Market Brief

As broadly expected the Federal Open Market Committee left short-term interest rates unchanged at between 0.25% and 0.50%. Since there was no press conference, the market had nothing to get its teeth into apart from the statement. The latter was little changed compared to the one from January, indicating that the Fed sticks to its dovish position. The line saying that “the global economic and financial developments continue to pose risks” was removed but on the other hand the Fed agreed that the domestic economic activity appeared to have slowed. All in all, it was roughly in line with the market was expecting and USD crosses remained flat as investors had already priced in that the Fed would most likely hold fire in June. It is now almost a sure thing. EUR/USD fell initially to 1.1272 before bouncing to 1.1362, and finally consolidate at 1.1322.

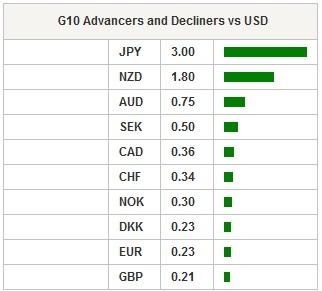

In Japan, the BoJ announced that the bank needs more time to assess the impact of negative interest rates, thus maintaining its monetary stimulus. Nevertheless, the move came as a surprise as the market was expecting the BoJ to take action in response to the recent JPY’s strength that could delay the BoJ’s inflation target. This decision raised some important questions. Is the BoJ worried about the real effects of ultra-accommodative monetary policy on growth and inflation? Or the central bank really need more time to fine tune its negative interest rate tool? However, one thing is clear: the BoJ made clear that the market will not dictate what the central bank should do. USD/JPY collapsed more than three figures or 3.25% and reached 108.20, the lowest level since April 18th. The closest support lies at 107.63 (low from April 11th), further south another support lies at 105.23 (low from October 2014). In our opinion, the first support should not last long given the rapid building in long JPY positioning.

On the commodity market, the West Texas Intermediate was unable to break the strong $45 resistance level and stabilised nearby. Similarly, the international gauge, the Brent crude, tumbled on the $47 level, down 0.53%.

On the equity market, the BoJ decision dampened the mood as Japanese equity fell sharply with the Nikkei 225 down 3.61% and the Topix down 3.16%. In mainland China, the Shanghai and Shenzhen Composites slid 0.26% and 0.13% respectively. In Hong Kong, the Hang Seng edged up 0.45%. in Europe, equity futures are blinking red across the board, pointing to a lower open as the negative mood is spreading from Asia.

Today traders will be watching CPI from Spain and Germany; retail sales from Sweden; unemployment from Germany; consumer confidence from the Eurozone; initial jobless claims, GDP, personal consumption and core PCE from the US.

| Global Indexes | Current Level | % Change |

| Nikkei 225 Index | 16666.05 | -3.61 |

| Hang Seng Index | 21456.68 | 0.45 |

| Shanghai Index | 2945.668 | -0.27 |

| FTSE futures | 6241 | -0.43 |

| DAX futures | 10280 | -0.47 |

| SMI Futures | 8002 | -0.35 |

| S&P future | 2079.1 | -0.55 |

| Global Indexes | Current Level | % Change |

| Gold | 1255.47 | 0.77 |

| Silver | 17.36 | 0.71 |

| VIX | 13.77 | -1.36 |

| Crude wti | 45.13 | -0.44 |

| USD Index | 93.74 | -0.69 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| SP 1Q Unemployment Rate | 20,90% | 20,90% | EUR/07:00 |

| SP Apr P CPI EU Harmonised MoM | 0,80% | 2,00% | EUR/07:00 |

| SP Apr P CPI EU Harmonised YoY | -0,90% | -1,00% | EUR/07:00 |

| SP Apr P CPI MoM | 1,10% | 0,60% | EUR/07:00 |

| SP Apr P CPI YoY | -0,70% | -0,80% | EUR/07:00 |

| IT Bank of Italy Annual Meeting of Shareholders | - | - | EUR/07:30 |

| SW Mar Retail Sales MoM | 0,40% | -0,20% | SEK/07:30 |

| SW Mar Retail Sales NSA YoY | 3,50% | 3,90% | SEK/07:30 |

| RU Bloomberg April Russia Economic Survey | - | - | RUB/07:30 |

| TU Bloomberg April Turkey Economic Survey | - | - | TRY/07:50 |

| GE Apr Unemployment Change (000's) | 0k | 0k | EUR/07:55 |

| GE Apr Unemployment Claims Rate SA | 6,20% | 6,20% | EUR/07:55 |

| NO Feb Unemployment Rate AKU | 4,80% | 4,80% | NOK/08:00 |

| NO Mar Retail Sales W/Auto Fuel MoM | 0,40% | -0,50% | NOK/08:00 |

| TU Mar Foreign Tourist Arrivals YoY | - | -10,30% | TRY/08:00 |

| NO 1Q Industrial Confidence | -6 | -8 | NOK/08:00 |

| IT Mar Hourly Wages MoM | - | 0,10% | EUR/08:00 |

| IT Mar Hourly Wages YoY | - | 0,80% | EUR/08:00 |

| FI Bank of Finland Governor Liikanen Speaks in Helsinki Seminar | - | - | EUR/08:40 |

