Market Brief

Crude oil extended gained in New York yesterday as easing supply glut takes the front stage after months of oversupply worries. The US gauge, the West Texas intermediate, rose as high as $49.35 a barrel, while the international gauge, the Brent crude, tested the $49.26 threshold. We expect crude oil prices to continue climbing higher in response to months of almost no investment in oil and gas. It will take an extended period of time to return to a normal, which would favour further crude oil strength.

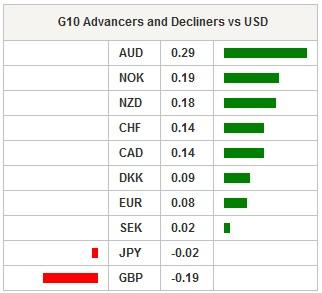

In the FX market, the US dollar wiped out yesterday’s gains with the dollar index, a measure of the greenback against a basket of currencies, falling 0.20% to 95.48 after hitting 95.78. Among the G10 complex, the Australian dollar rose the most against the US dollar, rising 0.30% and returning above the 0.72 threshold. Over the past few weeks, the Aussie suffered from a strengthening US, bolstered by increasing Fed rate hike expectations but also enhanced by the collapse of iron ore prices. Indeed, the most liquid future contracts on the Dalian commodity exchange are down more than 30% since the end of April as it slid from roughly 500 CNY/metric tons to 342 CNY/metric tons this morning. Further weakness of the Australian cannot be ruled out as we anticipate iron ore prices to continue to adjust to the downside; however we also expect the greenback to reverse momentum as the market will start to price out a June rate hike, which would provide support to AUD/USD.

The New Zealand dollar, was also better bid after the country’s trade surplus surprised massively to the upside. Exports rose to NZ$4.30bn, beating expectations of NZ$4.08bn and previous month’s reading of NZ$4.20. Simultaneously, imports rose NZ$4.01bn versus NZ$3.98bn median forecast, unchanged compared to March’s data. All in all, the trade surplus printed at NZ$292mn versus NZ$25mn consensus, while previous month’s reading was upwardly revised to NZ$189mn from NZ$117mn first estimate. NZD/USD surged 0.18% in Tokyo, hitting 0.6764.

EUR/USD remained under pressure as it failed to reverse clearly the negative momentum in spite of the dollar rally that is losing steam. The currency pair tested the 1.1144 support (low from March 24th) but was able to hold ground above it. We continue to expect the single currency to reverse momentum, especially against the USD. All the more so as the Eurozone finance minister and the IMF secured a deal on the Greek debt early this morning. It should therefore allow financial markets to spend a relax summer, clear of Greek worries. The market will now focus on the Brexit story, however, according to the latest polls, a Brexit is almost out of the table.

| Global Indexes | Current Level | % Change |

| Nikkei 225 Index | 16757.35 | 1.57 |

| Hang Seng Index | 20353.97 | 2.64 |

| Shanghai Index | 2816.522 | -0.18 |

| FTSE futures | 6254 | 0.6 |

| DAX futures | 10178 | 1.06 |

| SMI Futures | 8167 | 0.39 |

| S&P future | 2082.7 | 0.37 |

| Global Indexes | Current Level | % Change |

| Gold | 1224.93 | -0.19 |

| Silver | 16.27 | 0.33 |

| VIX | 14.42 | -8.85 |

| Crude wti | 49.33 | 1.46 |

| USD Index | 95.51 | -0.07 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| SP Apr PPI MoM | - | 0,70% | EUR/07:00 |

| SP Apr PPI YoY | - | -5,40% | EUR/07:00 |

| EC ECB Governing Council member Villeroy Speaks in Madrid | - | - | EUR/07:00 |

