Market Brief

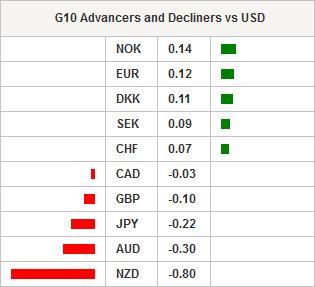

Markets are still focus on the Greek situation despite Euro zone finance ministers ruled out further talks with Greece’s government until the referendum that is scheduled to take place on Sunday. According to the latest GPO’s opinion poll published on Wednesday, 47.1% of voters will rather accept the term of the bailout while 43.2% will rather say “no”. The highly uncertain outcome is weighing on the single currency, dragging EUR/USD below the 1.11 threshold. EUR/USD has proven unable to break the strong support standing at 1.1067 (Fib 38.2% on May debasement). However, US June NFP are due this afternoon and will likely provide the small boost needed to break that support. The US economy is expected to have added 233k jobs during the month of June, while unemployment should print at 5.4%, according to the latest survey, from 5.5% a month earlier. However, given the current tense situation in Europe, we expect markets to show restraint in their reaction to upbeat data.

In the Asian session, equity returns are mixed this morning. South Korea’s Kospi is taking advantage of a weaker KRW to add 0.45% while Japan’s Nikkei gained 0.95%. USD/JPY is gaining upside momentum and broke the 123.20 resistance (Fib 38.2% on May-June rally). However, the pair still needs to break the top of its declining channel (around 123.50-60) to validate a bullish momentum. In China, the stock market is going further south - the Shanghai Composite is down -4.40% and the Shenzhen Composite retreats -5.03% - despite regulator eases rules for brokerages margin trading in an attempt to end the “vicious cycle” of margin calls as falling prices are prompting more selling.

In Australia, the S&P/ASX is up 1.53% while AUD/USD is approaching the bottom of its 1-month range and remains in a short-term declining momentum. Fresh boost will be needed to break the strong resistance lying at 0.7587 (previous low). The Kiwi pursues its free fall against the greenback and validated the break of the strong support standing at 0.6795. Next key support lies at 0.6561. New Zealand’s commodity prices continued to contract in June, however we may have reached the bottom as prices contracted -3.1% in June compared to -4.9% in May.

In Europe, regional equity markets edge up with Xetra Dax up 0.30%, Cac 40 up 0.31%, Euro Stoxx 50 up 0.34% and SMI up 0.21%. Only UK’s Footsie loses -0.02%. GBP/USD is finding strong support at 1.56 for the last 12 hours and currently sits on the level. The closest support stands at 1.5550 (Fib 50% on June rally) while the pair should find resistance slightly below 1.58. EUR/GBP is moving sideways for the last 2 days between 0.7060 and 0.7130.

Today traders will be watching the Riskbank’s interest rate decision and average house price from Sweden; Markit construction PMI from UK; May industrial production from Brazil; NFP, unemployment rate, wage growth, factory orders and Bloomberg consumer comfort from the US.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.