means the Fed should wait until early 2016, even if there’s a risk of slight over-inflation relative to the central bank’s 2% target.”

With Janet Yellen and the Fed still moving down the data dependent path to rate hikes most likely starting in December, she agrees with Lagarde’s comments re inflation but has stated over and over her ‘reasonable confidence’ that inflation will come back down towards 2% where it needs to be.

Nothing is changing.

But no, we can’t have a morning report without mentioning Greece somewhere along the way and today is no different.

Greece has now informed the IMF that they will not be able to make this week’s €321 million payment. They have instead asked to bundle it into one €1.5 billion payment at the end of the month.

EUR/USD Daily:

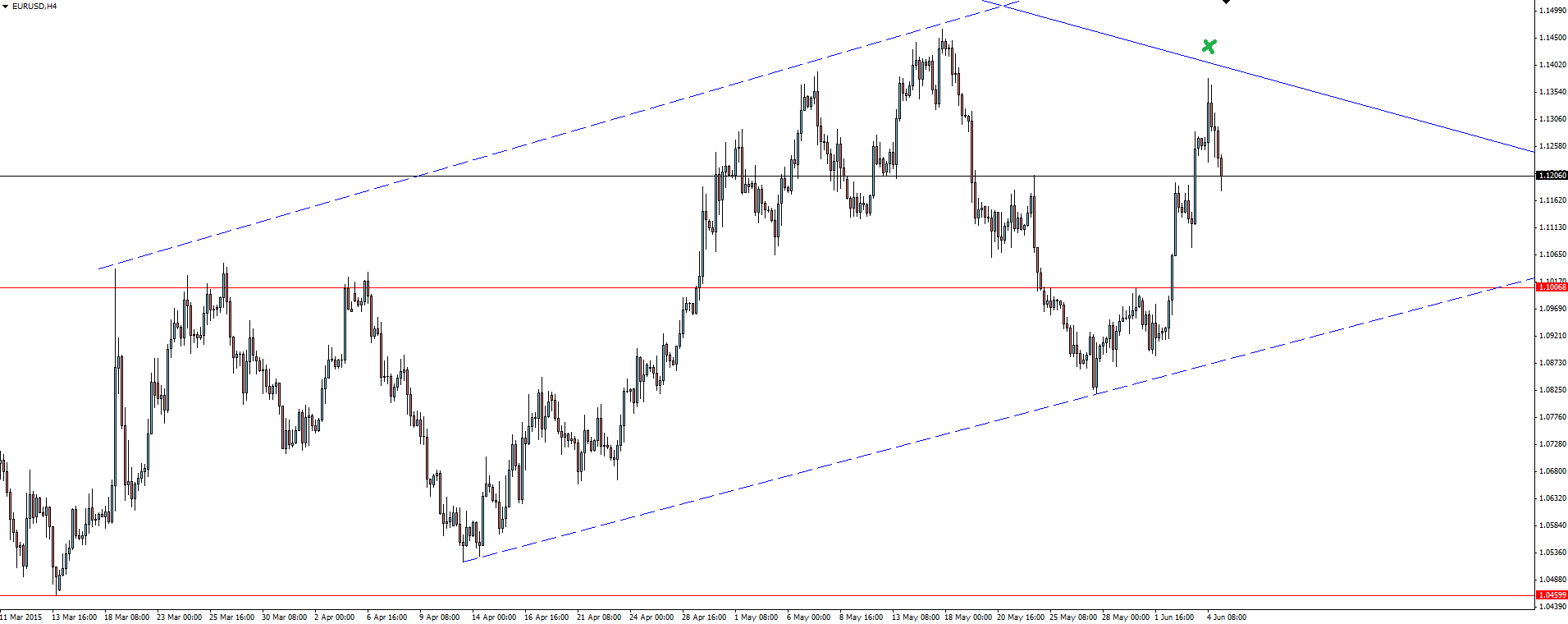

EUR/USD 4 Hourly:

Well in to anyone who was shorting that top into resistance. Stepping in front of the steamroller like that following the momentum behind the rally we have been seeing lately would have took guts. But it’s all about levels that you can manage your risk around and I know plenty of you jagged it with good trade management.

