USD Timeout:

Good Morning Traders. Both end of the week and end of the month so stay alert for any end of month flows as we head into the weekend.

We saw a little bit of that yesterday with some USD long squaring as traders took some profit ahead of tonight’s major US GDP release. USD/JPY hasn’t looked back since it’s Tuesday breakout so for me has some more to give back before the release. If the GDP number is good however, /USD pairs watch out. This one is going to be a serious market mover!

On the JPY side of the equation, Japanese Finance Minister Taro Aso was on the wires saying that recent currency moves were “rough” and that he will monitor forex moves carefully which helped the small pullback we got. Japan are enjoying the fruit that a weak Yen brings with it, but the government is worried about the almost straight line fall the currency is continuing to experience. With 125.00 not too far away, the risk of jawboning and some wild corrective spikes is definitely on the cards.

Euro Weekend Risk:

Turning back to the ever present Greece, time is running out for a deal with the IMF to be done.

With the G7 meetings this week, we got some juicy comments from Christine Lagarde talking to a German Newspaper, seeming almost reserved to the fact that the end for Greece is nigh.

“No one wishes the Europeans a Grexit.”

“It’s very unlikely that we will reach a comprehensive solution in the next few days.”

With public sector wages and pensions to pay out the domestic priority (and can you really blame them?), Greece wants to do things on it’s own terms. But with €448m of repayments due next week, it’s interesting to hear Lagarde reveal the mounting frustration among Greece’s paymasters.

One again just to re-iterate, Greece may be small and insignificant when looking at the issue from a purely numbers point of view, but the impact of a Grexit would set a dangerous precident for some of the other bigger nations in the Euro. The union is only as strong as it’s weakest link.

Aussie Capex Miss

Finally, yesterday saw the Aussie smacked down hard by a horrible Capital Expenditure (Capex) print. Like it’s /USD brethren, the AUD/USD clawed back some of the pounding it took during the Asian session but for me, this is definitely the weak one heading into the weekend. I see new lows on the cards and at least a re-test of the broken channel resistance from February coming into play and acting as support.

Throughout the week, we’ve been talking about the important AUD/NZD level on the @VantageFX Twitter feed which we will be keeping an eye on. Give us a follow and share your thoughts with the trading community.

On the Calendar Today:

An absolute tonne of 2nd and 3rd tier data on the calendar today all the way through to the weekend. The major release during Asia being the Kiwi Business Confidence data while the US Preliminary GDP number is obviously the big one.

With the Fed sticking hard to it’s data dependent tagline, this number will be a major factor in whether the 1st quarter slowdown was indeed just the anomaly that they need it to be to justify raising rates as early as possible.

Friday:

JPY Household Spending

JPY Tokyo Core CPI

AUD HIA New Home Sales m/m

NZD ANZ Business Confidence

USD G7 Meetings

CAD GDP

USD Prelim GDP

Chart of the Day:

With the Greece driven headlines featuring the decision on economic reforms needed to reach the nation’s debt repayment requirements, we take a look at where the single currency sits from a technical point of view.

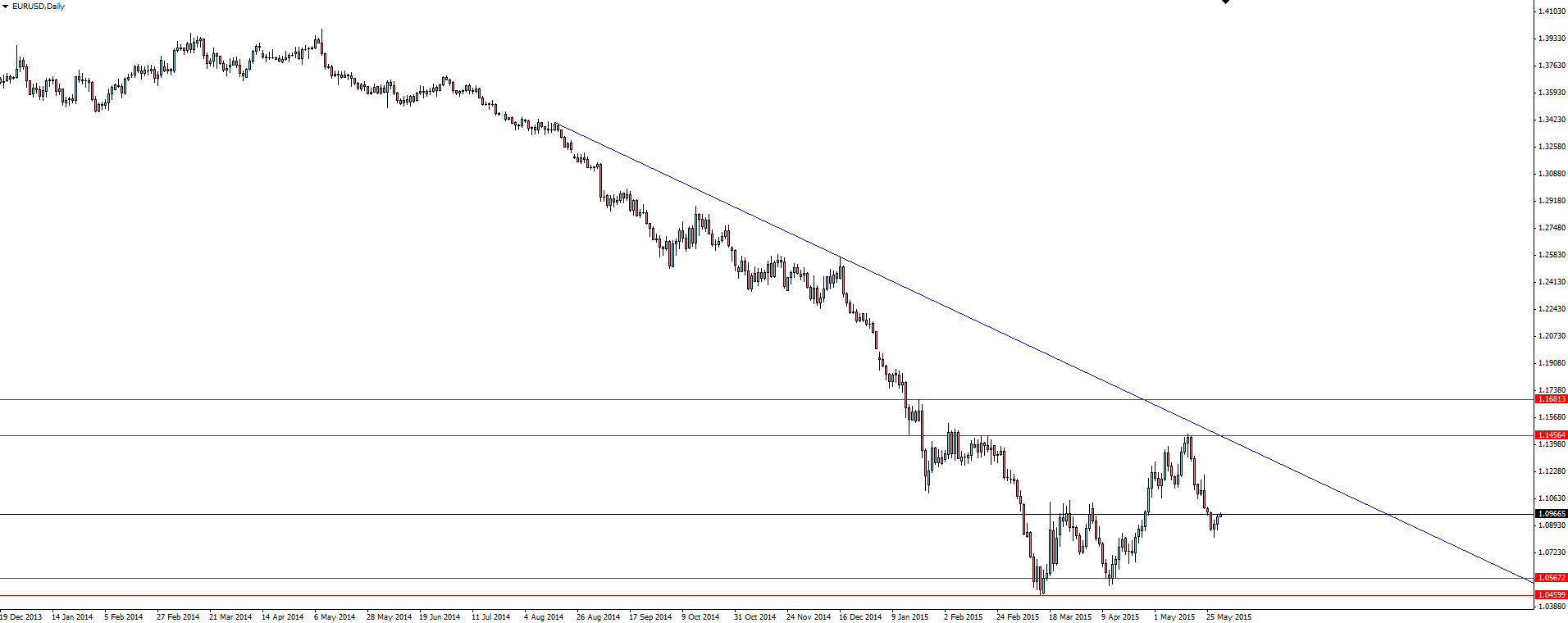

EUR/USD Daily:

Price is technically still in a bit of no-mans-land for me, right in the middle of the daily range that the pair has started to put in following it’s huge decline over the last 12 months or so. This middle zone is definitely a point of interest, but there isn’t really a clear indication of which direction it wants to go at the moment, so at this point on the daily, I’m not really interested in having a punt either way.

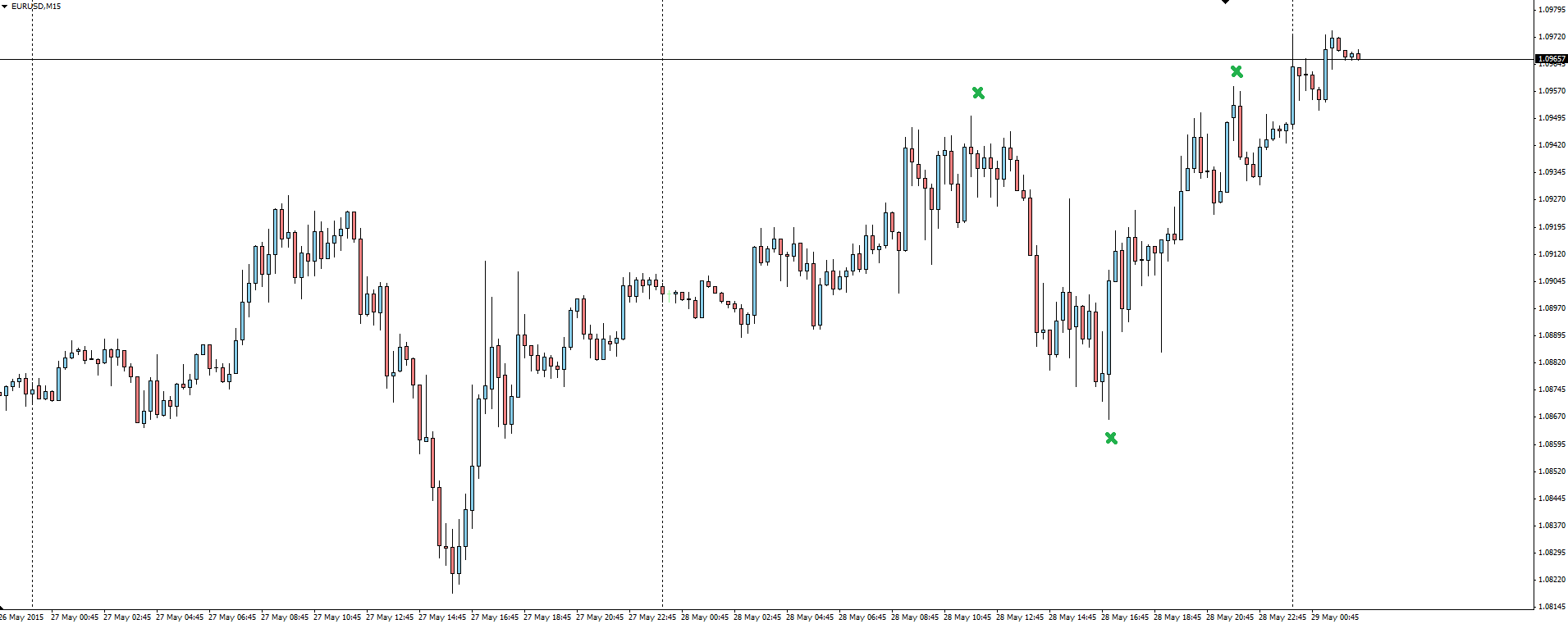

EUR/USD 15 Minute:

Zooming right down into the 15 minute chart really highlights yesterday’s headline driven price action in the pair. Whenever we get close to a deal on Greece, it’s always the same thing where price gets chopped about on an intra-session basis. Of course trading breakouts on the back of these headlines which are often just rumours misrepresented by journalists who crave a fact for the day is never a good idea.

Looking at the Euro on days like this (and lets face it, there are going to be plenty more as the can gets kicked just that little bit further down the road), I still like the strategy of fading the edges with the mentality of when I’m wrong, I’ll know I’m wrong without taking too much risk.

The alternative is sticking to the less headline driven pairs sitting at major decision levels such as the NZD/USD setup we have been talking about in the Technical Analysis section of the Vantage FX News Centre.

Let us know what you’re watching or trading? Leave a comment below or mention @VantageFX on Twitter.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

EUR/USD propped up near 1.0750 ahead of European Retail Sales

EUR/USD churned around 1.0770 to kick off the new trading week, with the pair rising after better-than-expected Purchasing Managers Index figures early Monday before settling into familiar chart territory above 1.0750 ahead of Tuesday’s pan-European Retail Sales figures.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

Ethereum traders show uncertainty following huge whale sale, Robinhood Crypto Wells notice

Ethereum holdings on centralized exchanges continue to decline despite recent whale sales. With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.