| GE May IFO Business Climate | 106,8 | 106,6 | EUR/08:00 |

| GE May IFO Current Assessment | 113,3 | 113,2 | EUR/08:00 |

| GE May IFO Expectations | 100,8 | 100,4 | EUR/08:00 |

| BZ May 23 FIPE CPI - Weekly | 0,46% | 0,41% | BRL/08:00 |

| IT Mar Industrial Sales MoM | - | 0,10% | EUR/08:00 |

| IT Mar Industrial Sales WDA YoY | - | -0,20% | EUR/08:00 |

| IT Mar Industrial Orders MoM | - | 0,70% | EUR/08:00 |

| IT Mar Industrial Orders NSA YoY | - | 3,80% | EUR/08:00 |

| SZ May Credit Suisse ZEW Survey Expectations | - | 11,5 | CHF/09:00 |

| EC ECB Governing Council member Klaas Knot Speaks in Madrid | - | - | EUR/09:00 |

| UK BOE FPC Member Martin Taylor Speaks in London | - | - | GBP/10:30 |

| UK ECB's Constancio Speaks at Workshop in London | - | - | GBP/10:30 |

| EC ECB Executive Board member Peter Praet Speaks in Madrid | - | - | EUR/10:30 |

| US May 20 MBA Mortgage Applications | - | -1,60% | USD/11:00 |

| BZ May FGV Construction Costs MoM | 0,36% | 0,41% | BRL/11:00 |

| TU May Real Sector Confidence SA | - | 105,7 | TRY/11:30 |

| TU May Real Sector Confidence NSA | - | 110,1 | TRY/11:30 |

| TU May Capacity Utilization | - | 75,30% | TRY/11:30 |

| US Apr Advance Goods Trade Balance | -$60.0b | -$56.9b | USD/12:30 |

| US 1Q House Price Purchase Index QoQ | - | 1,40% | USD/13:00 |

| US Mar FHFA House Price Index MoM | 0,50% | 0,40% | USD/13:00 |

| RU May 23 CPI Weekly YTD | - | 2,80% | RUB/13:00 |

| RU May 23 CPI WoW | - | 0,10% | RUB/13:00 |

| US Fed's Harker Speaks at Forum in Philadelphia | - | - | USD/13:00 |

| BZ Apr Outstanding Loans MoM | - | -0,70% | BRL/13:30 |

| BZ Apr Total Outstanding Loans | - | 3161b | BRL/13:30 |

| BZ Apr Personal Loan Default Rate | - | 6,20% | BRL/13:30 |

| US May P Markit US Services PMI | 53 | 52,8 | USD/13:45 |

| US May P Markit US Composite PMI | - | 52,4 | USD/13:45 |

| CA May 25 Bank of Canada Rate Decision | 0,50% | 0,50% | CAD/14:00 |

| US May 20 DOE U.S. Crude Oil Inventories | -2000k | 1310k | USD/14:30 |

| US May 20 DOE Cushing OK Crude Inventory | -450k | 461k | USD/14:30 |

| BZ Currency Flows Weekly | - | - | BRL/15:30 |

| US Fed's Kashkari Speaks on Energy and Monetary Policy in ND | - | - | USD/15:40 |

| FR Apr Total Jobseekers | 3535.5k | 3531.0k | EUR/16:00 |

| FR Apr Jobseekers Net Change | 4,5 | -60 | EUR/16:00 |

| US Fed's Kaplan Speaks at Greater Houston Partnership | - | - | USD/17:30 |

| BZ Apr Formal Job Creation Total | -62500 | -118776 | BRL/19:00 |

| SK May Consumer Confidence | - | 101 | KRW/21:00 |

| IN Apr Eight Infrastructure Industries | - | 6,40% | INR/22:00 |

| AU SURVEY: Private Capital Expenditure 2016-17 A$86.7B | - | - | AUD/22:00 |

Currency Tech

EURUSD

R 2: 1.1479

R 1: 1.1349

CURRENT: 1.1152

S 1: 1.1058

S 2: 1.0822

GBPUSD

R 2: 1.4770

R 1: 1.4663

CURRENT: 1.4604

S 1: 1.4404

S 2: 1.4300

USDJPY

R 2: 111.91

R 1: 110.59

CURRENT: 109.89

S 1: 108.23

S 2: 106.25

USDCHF

R 2: 1.0257

R 1: 1.0093

CURRENT: 0.9915

S 1: 0.9751

S 2: 0.9652

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.