Market Brief

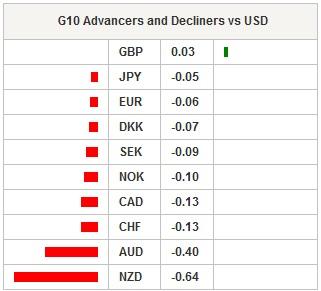

The US dollar strengthen substantially in overnight trading amid rising expectation about an upcoming rate hike by the Federal Reserve. The greenback gained ground against almost all G10 currencies with the exception of the pound sterling that was able to stabilise slightly below the 1.45 threshold. The probabilities of a rate hike at the June meeting - extracted from the overnight index swap - rose to 27% on Tuesday from almost zero a month ago.

US treasury yields stabilised along the curve with renewed upside pressure on the short end. The monetary policy sensitive 2-year yield rose another 3bps in overnight trading, reaching 0.9050%; while the 10-year continued to ease as it slid to 1.8350%, suggesting that the market is still cautious regarding inflation and growth expectations in the US. However, we remain cautious regarding further US dollar appreciation as we have the feeling the market is paying too much attention to the latest Fed members’ speech, which were mostly bullish. We expect the Fed to adopt a very cautious approach, especially given the lack of significant improvement on the growth and inflation sides. Therefore, over the next few weeks, we expect the dollar to erase earlier gains as the market realises a June rate hike is off the table.

In Asia, the strong dollar continued to weigh on equities with most regional equity indices trading in negative territory. In japan, the Nikkei was off -0.77%, while the broader Topix index eased -0.78%. In mainland China the Shnaghai and Shenzhen Composites were down 0.77% and 0.85% respectively. Offshore, Hong Kong’s Hang Seng fell 0.35%, while in Singapore the STI was down 0.40%. In Europe, equity futures are pointing towards a lower open.

In Australia, the Aussie fell another 0.55% against the US dollar as Governor Stevens defended the current target band inflation target, adding that inflation was difficult to control in the short term. AUD/USD reached 0.7193 in Sydney before stabilising at around 0.7195. We maintain our negative bias on AUD/USD as the Australian economy should suffer from a slowing Chinese economy in spite of the hype of the first quarter.

In China, the People’s Bank of China set the USD/CNY fixing higher to 6.6448 from 6.5455 in the previous day. Since the beginning of May the renminbi has continuously depreciated against the greenback, which could potential put the capital outflow story back under the spotlight.

Today traders will be watching trade balance from Switzerland; GDP and ZEW from Germany; manufacturing confidence from France; unemployment rate form Sweden; BoE’s Carney speech; Turkey’s interest rate decision (cut in the lending rate expected); current account balance and foreign direct investment from Brazil; new home sales and Richmond manufacturing index from the US.

| Global Indexes | Current Level | % Change |

| Nikkei 225 Index | 16527.18 | -0.77 |

| Hang Seng Index | 19739.88 | -0.35 |

| Shanghai Index | 2821.794 | -0.77 |

| FTSE futures | 6113.5 | -0.31 |

| DAX futures | 9797.01 | -0.6 |

| SMI Futures | 8007 | -0.25 |

| S&P future | 2041.5 | -0.19 |

| Global Indexes | Current Level | % Change |

| Gold | 1245.83 | -0.26 |

| Silver | 16.31 | -0.42 |

| VIX | 15.82 | 4.08 |

| Crude wti | 47.89 | -0.4 |

| USD Index | 95.29 | 0.06 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| SZ Apr Trade Balance | - | 2.16b | CHF/06:00 |

