Market Brief

The German GDP grew 0.1% q/q in 3Q, 1.2% y/y. Markets gave little reaction to good German data as more important concerns occupy the headlines in the Euro-zone, the QE being one of them. EUR/USD opened the week down to 1.2360 following “broader asset purchases” hinted by Draghi on November 21st speech. Trend and momentum indicators weaken. The MACD will step in red zone for a daily close below 1.2343. Decent vanilla expiries should cap the upside pre-1.25. EUR/GBP traded in tight range of 0.79175/276 overnight (daily Ichi cloud).

GBP/USD trades range-bound. The formation of bullish engulfing (conviction 5/9) hints at better short-term outlook, a daily close above 1.5692 (MACD pivot) should push for upside correction. Last week’s double top 1.5736/37 is yet to be broken to confirm a bullish reversal. BoE Governor Carney’s speech before the lawmakers should give fresh direction to GBP-complex today. Renewed dovishness should halt the improvement in technicals and reverse short-term tendency toward 1.55 target.

The China 7-day repo fixing fell 20 bps to 3.3%, USD/CNY extended gains to 6.1405. With bullish momentum developing, we see room for further upside. Next line of resistance is seen at 6.1500/33 (optionality / Fib 50% on January-April rally), then 6.1774/6.1803 (200-dma / Fib 61.8%).

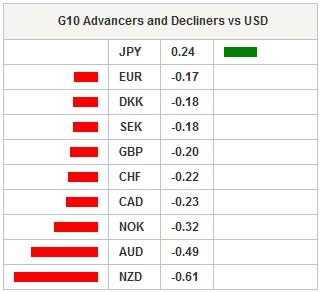

USD/JPY and JPY crosses were sluggish in Tokyo, the dovish BoJ minutes were offset by political uncertainties and the need for fiscal reforms. USD/JPY consolidates gains at year high levels, yet the limited appetite before December snap elections should keep the resistance solid pre-120. EUR/JPY bulls lose ground.

USD/CAD remains well bid above the 50-dma (1.1225) as oil markets trade water before Thursday’s OPEC meeting. There are rumors that some OPEC members will be willing to cut outcome to sustain prices, while the delay in Iran-US nuclear talks may also have a deferring impact on OPEC decision. This is no good news for oil exporters as the US continues extending its total production to record highs (9 million barrel per day according to Nov 14th data) to keep the downside pressures on oil markets.

In Brazil, the real starts the week offered as Rousseff takes her time to nominate her new economic team. The delay in decision increases fears in the markets, we expect higher FX volatilities until the decision is announced. Option bids trail above 2.55 for today expiry.

OECD will publish economic outlook for the Euro-zone. The economic calendar of the day: German 3Q (Final) GDP q/q & y/y, Personal Consumption q/q, Government Spending q/q, Capital and Construction Investment q/q, Exports and Imports q/q, French November Manufacturing and Business Confidence, Spanish and Swedish October PPI m/m & y/y, Italian September Retail Sales m/m & y/y, UK October BBA Loans for House Purchase, US 3Q (Second reading) GDP Annualized q/q, Personal Consumption, GDP Price Index and Core PCE q/q, Canadian September Retail sales m/m & y/y, US September S&P/CaseShiller House Price Index, US November Consumer Confidence Index and Richmond Fed’s November Manufacturing Index.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.