Market Brief

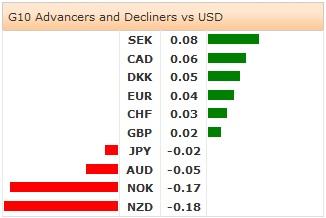

The FX markets started the week in quiet fashion. We are heading into an eventful week with important releases on the economic calendar. In US, we will be closely monitoring the GDP 2Q first reading and the FOMC decision (Wed), the July nonfarm payrolls and the unemployment rate (Fri). In the Euro-zone, the Spanish 2Q preliminary GDP (Wed), the EZ composite CPI estimate for July, the unemployment rate (Thu) and July final PMI readings (Fri) will be key. In addition, the Japanese jobless rate (Tue), the industrial production (Wed) and the Canadian GDP update (Thu) should keep traders busy through this week.

The US 10-year yields remain below 2.50% despite supportive US durable goods data released on Friday while the DXY index advanced to 81.084, the highest levels since June 5th (date matching the ECB announcement for its additional stimulus package). Low US yields keep USD/JPY limited on the upside, solid resistance is seen at 101.90/102.10 area (including option barriers, 100 and 200-dma and daily Ichimoku cloud cover). EUR/JPY started the week in the tight range of 136.64/84. Technicals are flat, the key support stands at 136.23 (2014 low).

EUR/USD extended weakness to 1.3422 on Friday and made a quiet start to the week. The pair consolidated losses in Asia. The sentiment remains bearish, combined to upside USD potential this week (FOMC, NFPs). Bids are eyed at 1.3400+, while decent option related offers wait to be activated at 1.3400 for the week ahead. Resistance should come into play at 1.3550 (last week high). EUR/GBP trades comfortably in the mid-range of June-July downtrend band (0.78673/0.79633). The overall bias remains bearish as long as resistance at 0.79330/0.79633 (21-dma/downtrend channel top) holds.

The broad based USD appetite sent USD/CAD above 1.0821 last Friday. The pair consolidates gains in the bullish consolidation zone, above 1.0800. Bids build up at 1.0789/1.0800 (50-dma/optionality). The key resistance stands at 200-dma (1.0832).

The week starts with light economic calendar. Technicals are likely to drive the FX trading as traders adjust positions before important data due in the second half of the week. Today, the economic calendar consists of Italian July Business Confidence and Economic Sentiment, US July (Prelim) Services and Composite PMI, US June Pending Home Sales m/m & y/y and Dallas Fed Manufacturing Activity.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.