Market Brief

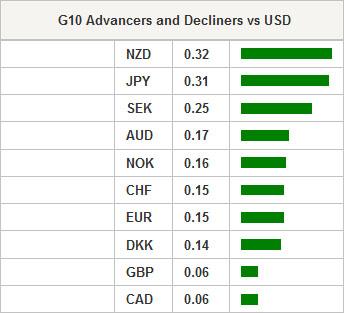

The FX trading has been quiet pre-Christmas, thin trading volumes should remain for the rest of the day. The greenback is broadly in charge after the US GDP surprised in 3Q third read yesterday by a solid 5% q/q annualized (vs. 4.3% exp. & 3.9% last). The personal consumption expanded 3.2% (vs. 2.5% exp. & 2.2% last), while the core PCE (the price indicator closely monitored by the Fed) remained unchanged at 1.4% y/y as expected.

The strong US data sent EUR/USD to 1.2170 overnight. The EUR-negative sentiment should keep the selling pressures tight on EUR-complex on mounting probabilities for announcement of ECB QE as soon as January 22nd meeting. Traders remain mostly sellers on rallies. EUR/GBP trades water with large option offers sitting at 0.7825/35 for today expiry.

USD/JPY and JPY crosses were sluggish as Japan Cabinet resigned. The new Cabinet will be announced today. The Finance Minister Aso commented that Abenomics’ third arrow cannot lead to success without participation of private sector and companies. The government should also renew its commitment for the second arrow – fiscal reforms. Clearly, without the second and the third arrow, the three-arrow Abenomics is nothing but massive liquidity injection. On a side note, we are not sure that further weakness in Yen has any significant benefit for Japan economy. After advancing to 120.73, USD/JPY legged down to 120.28/76 zone. The trend and momentum indicators turn JPY-negative, we see decent option bids at 121.00 for today expiry. We are looking for fresh bull market in USD/JPY, a close above 121.78/85 (MACD pivot / 7-year highs) should strengthen the positive momentum. EUR/JPY remains offered below Ichi base line (147.37). The bias is negative.

AUD/USD consolidates weakness a stone’s throw higher than the target level of 80 cents. Bids are presumed pre-0.80, while option markets are biased downward at, and below this level. NZD/USD traded in the tight range of 0.7706/33. Resistance is placed at 0.7819 (50-dma & Nov-Dec ascending triangle top).

Today, the Central Bank of Turkey gives policy verdict and is expected to maintain the benchmark repo rate unchanged at 8.25%, the overnight corridor stable at 7.50%/11.25%. Although the slide in oil prices should cool off the inflationary pressures and the ECB preparing to announce a QE gives room to keep rates unchanged, 2015 will be a challenging year for the lira due to political jitters and anticipation of Fed-related capital outflows. Playing down the rates at this stage is a risky action, especially a week after USD/TRY tested fresh record highs (2.4146).

We have a light economic calendar today. Traders watch French November Jobseekers Net Change and Total Jobseekers, US December 19th MBA Mortgage Applications, US December 20th Initial Jobless Claims and December 13th Continuing Claims.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.