Market Brief

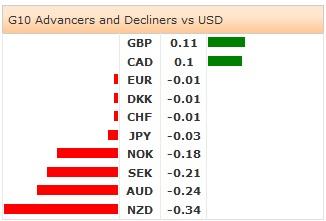

The EM currencies are broadly weaker against USD today, the majority of G10 grind lower as 10 year US government yields rally above 2.80% in New York. Fed officials remain supportive of policy normalization start by mid-2015. Released yesterday, the ADP employment report showed that the US economy added 191’000 new private jobs during March, slightly lower than 195K expected yet significantly higher than February’s 139K. DXY broke the 50-dma (80.221) on the upside. A good NFP reading on Friday should give further support to USD and US yields from next week.

In China, the official non-manufacturing PMI retreated from 55.00 to 54.5 in March, while HSBC/Markit composite PMI showed deeper contraction (49.8 in March versus 49.8). Shanghai’s Composite dropped 0.71% at the time of writing, Hang Seng index remains flat. The weakness in China sent AUDUSD down to 0.9206. Bullish momentum fades as we walk into NFPs (Fri). Option bids are placed at 0.9200/10, if cleared will place the 200-dma (0.9138) at risk pre-NFP.

In New Zealand, NZDUSD tests 0.8544/60 (Oct 2013 high & 21-dma) on the downside, more support is eyed at 0.8502 (Mar 20th low). The MACD stepped in the red zone pre-NFPs. We see decent option bids at 0.8475 and 0.8550 for Friday expiry, waiting to be activated pre-weekend.

JPY crosses were mixed in Tokyo. USDJPY shortly spiked to 104.07 on broad based USD demand. Bullish momentum gains pace pre-NFPs, option bids with today expiry trail above 103.85. EURGBP consolidates gains despite EUR-skepticism pre-ECB/Draghi, bias remains on the upside. A post-Draghi relief-rally (in case of inaction) will open the way towards the year high of 145.69. The key downside support stands at the daily Ichimoku cloud top (140.96).

EURUSD trends lower pre-ECB / Draghi today. The ECB is expected to keep the status quo (main refi rate at 0.25%, deposit rate 0.00% and marginal lending rate at 0.75%) despite the weakness in latest CPI data released on Monday. The risk of a dovish move has just started to get into EUR prices. EURUSD retreated to 1.3755 in Asia. The ECB decision and Draghi’s conference will define the course of the single currency this afternoon. Inaction from the ECB should send EUR higher. A break above the 21-dma (weekly support) will turn the short-term bias positive. EURGBP failed to clear resistance above 100-dma (0.83072) yesterday and opened below 50-dma (0.82816) in Asia. Trend and momentum indicators are solidly bearish.

The key event of the day is the ECB policy meeting and Draghi’s speech at 11:45 and 12:30 GMT respectively. The economic calendar consists of Swedish, Spanish Italian, French, German, Euro-zone and US March (Final) Services & Composite PMI, UK March Official Reserves, Euro-Zone February Retail Sales, Canadian February International Merchandise Trade, Us March 29th Initial Jobless Claims & March 22th Continuing Claims, US March ISM Non-Manufacturing Composite.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.