Market Brief

Crude oil printed a fresh 13-year low yesterday during the US session. The US crude benchmark, the West Texas Intermediate, fell another 3.70% on Thursday before bouncing back in overnight trading as fears of oversupply eased. WTI was up 4.46%, while its counterpart from the North Sea, the Brent crude, rose 4.69%.

On Thursday Japanese markets were closed for National Foundation Day and reopened in pain for the last trading session of the week. The Nikkei 225 closed significantly lower, down 4.84% as traders caught up with the rest of equity markets. In Hong Kong, the Hang Seng settled down 1.01%, which does not bode well for the Chinese re-open next Monday. Elsewhere, in Australia the S&P/ASX fell 1.16%, in New Zealand the NZX was down 0.89%, while in South Korea the Kospi slid 1.41%. In the EM complex, Thai equities were down 0.38%, the Indian Sensex slip 0.71%, while Indonesian equities were down another 1.16%. European futures are blinking green across the screen.

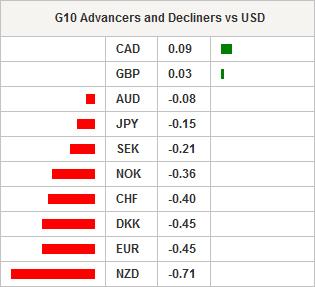

In the FX market, rumours regarding a potential intervention from the BoJ to stop the yen's sharp appreciation are fading as the central bank did not provide any comment. In our opinion, it is very unlikely that the BoJ intervened as they cannot afford to take another half measure - like they did with the negative interest move a couple of weeks ago - as it would further damage the little credibility they have left. USD/JPY stabilised around 112 in Tokyo after reaching its lowest level since October 31, 2014. We believe there is still some downside potential for the pair; however traders are still trying to understand what happened yesterday - when USD/JPY spiked two figures in less than 5 minutes - and will likely remain sidelined before the weekend break.

The Swedish central bank surprised the market on Thursday by cutting its benchmark interest rate by 0.15% (versus 0.10% expected), pushing the repo rate further into negative territory, down to -0.50%. USD/SEK jumped 1.30% on the news, up to 8.4770, but returned quickly to its initial level at around 8.37. Over the last few months, the market reactions to interest rate cuts from central banks around the globe appear to have had a weaker impact on the market - USD/SEK needed just six hours to return to its pre-announcement level.

EUR/CHF consolidated yesterday’s gains and held ground above the 1.10 threshold. USD/CHF was moving sideways between 0.9715 and 0.9754 in Tokyo; however the pair is having a hard time breaking its 200dma (currently at 0.9731) to the downside. We therefore would not be surprised if USD/CHF recovers over the next few days.

Today traders will be watching the inflation report from Spain; GDP from Italy; industrial production and GDP from the Eurozone; retail sales and Michigan sentiment index from the US.

| Global Indexes | Current Level | % Change |

| Nikkei 225 Index | 14952.61 | -4.84 |

| Hang Seng Index | 18358.03 | -1.01 |

| FTSE futures | 5534.5 | 0.69 |

| DAX futures | 8836 | 0.71 |

| CAC futures | 3941.5 | 1.17 |

| SMI Futures | 7459 | 0.39 |

| S&P future | 1830.7 | 0.34 |

| Global Indexes | Current Level | % Change |

| Gold | 1243.62 | -0.25 |

| Silver | 15.69 | -0.36 |

| VIX | 28.14 | 7.04 |

| Crude wti | 27.38 | 4.46 |

| USD Index | 95.59 | 0.03 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| RU Feb 5 Money Supply Narrow Def | - | 8.20t | RUB/08:00 |

| SP Jan CPI Core MoM | - | 0,00% | EUR/08:00 |

| SP Jan CPI Core YoY | 0,70% | 0,90% | EUR/08:00 |

| SP Jan F CPI EU Harmonised MoM | -2,50% | -2,50% | EUR/08:00 |

| SP Jan F CPI EU Harmonised YoY | -0,40% | -0,40% | EUR/08:00 |

| SP Jan F CPI MoM | -1,90% | -1,90% | EUR/08:00 |

| SP Jan F CPI YoY | -0,30% | -0,30% | EUR/08:00 |

| IT 4Q P GDP WDA QoQ | 0,30% | 0,20% | EUR/09:00 |

| IT 4Q P GDP WDA YoY | 1,20% | 0,80% | EUR/09:00 |

| UK Dec Construction Output SA MoM | 2,00% | -0,50% | GBP/09:30 |

| UK Dec Construction Output SA YoY | 0,80% | -1,10% | GBP/09:30 |

| BZ Feb IGP-M Inflation 1st Preview | 1,22% | 0,41% | BRL/10:00 |

| EC Dec Industrial Production SA MoM | 0,30% | -0,70% | EUR/10:00 |

| EC Dec Industrial Production WDA YoY | 0,70% | 1,10% | EUR/10:00 |

| EC 4Q A GDP SA QoQ | 0,30% | 0,30% | EUR/10:00 |

| EC 4Q A GDP SA YoY | 1,50% | 1,60% | EUR/10:00 |

| IN Dec Industrial Production YoY | -0,40% | -3,20% | INR/12:00 |

| IN Jan CPI YoY | 5,40% | 5,61% | INR/12:00 |

| CA Jan Teranet/National Bank HPI MoM | - | -0,10% | CAD/13:30 |

| CA Jan Teranet/National Bank HP Index | - | 177,51 | CAD/13:30 |

| CA Jan Teranet/National Bank HPI YoY | - | 6,20% | CAD/13:30 |

| US Jan Import Price Index MoM | -1,50% | -1,20% | USD/13:30 |

| US Jan Import Price Index YoY | -6,80% | -8,20% | USD/13:30 |

| US Jan Retail Sales Advance MoM | 0,10% | -0,10% | USD/13:30 |

| US Jan Retail Sales Ex Auto MoM | 0,00% | -0,10% | USD/13:30 |

| US Jan Retail Sales Ex Auto and Gas | 0,30% | 0,00% | USD/13:30 |

| US Jan Retail Sales Control Group | 0,30% | -0,30% | USD/13:30 |

| CA Bloomberg Feb. Canada Economic Survey | - | - | CAD/14:00 |

| US Fed's Dudley Answers Questions at Press Briefing in New York | - | - | USD/15:00 |

| US Dec Business Inventories | 0,10% | -0,20% | USD/15:00 |

| US Feb P U. of Mich. Sentiment | 92,3 | 92 | USD/15:00 |

| US Feb P U. of Mich. Current Conditions | - | 106,4 | USD/15:00 |

| US Feb P U. of Mich. Expectations | - | 82,7 | USD/15:00 |

| US Feb P U. of Mich. 1 Yr Inflation | - | 2,50% | USD/15:00 |

| US Feb P U. of Mich. 5-10 Yr Inflation | - | 2,70% | USD/15:00 |

| BZ ABPO Jan. Cardboard Sales | - | - | BRL/23:00 |

Currency Tech

EURUSDR 2: 1.1495

R 1: 1.1387

CURRENT: 1.1313

S 1: 1.0711

S 2: 1.0524

GBPUSD

R 2: 1.5242

R 1: 1.4969

CURRENT: 1.4459

S 1: 1.4081

S 2: 1.3657

USDJPY

R 2: 125.86

R 1: 123.76

CURRENT: 112.01

S 1: 105.23

S 2: 100.78

USDCHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 0.9700

S 1: 0.9476

S 2: 0.9072

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD drops toward 0.6500 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is extending losses toward 0.6500, hit by an unexpected drop in the Australian Retail Sales for March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data failed to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY holds rebound to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.