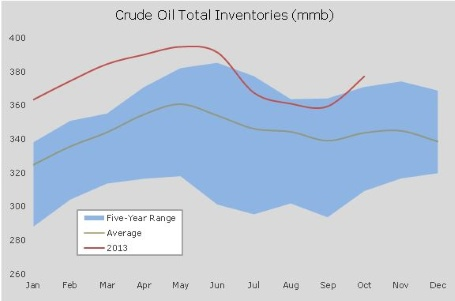

Crude inventories rose by 4.1 million barrels last week, according to data released yesterday by the US Department of Energy. This was the sixth week in-a-row that inventories rose, this time to a total of 383.9 million barrels, the highest since June and some 11 percent above the five-year average.

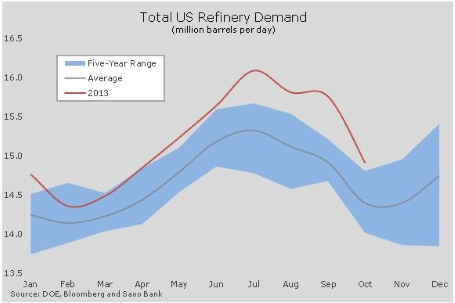

The increase was triggered by the continued slowdown in demand from refineries as they go through seasonal maintenance and turnaround from (summer) gasoline to (winter) distillate production.

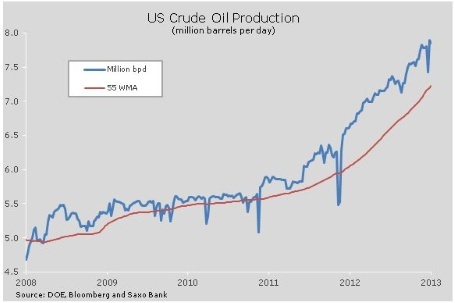

Domestic production continues its upward trajectory with some 7.8 million barrels being produced last week. Such a level of production in the US was last witnessed in 1989.

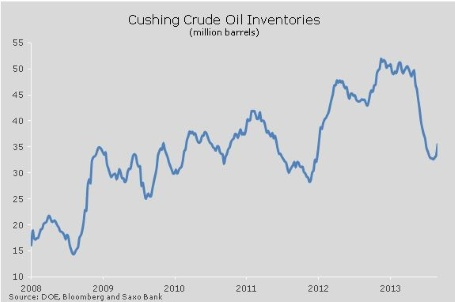

As a result of strong production and reduced refinery demand crude inventory levels at Cushing, Oklahoma, the delivery point for WTI crude, rose by 2.2 million barrels to 35.5 million. This was the biggest jump since December following a long period earlier this year where inventories dropped due to increased pipeline infrastructure taking oil away from the production region towards the Gulf of Mexico.

The lack of demand against continued strong production has resulted in the spread between WTI crude and Brent crude staying elevated. The spread is currently at USD 13.05/barrel, the highest since early April.

The slowdown in US refinery demand witnessed at the moment is expected to be reversed within a few weeks which then should begin to lend some relative support to WTI crude, not least if some of the current supply disruptions, especially in Libya, begin to improve. Brent crude as the seaborne global benchmark would be more price sensitive to such changes in geopolitical risk relative to landlocked and non-exportable WTI crude.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.