Market Brief

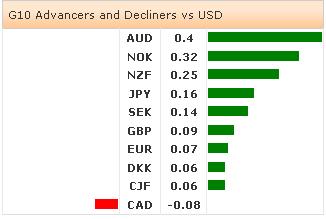

Nothing much has happened in FX markets during the Easter holidays. Low liquidities drove the markets. The US yields climbed above 2.70% on last week’s Philly Fed and lower jobless claims (below 4-week average of 312K). The G10 majors mostly pare losses vs. USD as holidays end.

JPY started the week well offered amid the trade deficit widened significantly more than expectations. Japan printed -4,446.3bn yen deficit in March (vs. -800.3bn yen & -1,427.6bn yen), the exports slumped from 9.8% to 1.8%, imports hiked from 9.0% to 18.1%. USD/JPY advanced to 102.73 in Tokyo. Resistance at 100-dma (102.95) and exporter offers keep the upside choppy pre-103.00, bids are seen above. EUR/JPY trades flat at about the 100-dma (141.27). A daily close above 141.55 should send MACD into the bullish area but EUR risk remains.

AUD/USD is better bid despite rumors of Australian Treasurer Hockey’s discontent with RBA’s neutral bias. The focus is on tomorrow’s CPI readings. The AUD inflation had surprised on the upside in Q4. Markets expect faster CPI y-o-y at 3.2%, versus 2.7% last quarter. If the expectations are confirmed, the hawkish RBA expectations should keep the AUD-bulls in place. AUD/USD sees resistance above the 21-dma (0.9311). The next key resistance stands at 0.9499/0.9500 (Fib 76.4% on Nov’13 – Jan’14 pullback & psychological level).

EUR/USD traded marginally lower in Asia and opens volatile as Europe comes back from Easter holidays. The big picture in EUR remains unchanged. The ECB threats keep the upside pressures subdued, yet do not trigger significant sell-off. The sentiment is uncertain, the deflation fears outweigh ECB risk at the moment. EUR/USD tests support at 1.3781 (Fib 61.8% on Feb-Mar rally), more bids are seen at 1.3722 (Fib 50% & 100-dma). On the upside, resistance remains pre-1.3830 (last week high), then 1.3906 (April high).

The Cable consolidates last week gains above 1.6775. Trend and momentum indicators are steadily bullish, the bias remains on the upside. EUR/GBP is heading towards our target at 0.82042 (March 5th low). The support zone is placed at 0.81828/0.82000 (30-day lower BB/psychological support).

Today, the economic calendar consists of Swiss March M3 Money Supply, Swedish March Unemployment Rate, Euro-Zone February Construction Output m/m & y/y, Canadian February Wholesale Sales m/m, US February FHFA House Price Index, Richmond Fed April Manufacturing Index, US March Existing Home Sales m/m, Euro-Zone April (Prelim) Consumer Confidence.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.