Market Brief

The Asian equity markets ended the week with losses ahead of two-day G20 meeting starting in Moscow today and the Upper House elections in Japan Sunday. The Japanese equities traded on the downside; Nikkei 225 lost 1.48%, Topix index retreated 1.26%, while the Japanese interest in foreign bonds reached its highest since Abenomics started.

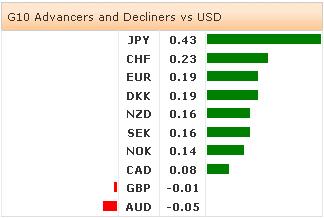

USDJPY and JPY crosses were mixed in Tokyo. USDJPY advanced to 100.87 on Gotobi demand, before fading to 99.81 alongside with Nikkei stocks and pre-election position adjustments. Bids are seen at 99.80/100.00, while offers remain pre- 101.00 on optionality. Sunday’s elections will give fresh direction to JPY. The expectations are in favor of big victory for PM Abe’s LDP, in which case the political stability and higher confidence in Abe should be JPY-negative.

In US, Fed Chairman Bernanke didn’t say anything new at the second day of his semi-annual testimony. The rise in market rates is partly due to unwinding in leveraged and risky positions, said Bernanke, which he added, is a good thing. Besides, the US jobless claims fell from 360K to 334K last week, giving a minor boost to USD, but the USD-bulls have decidedly lost pace since July 10th (FOMC minutes & Bernanke’s speech).

EURUSD fell to 1.3067 on strong US data in New York and rallied to 1.3150 in Tokyo. Euro remains in demand at 1.3080/1.3100 (200-dayMA/psychological support). While the German FinMin Schaeuble sees improvement in Greece, no agreement has been reached between the Portuguese ruling coalition parties and the opposition.

In UK, the better-than-expected retail sales and broad based USD-weakness pushed GPBUSD to 1.5200/50 range, while USDCHF eased from 0.9478 to 0.9407 overnight. EURCHF is still subject to decent offers pre-1.2400, yet the sentiment in CHF remains on the downside.

Today, traders will focus on German June PPI m/m & y/y, Italian May Industrial Orders and Sales m/m & y/y, UK June Public Finances, UK June PNSB ex Interventions and Public Sector Net Borrowing, Canadian June CPI m/m & y/y and Bank of Canada CPI Core m/m & y/y.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.