Market Brief

World stock markets ended last week on a positive note, with Chinese mainland shares recovering more 10% losses in two days. However, this week is a different story as stocks from across the globe are moving into negative territory again. Wall Street ended the first day of the week in red with the S&P 500 down -0.84%, the Dow Jones down -0.69% and the Nasdaq down -1.07%. Unfortunately we may not have reached a bottom yet as Asian regional markets plunge further, dragged lower by weak data from China. China’s official manufacturing PMI contracted to 49.7 in August, matching expectation, from 50 a month earlier. In addition, the final August Caixin manufacturing PMI printed at 47.3 versus 47.1 median forecast - a reading below the 50 threshold indicates a contraction. The Shanghai Composite retreats 1.06% and the Shenzhen Composite loses 4.61%. Regional benchmarks follow the Chinese lead as Japanese Nikkei dropped 3.84% and the Topix index -3.83%. In Hong Kong, the Hang Seng fell 0.76% while in South Korea the Kospi index retreated 1.40% as exports fell the most in 6 years. Exports contracted 14.7%y/y in August versus 5.9% while imports contracted 18.3%y/y verse 15% expected. All in all, August’s trade balance came in at $4347mn versus $6077mn median forecast.

Unsurprisingly, the Reserve Bank of Australia kept the cash rate unchanged at record low 2%. In the accompanying statement, the RBA stated that “monetary policy needs to be accommodative” as the economy is expected to continue expanding at a moderate pace. Governor Stevens maintained that “The Australian dollar is adjusting to the significant declines in key commodity prices”. All in all, the RBA seems to be comfortable with the current level of the Aussie, especially since the AUD lost more than 4% against the USD since their last meeting in early August. AUD/USD reacted negatively to the decision and is grinding slightly lower since then. On a side note, we think it is odd that Governor Stevens didn’t mention recent developments in China, suggesting that the RBA is waiting until the smoke clears to assess the effects of a persisting slowdown in China.

In Europe, equity futures are pointing to a lower open across regional markets. Futures on the DAX are down 1.63%, ones on the CAC -1.55% while the ones on the SMI fell 1.04%. Crude oil is sliding lower with the WTI retreating 2.89% while its counterpart from the North Sea falls 2.55%.

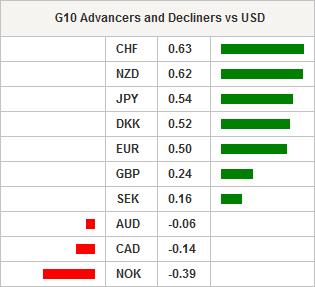

In the FX market, the US dollar is under pressure as market participants are still waiting on strong data from the US to resume the dollar rally. A strong reading of Friday’s non-farm payrolls will therefore be key to maintain a September rate hike on the table as a reading in line with expectations will not be sufficient to ensure a September lift-off. EUR/USD is back above 1.1262 (Fib 50% on July-August rally) and will need fresh boost to reach the closest resistance standing at 1.1368 (Fibo 38.2%). A weak ISM Manufacturing reading this afternoon could be that trigger. On the downside, a support can be found at 1.1155 (Fibo 61.8%).

Today traders will be watching unemployment change from Germany; PMI from Switzerland; Markit manufacturing PMI from France; mortgage approval and market manufacturing PMI from UK; unemployment rate from the Euro zone; GDP from Canada; Markit manufacturing PMI from Brazil; construction spending and ISM manufacturing from the US.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.