Last week was relatively positive for the Kiwi Dollaras a range of US economic data proved weaker than expected. The US NFP was highly negative, coming in at 142k (202k exp) whilst Average Hourly Earnings also fell to 0.0% m/m. The NZD Subsequently rose higher and managed to finish the week around the 0.6450 level. However, the week ahead will prove critical for the venerable currency as it prepares to be largely dominated by the US unemployment rate and Non-Manufacturing PMI results.

The next few days will see the Kiwi Dollar focused upon the US labour market as the Unemployment Claims figures fall due. The market will be closely watching the results from this indicator, for some sort of signal as to the US Federal Reserve’s intent in the coming FOMC meeting.

Any further demonstrated weakness within US labour markets could doom any rate hikes for 2015. The pressure is already mounting for the central bank to hold off on any monetary policy changes given the weaker than expected NFP data. So any weakness in the US Unemployment Claims figures could benefit the NZD and cause a sharp appreciation against its namesake. In fact, the NZD is currently climbing ahead of the labour market result, as the market looks to take a risk off approach.

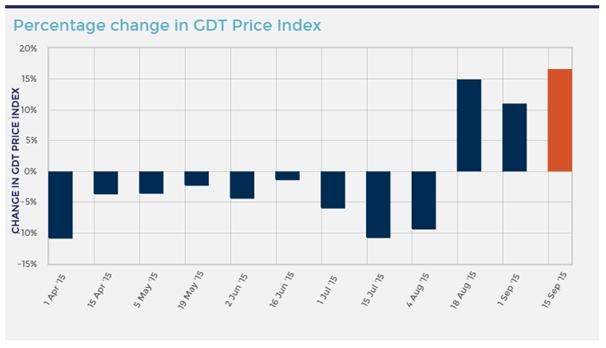

However, there is also some important NZ macroeconomic data due this week that has the potential to be missed considering the volatility that is likely to be present around the US unemployment Claims data. A Global Dairy Trade (GDT) auction result is due shortly and, given the importance of dairy to the New Zealand economy, should be watched closely.

New Zealand’s largest dairy producer, Fonterra, has recently restricted supply in an attempt to alter the equilibrium price, which obviously limits the possibility of a negative result. Subsequently, it is likely that the GDT auction will provide another price increase, albeit a largely artificial one.

From a technical perspective, the pair continues to consolidate as it remains above the 64 cent handle. Also, the moving averages have started to turn with the 12 crossing the 30EMA whilst RSI continues to creep higher. Subsequently, the NZD is looking bullish, albeit in the short term, given the MA crossover and trending RSI oscillator. Support is found at 0.6285, 0.6237, and 0.5918. Resistance is found at 0.6521, 0.6679, and 0.6707.

Ultimately, the coming week is likely to be critical in determining the NZD’s short term trend given some of the encouraging signs. However, the medium term is still presenting some highly bearish signals, so buyers should be careful not to get their fingers burned.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

GBP/USD hovers around 1.2500 on the stronger US Dollar, focus on BoE rate decision

The GBP/USD pair trades on a softer note around 1.2500 on Wednesday during the Asian session. The USD Index recovers modestly to 105.40, which drags the major pair lower. Investors focus on the upcoming Bank of England's monetary policy meeting.

Gold price recovers its recent losses, despite a firmer US Dollar

Gold price attracts some buyers during the Asian trading hours on Wednesday. Safe-haven demand, fueled by geopolitical tensions and uncertainty, as well as ongoing central bank purchases, might contribute to a rally in gold.

Ethereum resume sideways move as Grayscale files to withdraw Ethereum futures ETF application with the SEC

Ethereum is hinting at a resumption of a sideways movement on Tuesday after seeing inflows for the first time in seven weeks. Grayscale withdrew its application for an Ethereum futures ETF, and the SEC’s Chair Gary Gensler has also called most crypto assets securities.

No obvious macro catalysts to steer the bus

The US data calendar remains relatively light, with initial jobless claims and the University of Michigan survey being the key focus. However, these releases may not provide a significant catalyst for the next directional move in the US Dollar.