| SZ Apr Exports Real MoM | - | -1,10% | CHF/06:00 |

| SZ Apr Imports Real MoM | - | 9,30% | CHF/06:00 |

| GE 1Q Private Consumption QoQ | 0,60% | 0,30% | EUR/06:00 |

| GE 1Q Government Spending QoQ | 0,80% | 1,00% | EUR/06:00 |

| GE 1Q Capital Investment QoQ | 1,40% | 1,50% | EUR/06:00 |

| GE 1Q Construction Investment QoQ | 1,50% | 2,20% | EUR/06:00 |

| GE 1Q Domestic Demand QoQ | 0,90% | 0,80% | EUR/06:00 |

| GE 1Q Exports QoQ | 0,50% | -0,60% | EUR/06:00 |

| GE 1Q Imports QoQ | 1,00% | 0,50% | EUR/06:00 |

| GE 1Q F GDP SA QoQ | 0,70% | 0,70% | EUR/06:00 |

| GE 1Q F GDP WDA YoY | 1,60% | 1,60% | EUR/06:00 |

| GE 1Q F GDP NSA YoY | 1,30% | 1,30% | EUR/06:00 |

| FR May Business Confidence | 101 | 101 | EUR/06:45 |

| FR May Manufacturing Confidence | 104 | 104 | EUR/06:45 |

| FR May Production Outlook Indicator | - | -1 | EUR/06:45 |

| FR May Own-Company Production Outlook | - | 9 | EUR/06:45 |

| SA Mar Leading Indicator | - | 91,6 | ZAR/07:00 |

| EC ECB's Praet Speaks at NABE/OECD Symposium in Paris | - | - | EUR/07:00 |

| SW Apr Unemployment Rate | 7,60% | 7,70% | SEK/07:30 |

| SW Apr Unemployment Rate Trend | - | 7,10% | SEK/07:30 |

| SW Apr Unemployment Rate SA | 7,10% | 7,20% | SEK/07:30 |

| AS ECB's Nowotny Testifies in Austrian Parliament Investigation | - | - | EUR/08:00 |

| UK Apr Public Finances (PSNCR) | - | 16.6b | GBP/08:30 |

| UK Apr Central Government NCR | - | 18.8b | GBP/08:30 |

| UK Apr Public Sector Net Borrowing | 5.8b | 4.2b | GBP/08:30 |

| UK Apr PSNB ex Banking Groups | 6.4b | 4.8b | GBP/08:30 |

| GE May ZEW Survey Current Situation | 49 | 47,7 | EUR/09:00 |

| GE May ZEW Survey Expectations | 12 | 11,2 | EUR/09:00 |

| EC May ZEW Survey Expectations | - | 21,5 | EUR/09:00 |

| UK BOE's Carney, Broadbent, Weale and Vlieghe in Parliament | - | - | GBP/09:00 |

| UK BOE's Ben Broadbent Publishes MPC Annual Report | - | - | GBP/09:00 |

| FI Bank of Finland Governor Liikanen Gives Speech in Parliament | - | - | EUR/09:10 |

| UK May CBI Retailing Reported Sales | 8 | -13 | GBP/10:00 |

| UK May CBI Total Dist. Reported Sales | 13 | 13 | GBP/10:00 |

| NO Norges Bank Issues Financial Infrastructure Report | - | - | NOK/10:00 |

| TU May 24 Benchmark Repurchase Rate | 7,50% | 7,50% | TRY/11:00 |

| TU May 24 Overnight Lending Rate | 9,50% | 10,00% | TRY/11:00 |

| TU May 24 Overnight Borrowing Rate | 7,25% | 7,25% | TRY/11:00 |

| BZ May FGV Consumer Confidence | - | 64,4 | BRL/11:00 |

| CH Conference Board China April Leading Economic Index | - | - | CNY/13:00 |

| BZ Apr Current Account Balance | -$900m | -$855m | BRL/13:30 |

| BZ Apr Foreign Direct Investment | $6150m | $5557m | BRL/13:30 |

| CA May 20 Bloomberg Nanos Confidence | - | 57,3 | CAD/14:00 |

| US May Richmond Fed Manufact. Index | 8 | 14 | USD/14:00 |

| US Apr New Home Sales | 523k | 511k | USD/14:00 |

| US Apr New Home Sales MoM | 2,30% | -1,50% | USD/14:00 |

| BZ Apr Formal Job Creation Total | -55000 | -118776 | BRL/22:00 |

| AU SURVEY: Private Capital Expenditure 2016-17 A$86.7B | - | - | AUD/22:00 |

Currency Tech

EURUSD

R 2: 1.1479

R 1: 1.1349

CURRENT: 1.1214

S 1: 1.1144

S 2: 1.1058

GBPUSD

R 2: 1.4770

R 1: 1.4663

CURRENT: 1.4483

S 1: 1.4404

S 2: 1.4300

USDJPY

R 2: 111.91

R 1: 110.59

CURRENT: 109.24

S 1: 108.23

S 2: 106.25

USDCHF

R 2: 1.0257

R 1: 1.0093

CURRENT: 0.9907

S 1: 0.9652

S 2: 0.9444

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.