Market Brief

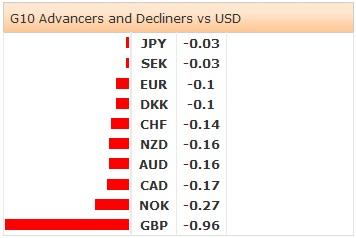

FX traders begin the week focused on the economic data. JPY crosses remained well bid as the second quarter final GDP growth decelerated at the faster-than-expected pace of -7.1% q/q annualized (vs. -7.0% exp. & -6.8% last). The business spending dropped 5.1% (vs. -3.4% exp. & -2.5% last), the consumer spending decreased 5.3% (vs. -5.0% exp. & -5.2% last). Finally, the current account balance turned positive in July (416.7bn yen) yet slightly missed the market expectations (444.2bn yen). USD/JPY traded in 104.90/105.23 range as speculations for more monetary stimulus and the recent cabinet shuffle are widely expected to further weigh on JPY. USD/JPY failed to push higher on Friday (post-NFPs) following the stop-rally to fresh 6-year high of 105.71. Trend and momentum indicators are comfortably bullish, while resistance is likely building at 105.75/106.00 zone. EUR/JPY extended weakness to 135.78 – lowest since Aug 8th – on broad EUR weakness post-ECB actions announced on Thursday 4th. The cross trades below 136.75 (Fib 38.2% on Nov’13 – Jan’14 rally), the sentiment is negative.

The Chinese trade surplus advanced to 49.84bn dollars (vs. 40bn exp. & 47.30bn last month), exports surged 9.4% y/y as shipments toward US and Europe gained traction. Yuan gave little reaction as markets start talking about a possible cut in mortgage rates to boost the economic recovery by reviving the property market.

GBP/USD and EUR/GBP gap opened as Sunday Times/YouGov poll printed 51%/49% in favor of Scottish independence. The Cable opened the week at 1.6196 (vs. Friday close at 1.6327), EUR/GBP opened at 0.79965 (vs. Friday close at 0.79326). It seems that the GBP-negative pressures will intensify walking toward Sep 18th. The CFTC data showed that GBP-long contracts retreated to lower levels in 2014. We remain on sidelines as uncertainties continue.

The important highlight of last Friday has been the US labor market data. The US economy released disappointed jobs report in August. The NFPs greatly surprised on the downside with 142’000 print (the first reading below 200K in seven months) versus 230K expected and 212K revised a month ago. The unemployment rate fell to 6.1% but the participation rate further deteriorated to 62.8%. The average weekly earnings remained little changed. The US 10-year yields dropped from 2.4721% session highs. DXY index remained capped below 84.000, highest levels over a year. US jobs data revived speculations that the Fed might delay its first rate hike, while markets still price in the first rate move by mid-2015. Across the border, the Canadian unemployment remained unchanged at 7.0%, while the participation rate fell to 66.0% in August release. The heavy knee-jerk reaction sent USD/CAD down to 1.0841 yet the disappointment in Canada limited the CAD-bulls. The 100-day moving average is now a weakened support, especially as we believe it is time for USD bulls to step aside in the absence of major data this week. Fed officials comments will be monitored closely. The August retail sales and University of Michigan’s confidence index (both due on Friday) are the key data in US this week.

The broad USD sell-off pushed EUR/USD up to 1.2988 on Friday, yet the top selling pressures quickly halted the bullish move. The pair was sustained in Asia as EUR/GBP took a lift on Scottish independence concerns. EUR/USD is deeply oversold according to 30-day RSI index at 18% and 30-day lower Bollinger band at 1.2975. The fundamentals point toward more EUR weakness. Offers are eyed at 1.3000+.

Traders watch Swiss August Unemployment Rate and CPI m/m & y/y, German 2Q Labor Costs q/q & y/y, German July Current Account and Trade Balance, Exports & Imports m/m, Swedish July household Consumption m/m & y/y, Canadian July Building Permits m/m and US July Consumer Credit.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.