Market Brief

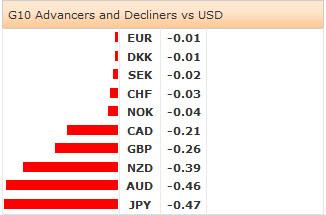

As widely expected, the RBA left its overnight cash rate target unchanged at 2.50%. Governor Stevens stated that AUD remains “above most estimates of its fundamental value, particularly given the decline in key commodity prices” thus adding that it offers “less assistance […] in achieving balanced growth in the economy”. From the session open, AUD-complex traded under selling pressures in Sydney as larger current account deficit in 2Q (AUD -13.7bn vs. AUD -5.7bn last quarter) preceded (and reinforced) the dovish RBA statement. The improvement in building approvals in July didn’t gather traders’ attention. AUD/USD tumbled down to 0.9285, crossed below its 21-dma (0.9308). The critical support stands at 0.9238/39 (August support). A daily close below 0.9230 (MACD pivot) should signal a short-term bearish reversal. Large option related offers wait to be activated at 0.9250 for today expiry. In New Zealand, the commodity prices dropped additional 3.3% in August according to ANZ, leading to sustained NZD/USD sell-off to 0.8342 overnight. Resistance is eyed at 0.8400/20 (optionality / 21-dma), while support remains at 0.8300/11 zone. The sentiment is mixed between the broad USD strength yet the good carry appetite.

In Japan, the labor cash earnings increased 2.6% in July (despite 1.4% drop in real wages, special payments and bonuses helped increasing total earnings). The Japanese FinMin Aso said the government should stick to the fiscal consolidation (suggesting no delay in second round of sales tax hike from 8.0% to 10.0%), while the PM advisor Honda voiced his preference to wait until wages grow substantially and the BoJ’s inflation target is met. In this respect, Honda said that BoJ may add more monetary stimulus to reach its 2.0% inflation target. The situation remains unclear. Abe’s Cabinet meets tomorrow, while BoJ policymakers gather on Thursday and are expected to maintain the status quo. USD/JPY rally fastened as 104.50 barriers have been cleared. The pair advanced to 104.87 in Tokyo. Exporter offers should join the option barriers at 105.00, then 105.50. The key resistance stands at 105.44 (6-year high reached on Jan 2nd 2014). EUR/JPY test the 50-dma (137.53) despite broad EUR-negative pressures. At this stage, hopes for more reforms out of tomorrow’s cabinet should keep the sentiment positive in JPY-crosses. Traders will be seeking hint for more BoJ easing if sales tax are not rescheduled later next year. The event risk is to be considered.

Released in the morning, Swiss GDP growth unexpectedly flattened in 2Q (0.0% q/q vs. 0.5% exp. & last), pulling the year-on-year growth down to 0.6% from 2.0% a quarter ago. CHF lost against USD and EUR. EUR/CHF recovered to 1.20778, yet the 1.20 cap is still very close. The proximity to SNB’s cap seems to be a good opportunity for long positions given SNB’s determination to defend the 1.20 floor.

EUR/USD extended weakness to 1.3115 in Asia, as EU officials discuss further sanctions to Russia. Trend and momentum indicators remain steadily bearish with key support eyed at 1.3105 (6th Sep 2013 low). Option related offers are placed between 1.3000/1.3200, thus should keep the upside attempts limited. ECB decision and Draghi’s speech (Thu) are among most expected events of the week, especially given the sharp drop in inflation expectations in the Euro-zone. We remain seller on rallies.

The economic calendar of the day consists of Swiss 2Q GDP q/q & y/y, Spanish August Unemployment, Swedish 2Q Current Account Balance, UK August Construction PMI, Euro-zone July PPI m/m & y/y, US and Canada August PMI manufacturing, US August ISM Manufacturing and Prices Paid US July Construction Spending and US September IBD/TIPP Economic Optimism.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.