The request to bundle payments is a game changer in that for the first time, this is Greece actually not doing what was asked of them. There was no sideways deal from the IMF, this was Greece putting it off.

They won’t get many chances like this.

On the Calendar Today:

Quiet one in Asia with no tier 1 data on the calendar. It’s all about NFP during the US session with NY Fed’s Dudley due to speak a few hours later in Minneapolis which could see some interesting questions asked if we get a big miss either way.

Friday:

USD OPEC Meetings

CAD Employment Change

CAD Unemployment Rate

USD Non-Farm Employment Change

USD Unemployment Rate

USD FOMC Member Dudley Speaks

Chart of the Day:

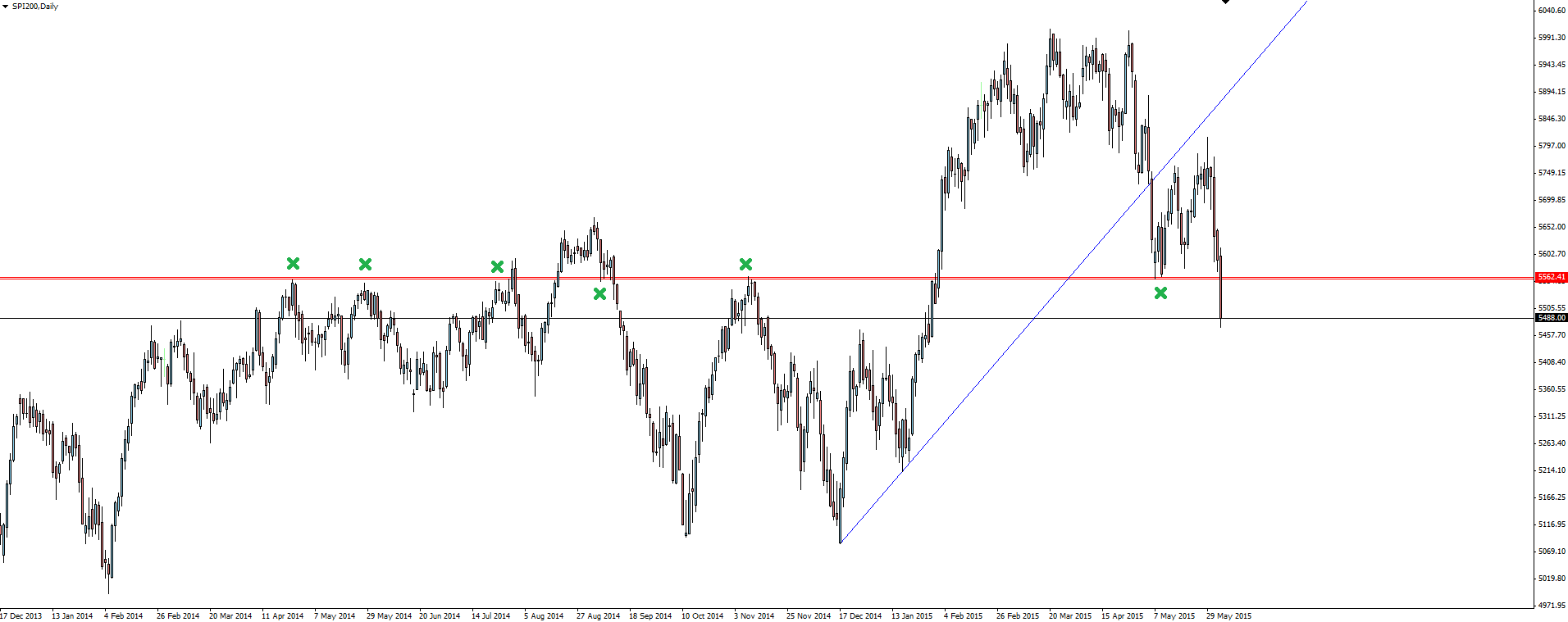

SPI200 Daily:

With the 6000 level now long gone, the Australian market broke through major support at 5560 yesterday, showing good momentum in it’s follow through to close on it’s daily lows.

