Market Brief

Earlier this night, the Reserve Bank of Australia released the minutes from its August meeting. The minutes indicate that the Bank is pleased with the current monetary policy setting as it left the cash rate unchanged at record low 2%. The tone of the minutes was actually pretty dovish as the RBA stated “Domestically, economic activity had generally been more positive over recent months”, adding that a low interest rates environment helped to support growth in consumption while a weak Australian dollar supported exports. It is therefore unlikely that the RBA will cut rate further as it is relying on the Federal Reserves to start to hike rates as soon as September. AUD/USD’s response was muted as the pair traded in a tight range in the Asian session. A strong support can be found at 0.7216 (previous low) while on the upside a resistance lies at 0.7458 (Fib 38.2% on June-August debasement).

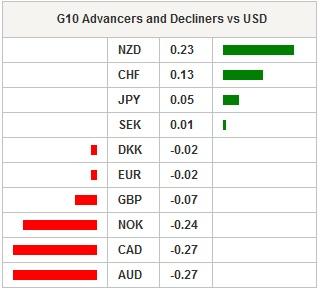

Overnight, limited price action has been seen across FX markets globally as traders make the finally adjustment to their positioning ahead of the Fed minutes and CPI report due tomorrow. However, the USD is trading slightly higher since yesterday with USD index up 17% to 96.97. Yesterday’s August Empire manufacturing dropped to -14.92 while analysts were looking for a reading closer to 4.5 (previous reading at 3.86). It was the biggest slump in more than 6 years as US exports got hurt by a strong dollar. EUR/USD is grinding towards the next support level standing at 1.1049 (Fib 38.2% on June-July debasement). On the upside a first resistance can be found at 1.1123 (Fib 50%) while a stronger one lies around 1.12 (psychological level and previous high).

On the equity front, Chinese mainland shares suffer a wild sell-off while the PBoC set the reference rate slightly lower to 6.3966 from 6.3969. The Shanghai Composite fell 5.20% while its tech-heavy counterpart, the Shenzhen Composite is down 5.66% as traders are worried about the government’s ability to continue supporting equity markets. Elsewhere in Asia, Japanese Nikkei fell -0.32%, the Hang Seng -0.85% while the China’s sensitive S&P/ASX plummeted -1.20%. NZD/USD has been unable to break the 0.66 resistance level and is stabilising slightly lower, around 0.6580.

In Europe, equity futures are trading into negative territory, following lead from Asia. The French CAC 40 is the only one blinking green on the screen, edging higher by 0.02%. In Germany, the DAX is down -0.25% while in Switzerland the SMI loses -0.09.

In UK, the Footsie is down -0.10% while the cable is treading water ahead of UK inflation report for July. On a month-over-month, headline inflation is expected to have been negative in July by 0.3% while on a year-over-year basis, analysts expect a flat reading. However, core inflation is expected at 0.9%y/y from 0.8% a month earlier, indicating that low energy prices keep headline CPI at low level. A reading below median forecast would seriously questions an upcoming rate hike from the BoE.

Today traders will be watching UK July inflation report; housing starts and building permits figures for July in the US; formal job creation and tax collection from Brazil; rate decision from Turkey.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.