Market Brief

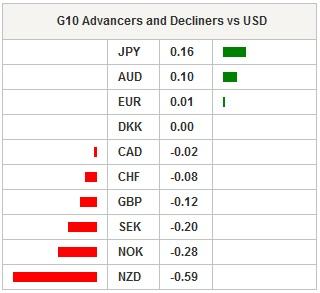

Risk sentiment remains volatile on concerns over Greece debt repayments. Developments regarding a bailout for Greece will remain the primary driver of FX today. Asia equity markets were mixed with the Shanghai composite down -0.2% and Nikkei marginally up 0.06%, while the Hang Seng fell -0.01%. The wires have been filled with false headlines over negotiation progress from the G7 meeting, making Euro trading extremely difficult. In a recent comments EU's Economic Commissioner Pierre Moscovici stated that a deal between Greece and international creditors could happen yet cautioned that the parties still had significant disagreements while liquidity conditions in Greece were deteriorations quickly. Before releasing additional bailout cash the EU is demanding significant reform to pensions, liberalization of labor markets and privatization of assets. Greece seems to be pushing for a deal this weekend ahead of the repayment to the IMF, debt is due 5th of June. However, judging from Mr. Moscovici comments, the EU is more conservative on estimates for an agreement. Without cash from reform deal and agreement with the EU to release bailout funds, it will be difficult for Greece to make repayments, consistently weighing on EUR and European equity markets. US short end yields have given back most of their gains since the strong core CPI read yet EURUSD is skewed towards the downside.

Incoming US data continue to point to recovery from a weak Q1 GDP read. The healthy housing market a strong tone as April pending homes sales rose. However, US jobless claims unexpectedly increased by 282k which will put emphasize on next week’s critical payroll report. Interestingly, Fed members are increasingly signaling that they are ready to vote for a rate increase this year. Extreme dove Minneapolis Fed President Kocherlakota recent comments a clear exception. Today's second estimate for Q1 GDP should be revised further downward potentially into contraction territory, however, fresh data will be more important for the markets. We should see leading indicators in the Chicago PMI and Michigan consumer sentiments rise above markets expectations. DXY should remain bid with EURUSD heading back to 1.0867 support near term.

After breaking critical resistance at 122.50 and extending strengthen to 124.46. USDJPY has taken a brief pause. Inflation data has been slightly stronger than expected yet consumer spending remained soft. But the key reason for the USDJPY retreat from the highs was Finance ministers Aso’s comments that indicated Japanese policy makers are monitoring the JPY weakness. We suspect that while on the surface Japan's government publicly wants avoid rapid appreciation in USDJPY, in private they want and need a soft yen. Economic growth has remained decent there are clear concerns in the recovery. In addition, while today's inflation report was not as negative as we had anticipated, we suspect the deflationary trend is entrenched and the BoJ will need to react. The comments injected a bit of two price action yet with short term US yield near corrective lows and Japanese investors rotating back into foreign securities we see further upside for USDJPY. On the calendar today we should see Swiss GDP and KOF indicators, Canada's GDP and U.S. Chicago PMI.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.