Market Brief

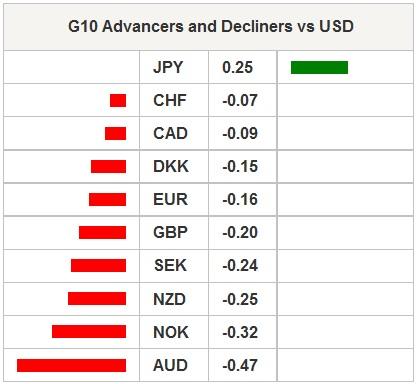

The ECB unveiled the much expected QE program yesterday. In addition to its private bond purchases introduced in the last quarter of 2014, the ECB will start buying 60 billion euros government debt and European institutional debt starting from March 2015 to September 2016. The total amount of the program sums up to 1.1 trillion euros, which exceeds the already aggressive market expectations (750 billion to 1 trillion euros anticipated with NCBs being part of the program). The NCBs will hold 80% of domestic bonds, while the 20% of risk will be shared. “I am surprised the risk sharing issue has become the most important aspect of the effectiveness of our monetary policy. » said Draghi as such framework brought a level of fragmentation in the heart of the Euro-zone’s single monetary system. The euro sold aggressively after the announcement, taking out the 2005 low (1.1460). Asian traders pulled EUR/USD down to 1.1315 for the first time since September 2003. The heavy unwind deepened the oversold conditions (RSI at 19.5%).The sentiment is comfortably negative. We believe short-covering is underway yet decent option barriers should limit the upside attempts pre-weekend. Large put expiries are seen at 1.1450, 1.1400, 1.1350 and 1.1300. EUR/GBP extended losses to 0.75523 (beginning of 2008 levels). Large option barriers at 0.76 should keep the selling pressures tight on the cross before the week’s closing bell.

EUR/JPY tumbled down to 133.95, therefore fully writing-off Oct-Dec gains. Decent JPY demand verse EUR limited gains on the entire JPY-complex. USD/JPY made a timid step above its daily Ichimoku cloud top (118.47). A week close above 118.58 (MACD pivot) should call for short-term bullish reversal. Option bets are positively skewed above 118.35/50 zone today.

Danish National bank cut its deposit rate from -0.20% to -0.35% post ECB QE announcement, signaling further stress on the EUR/DKK peg. While DNB still has room to defend the peg, we believe that two interventions in a week has just attracted speculators’ attention, and might push the bank toward more aggressively defensive strategies in the coming weeks, months.

AUD/USD stepped below 80 cent as the cheap liquidity environment and persistent weakness in commodity prices increase speculations for an RBA cut on February 3rd meeting. Failure to close above 0.8050/54 (MACD pivot & intraday high) should signal the end of the bullish correction era. From next week, the option barriers are solid at 0.80+.

The Cable clears support at 1.50. Next support stands at 1.4814 (2013 low). The GBP/USD 1-month risk reversal steadily slides lower confirming the broad negative bias following the dovish shift in the heart of the BoE.

Today’s economic calendar: French January Manufacturing and Business Confidence, French, German and Euro-zone’s January (Prelim) Manufacturing, Services and Composite PMI, UK December Retail Sales, Chicago Fed’s National Activity Index in December, Canadian December CPI m/m & y/y and November Retail Sales m/m, US January (Prelim) Manufacturing PMI, US December Existing Home Sales m/m and US December Leading Index.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.