Market Brief

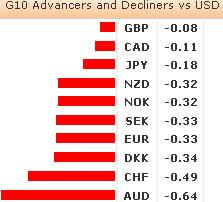

The risk appetite rebounded as the attention moved away from the European debt crisis to news out of Japan. BoJ’s Governor Shirakawa decided to step down earlier than scheduled. In reaction, Yen weakened against all of its major counterparts, except AUD, over the last 24 hours even though the BoJ policy board stated that the focus should be on “channel” in which the monetary policy can indirectly affect FX, as the 2% inflation target cannot be reached only by weakening Yen.

USDJPY tested 94.06 early in the session, yet retreated due to stops above 94.00. EURJPY hit 127.71, its highest level since April 2010, GBPJPY rallied to 147.255. NZDJPY came to its lowest since July 2008, while AUDJPY was bearish amid weak December retail sales out of Australia.

EURUSD traded in 1.3560 / 96 range in Asia, thanks to bullish pressure on EURJPY and EURAUD. EURCHF had support at 1.2260, and recovered above 1.2360 ahead of German manufacturing orders release this morning.

On the back of Shirakawa’s decision, Japanese stocks saw massive rally overnight. The Nikkei 225 surged 3.8%, Hang Seng and Shanghai’s Composite advanced by 0.6% and 0.02%, Taiex added 0.25%. Australia’s ASX200 gained 0.78%. The Korean Kospi index was the only one to retreat 0.10%, amid the concerns on weaker Yen hurting country’s exports.

Overseas, the US stock markets advanced yesterday, despite the worse-than-expected ISM non-manufacturing figures. The S&P500 increased by 1.04%, Dow Jones and Nasdaq’s Composite followed by 0.7% and 1.29%.

Today, the economic calendar is light. We will watch German Dec Factory Orders m/m and y/y and the US MBA Mortgage Applications.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.