Market Brief

The Asian stocks partly recovered yesterday’s losses as China’s actual foreign direct investments rose 6.3% year-on-year, overbeating the expectations of -4.8%. Hang Seng advanced 0.04%, Shanghai’s Composite added 0.5%, while Taiex and Kospi index gained 0.4% and 0.5% respectively. In Australia, the RBA minutes showed optimism on the economy well responding to policy stimulus, on China’s stability and on the rest of Asia’s progress. Aussie traded up to 1.0410, yet failed to extend gains overnight as the RBA minutes highlighted concerns on high AUD.

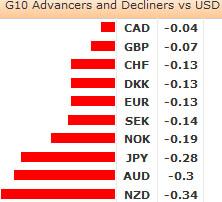

In Japan, the Nikkei 225 index advanced 2% as BoJ’s exiting Governor Shirakawa said he was confident on the Japanese economy, while about the two-thirds of the Japanese voters are likely to support the PM Abe’s ambition to enter US-led regional trade negotiations. JPY lost against all of its G10 major peers, though slowly as the concerns on the Cyprus bailout vote continues to crowd investors’ minds. USDJPY hit 95.75 in Asia, yet failed to extend weakness. EURJPY recovered cautiously, and traded tight in Asia ahead of the Cyprus bailout vote today.

The Cypriot parliament is expected to vote for the EU bailout plan tonight at 16:00 GMT. In our view, the bailout plan will not be approved, as the Cypriot President Anastasiades stated that he lacks support to get the levy on deposits approved. At this stage, the Eurogroup thinks that the small depositors’ (below EUR100K) savings should be guaranteed; however Cyprus needs to employ more aggressive progressivity to raise EUR5.8bln out of the bank deposits.

Yesterday, several European officials emphasized that Cyprus situation is unique and there is no risk of contagion. The head of Portugal’s Banking Association reinsured the investors that it is “absurd” to compare the Portuguese situation to Cyprus’ and it “makes no sense to consider applying tax on Portugal deposits”. On the back of European officials’ comments, Euro got lifted a small leg up late in NY. The Asian trading gave no direction to the single currency. EURUSD traded between 1.2935/70 overnight, ahead of ZEW scheduled this morning.

IMF said yesterday that the Swiss National Bank should charge banks on their excess reserves if the Swiss franc rises against the euro. As immediate reaction, EURCHF jumped to 1.2290, before easing back to 1.2215/20 zone. In Asia, the pair traded between 1.2245/67; the volatility was low.

Today, the focus is on Italian January Industrial Production and Current Account, UK February PPI m/m & y/y, UK February CPI m/m & y/y, UK February RPI m/m & y/y, Euro-Zone January Construction Output m/m & y/y, German March ZEW Survey on Economic Sentiment, Euro-Zone March ZEW Survey on Economic Sentiment and the Current Situation, Canadian January Wholesale and Manufacturing Sales, US February Housing Starts and Building Permits.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.