| EC Apr Economic Confidence | 103,4 | 103 | EUR/09:00 |

| EC Apr Business Climate Indicator | 0,14 | 0,11 | EUR/09:00 |

| EC Apr Industrial Confidence | -4 | -4,2 | EUR/09:00 |

| EC Apr Services Confidence | 10 | 9,6 | EUR/09:00 |

| EC Apr F Consumer Confidence | -9,3 | -9,3 | EUR/09:00 |

| AS Austrian Central Banker Nowotny Presents Annual Report | - | - | EUR/09:15 |

| SA Mar PPI MoM | 1,10% | 0,80% | ZAR/09:30 |

| SA Mar PPI YoY | 7,40% | 8,10% | ZAR/09:30 |

| NO Norway Wealth Fund Issues 1Q, Real Estate Reports | - | - | NOK/10:00 |

| BZ Apr FGV Inflation IGPM MoM | 0,35% | 0,51% | BRL/11:00 |

| BZ Apr FGV Inflation IGPM YoY | 10,65% | 11,56% | BRL/11:00 |

| PO Bank of Portugal's Costa Speaks at Conference in Lisbon | - | - | EUR/11:30 |

| GE Apr P CPI MoM | -0,20% | 0,80% | EUR/12:00 |

| GE Apr P CPI YoY | 0,10% | 0,30% | EUR/12:00 |

| GE Apr P CPI EU Harmonized MoM | -0,20% | 0,80% | EUR/12:00 |

| GE Apr P CPI EU Harmonized YoY | 0,00% | 0,10% | EUR/12:00 |

| US Apr 23 Initial Jobless Claims | 259k | 247k | USD/12:30 |

| US Apr 16 Continuing Claims | 2136k | 2137k | USD/12:30 |

| US 1Q A GDP Annualized QoQ | 0,60% | 1,40% | USD/12:30 |

| US 1Q A Personal Consumption | 1,70% | 2,40% | USD/12:30 |

| US 1Q A GDP Price Index | 0,50% | 0,90% | USD/12:30 |

| US 1Q A Core PCE QoQ | 1,90% | 1,30% | USD/12:30 |

| RU Apr 22 Gold and Forex Reserve | - | 386.2b | RUB/13:00 |

| BZ Mar Outstanding Loans MoM | - | -0,50% | BRL/13:30 |

| BZ Mar Total Outstanding Loans | - | 3184b | BRL/13:30 |

| BZ Mar Personal Loan Default Rate | - | 6,20% | BRL/13:30 |

| US Apr 24 Bloomberg Consumer Comfort | - | 42,9 | USD/13:45 |

| US Apr Kansas City Fed Manf. Activity | - | -6 | USD/15:00 |

| BZ Mar Central Govt Budget Balance | -9.9b | -25.1b | BRL/17:00 |

| SK May Business Survey Non-Manufacturing | - | 71 | KRW/21:00 |

| SK May Business Survey Manufacturing | - | 70 | KRW/21:00 |

| IN Mar Eight Infrastructure Industries | - | 5,70% | INR/22:00 |

Currency Tech

EURUSD

R 2: 1.1714

R 1: 1.1465

CURRENT: 1.1353

S 1: 1.1144

S 2: 1.1058

GBPUSD

R 2: 1.4959

R 1: 1.4668

CURRENT: 1.4588

S 1: 1.4284

S 2: 1.4132

USDJPY

R 2: 112.68

R 1: 111.91

CURRENT: 108.29

S 1: 107.63

S 2: 105.23

USDCHF

R 2: 1.0093

R 1: 0.9913

CURRENT: 0.9672

S 1: 0.9476

S 2: 0.9259

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD remains firmer ahead of RBA interest rate decision

The Australian Dollar continued its winning streak for the fifth consecutive session on Tuesday, driven by a hawkish sentiment surrounding the Reserve Bank of Australia. This positive outlook reinforces the strength of the Aussie Dollar, offering support to the AUD/USD pair.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold price extends its upside as markets react to downbeat jobs data

Gold price extends its recovery on Tuesday. The uptick of the yellow metal is bolstered by the weaker US dollar after recent US Nonfarm Payrolls (NFP) data boosted bets that the Federal Reserve would cut interest rates later this year.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.