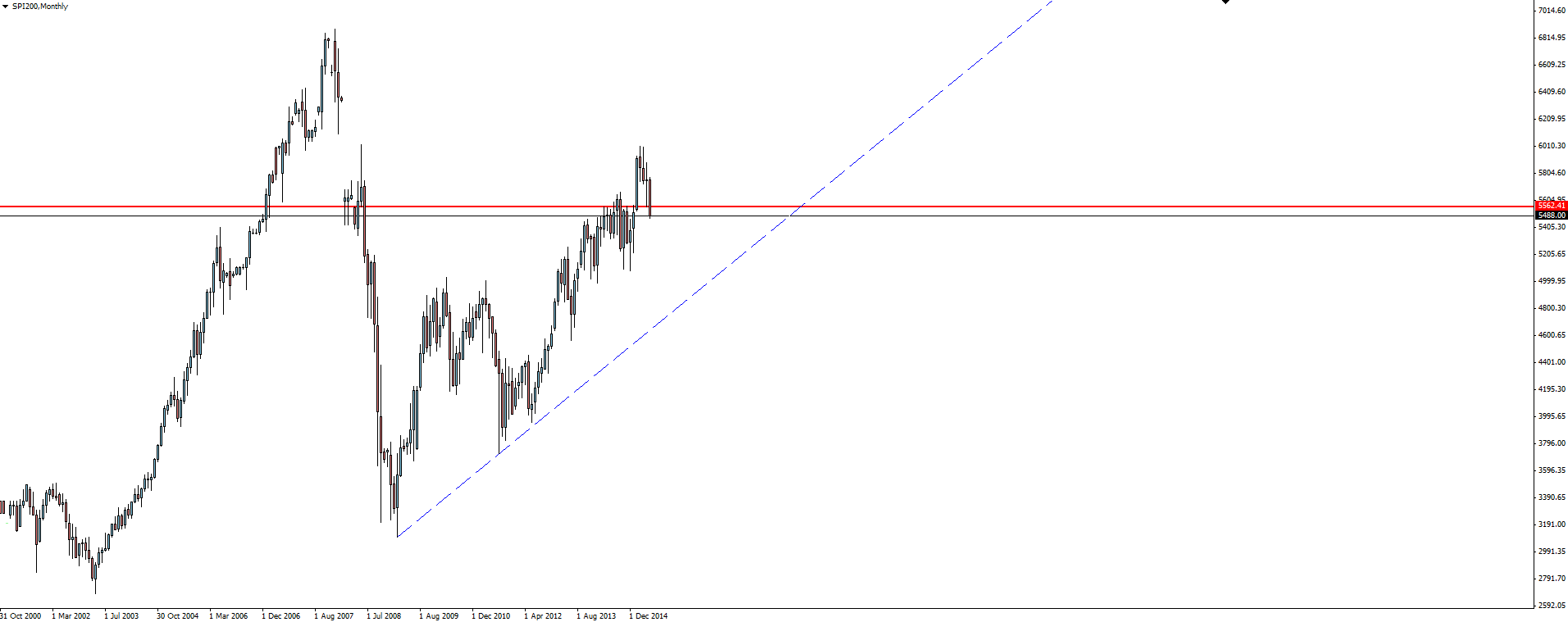

SPI200 Monthly:

What looks like a big deal on the daily is shown on the Monthly chart as a healthy correction that a market in an up trend needs to have. Always good to use that chart with the GFC carniage on it for some perspective when we get some bearish days.

Finally, just a heads up that there will be no Asian Session Morning blog on Monday as I’m out of the office due to the Queen’s Birthday long weekend.

For one day a year the colonies still love you. God Save the Queen!

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold holds below $2,300, Fedspeak eyed

Gold price loses its recovery momentum around $2,295 on Monday during the early Asian session. Investors will keep an eye on Fedspeaks this week, along with the first reading of the US Michigan Consumer Sentiment Index for May on Friday.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.