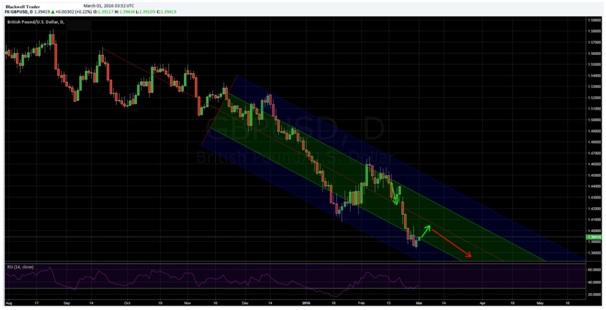

The Past few weeks have been relatively torrid for the Cable as speculation continues to mount over whether the UK will ultimately exit the Eurozone. As the talk of a BREXIT has increased, so too has the bearish pressure upon the Cable. Subsequently, the question remains as to whether the pair has finally found some support above the 1.38 handle, or if a further collapse is on the horizon.

Taking a look at the Cable’s technical indicators points to a currency in a weakened state as price action continues to slide lower. In extension, price remains firmly below the 100-Day Moving average with little chance of rising back above the 1.45 range. MACD is also steadily trending lower, giving some credence to the argument that the pair is facing further falls ahead. However, RSI has just reached into over-sold territory and this could be signalling the need for a pullback ahead of the resumption of the bear trend.

Further supporting the downside view is the recent commitment of trader’s report that shows a range of mounting short positions against the pair. It would appear that the last week has seen a significant rise in the amount of speculation over the potential direction of any BREXIT vote.

However, any further depreciation against the US Dollar will need to breach a few key support areas to cement a move lower. In particular, any bearish activity will firstly face the 29th of February low of 1.3834 and then potentially the Fibonacci extension at 1.3750. If those two key points are breached, a potential slide towards the 1.35 handle could be on the cards.

Unfortunately, the current price level brings with it a significant amount of risk for unwary traders. The current Risk/Reward ratio is unfavourable and it would therefore be more prudent to wait for a pullback towards resistance around the 1.4000 handle, before looking to re-enter short. Subsequently, look to sell a bounce from around that resistance level or a downside break of 1.3834, with either scenario being highly likely in the coming session.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

AUD/USD weakens further as US Treasury yields boost US Dollar

The Australian Dollar extended its losses against the US Dollar for the second straight day, as higher US Treasury bond yields underpinned the Greenback. On Wednesday, the AUD/USD lost 0.26% as market participants turned risk-averse. As the Asian session begins, the pair trades around 0.6577.

EUR/USD stuck near midrange ahead of thin Thursday session

EUR/USD is reverting to the near-term mean, stuck near 1.0750 and stuck firmly in the week’s opening trading range. Markets will be on the lookout for speeches from ECB policymakers, but officials are broadly expected to avoid rocking the boat amidst holiday-constrained market flows.

Gold price drops amid higher US yields awaiting next week's US inflation

Gold remained at familiar levels on Wednesday, trading near $2,312 amid rising US Treasury yields and a strong US dollar. Traders await unemployment claims on Thursday, followed by Friday's University of Michigan Consumer Sentiment survey.

President Biden threatens crypto with possible veto of Bitcoin custody among trusted custodians

Joe Biden could veto legislation that would allow regulated financial institutions to custody Bitcoin and crypto. Biden administration’s stance would disrupt US SEC’s work to protect crypto market investors and efforts to safeguard broader financial system.

US inflation data in the market purview

With next week's pivotal US inflation data looming, we're witnessing a stall in stock market momentum and an uptick in US Treasury yields. This shift comes amid murmurs of hawkish sentiment from Fed speak. Indeed the mind games intensify even further as investors cling to their rate cut hopes.