Market Brief

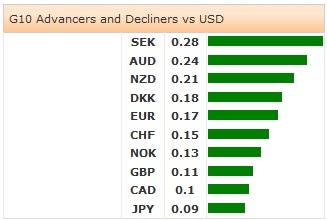

FX markets were subdued in the Asian session as USD lost some ground on further profit taking. Regional equity indices were in the red as the Nikkei fell -0.48%, the Hang Seng dropped -0.28% and Shanghai was slightly lower at -0.5% (at the time of writing). In FX, USDJPY continued to fall, slipping to 103.68 weakness in US treasury yields while EURUSD rose to 1.3218 on a Reuters report stating the ECB was doubtful to ease at next weeks policy meeting, unless Friday’s inflation data was meaningfully softer then consensus. EURUSD traders are eyeing the gap open from Friday-Monday (1.3242 close), which could get filled should inflation data come better than expected (lower should data come in lower then forecasts). AUDUSD climbed to 0.9372 from 0.9332 as stronger CAPEX data cleared stops above 0.9350 resistance. Most Asia EM traded higher verse the USD. USDKRW was sold to 1013.30 were official support was rumored to have stepped in. USDINR fell to 60.3600 as yields rose 2bp. Yet the broader trend of EM bonds and currecnies being in demand looks to continue. We are highly constructive on EM Asia currecneis in particular.

Asian Session

In the Asian session, report showed that China’s industrial profits grew 13.5% y/y in July, decelerating from its prior increase of 17.9% in June. Australia’s private capital expenditure jumped 1.1% q/q in Q2 2014 significantly better than expectations of a 0.9% fall. The CAPEX underlying spending results illustrates a more balanced investment approached then just heavy allocation toward mining. South Korea’s Balance of Payment current account surplus slipped marginally to $7908.8mn in July from $7919.7mn in June.

On the docket

In the European session, Spanish GDP Q2 final came in as expected at 0.5% q/q and 1.2% y/y. While German CPI fell to 0.0% from 0.4%. The weaker inflation reads will support the pro-QE team demand to launch aggressive easing next week. We still suspect that weak European data will increase debate for ECB action and keep EUR soft. However, we are still in the camp that doesn’t anticipate the ECB will pull the trigger at next week’s meeting. In the UK, CBI reported sales for August expect to come in at 27, stronger then the July print of 21. And in Sweden, retail sales growth is expected at 4.3% y/y in July verse 3.3% y/y in June.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.