However, given the RBNZ’s recent comments regarding a rate hike, it seems unlikely December will see a cut from the central bank. In fact, the RBNZ’s Governor Wheeler made a statement in the middle of October outlining the case for leaving the Official Cash Rate (OCR) unchanged. Although the venerable central banker did concede that the OCR may need to decrease in the short term if conditions worsen.

In addition, a bevy of economists are urging the central bank to take a conservative approach to any further cuts given the need to retain sufficient capacity to cut if global conditions decline. There appears to be a view that there is a diminishing return in attempting to stoke inflation solely through the manipulation of rates. This is particularly salient given the effect of rolling rounds of currency depreciations that are currently occurring throughout Asia. Subsequently, the higher Kiwi dollar complicates both the trade balance and export competitiveness.

It is highly likely that the RBNZ will seek to delay any rate cut in December despite the dovish rhetoric from the NZ Finance Minister. Thankfully, economic policy drives rate setting, not political ambitions.

NZD: Subsequent Outlook - Bearish

The NZD had a largely volatile week as New Zealand’s trade balance deteriorated to -1.22B along with exports dipping significantly. The pair subsequently experienced a sharp decline of around 80 pips before the RBNZ helped to fuel a rally when they elected to hold interest rates steady at 2.75%. The NZD subsequently managed to close the week only fractionally lower, around the 0.6773 mark.

The week ahead will largely be focused upon the NZ Global Dairy Trade (GDT) and Unemployment figures. The dairy trade result will be closely monitored by the market given the recent deterioration in New Zealand exports. Also, recent comments from the NZ Finance Minister indicate a definite dovish bias and are likely to impact the pair in the short term. On the news front, keep a close watch upon the US NFP’s as they are likely to cause some sharp volatility within the markets.

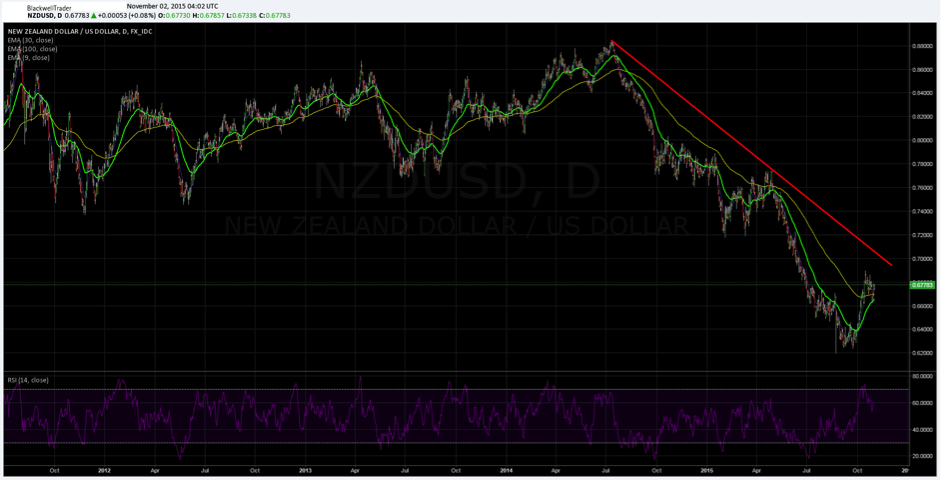

From a technical perspective, the NZD is being squeezed between the long run bearish trend line and the 100-Day moving average. That consolidating wedge is likely breakout in the coming week with a bias to the downside. Subsequently, monitor the pair closely for a break below the 100-Day MA. Support is found at 0.6631, 0.6497, and 0.6408. Resistance is found at 0.6895, 0.7013, and 0.7229.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

EUR/USD propped up near 1.0750 ahead of European Retail Sales

EUR/USD churned around 1.0770 to kick off the new trading week, with the pair rising after better-than-expected Purchasing Managers Index figures early Monday before settling into familiar chart territory above 1.0750 ahead of Tuesday’s pan-European Retail Sales figures.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

Ethereum traders show uncertainty following huge whale sale, Robinhood Crypto Wells notice

Ethereum holdings on centralized exchanges continue to decline despite recent whale sales. With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.