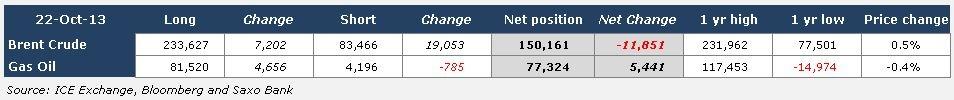

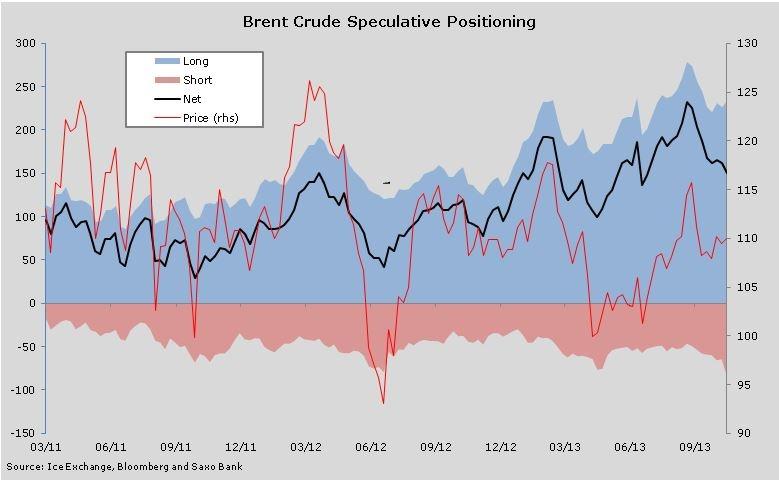

Hedge Funds cut their net-long exposure to Brent Crude by 11,851 contracts during the week ending October 22, according to the latest data from the ICE Europe Exchange. Speculative positions have now been reduced in seven out of the last eight weeks with the current net position of 150,161 some 35 percent below the record peak in August when the Syrian conflict and Libyan strikes lifted the price to USD 117.34/barrel.

Interestingly, both the gross long and short positions were increased, indicating some uncertainty about the near-term direction. This could help lift volatility from its current historically low levels of below 20 percent. The gross short actually reached 83,466 contracts, the highest since the exchange began reporting this data back in January 2011.

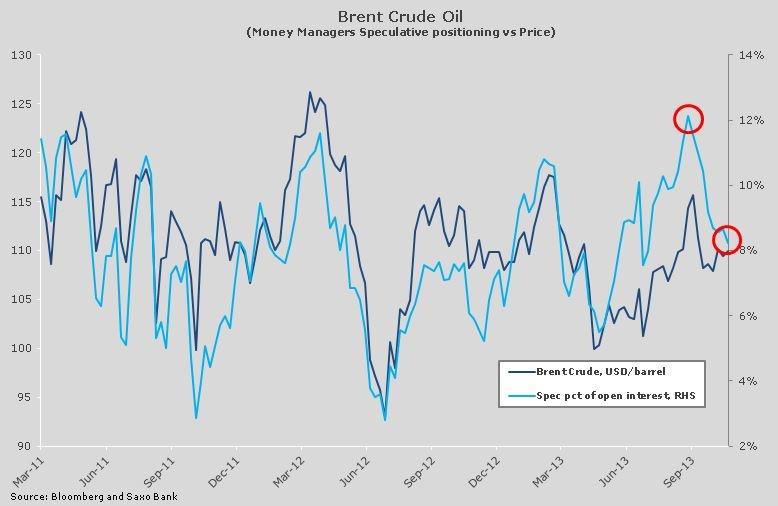

The speculative bubble which continued to inflate over the summer has now popped with the percentage of speculative net-long positionings compared with total open interest in Brent Crude now back down close to eight percent compared with 12.1 percent back on September 1. Compared with the previous big unwinds of speculative extended positions some further long liquidation can not be ruled out. However, the fact that both shorts and longs are rising has left the market less one-sided than just a few weeks ago.

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

AUD/USD gains ground on hawkish RBA, Nonfarm Payrolls awaited

The Australian Dollar continues its winning streak for the third successive session on Friday. The hawkish sentiment surrounding the Reserve Bank of Australia bolsters the strength of the Aussie Dollar, consequently, underpinning the AUD/USD pair.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.