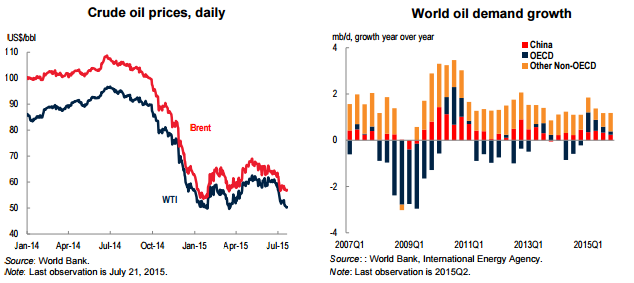

As WTI Crude Oil prices continue to find downward pressure, the oil industry is facing structural change as some producers find difficulty in repaying debt and may face exiting the sector altogether.

As the price of West Texas intermediate has continued to slide, and subsequently reached the lowest levels in over six years, many are now questioning how the smaller producers will meet their upcoming bond repayments.

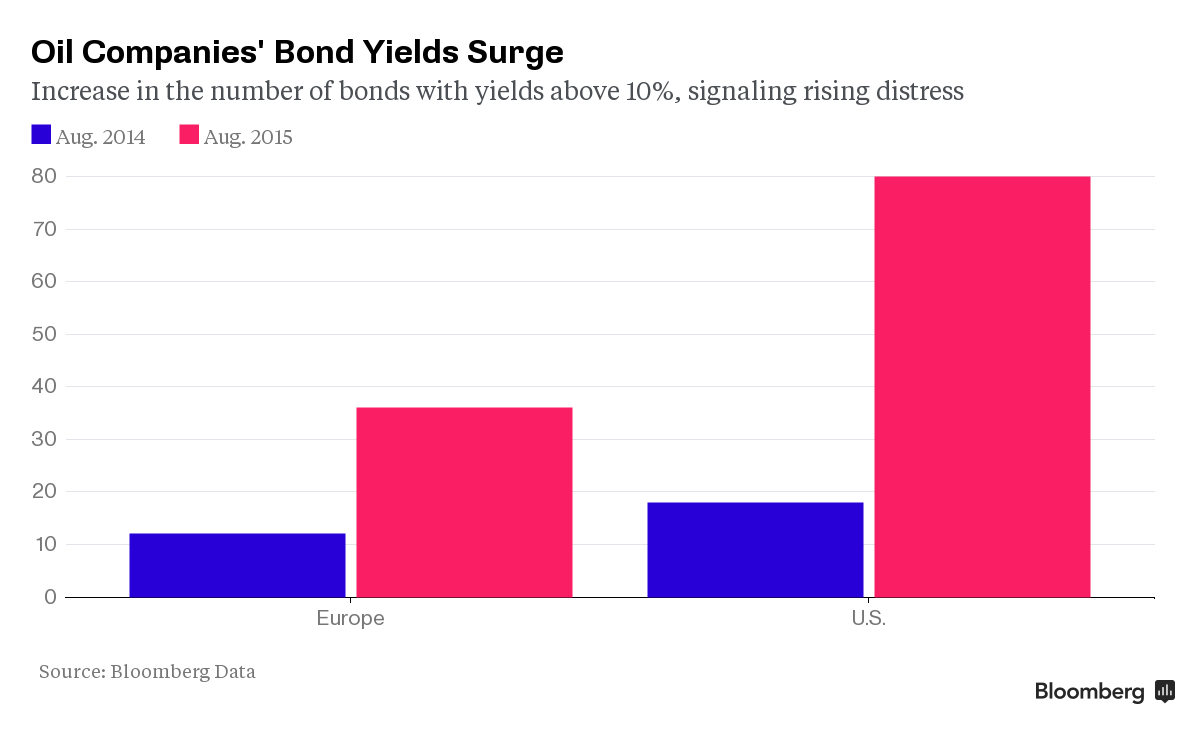

The number of oil and gas sector defaults is on the rise and bond yields are rising across the board for the sector. In fact, the number of bonds falling into the `distress’ range (exceeding 10% yield), has increased markedly over the past year. Whilst the price of crude oil remains below the $40.00 a barrel level the number of corporate bond instruments moving towards junk status will only increase.

Subsequently, the pressure upon small producers is likely to increase as the lacklustre oil prices and increasing bond yields start to eat into their cash flow. Considering that medium term modelling shows WTI prices remaining within the $30’s, the number of distressed bonds and resulting corporate insolvencies can only increase. In fact, according to BMI research, debt repayments are likely to top US$72 billion this year alone.

It is clear that the oil and gas sector is facing a reshaping and consolidation of epic proportions as producers, without the large cash reserves required to survive, will face an increasingly hostile debt market. This is also a global problem, given that Brent producers are suffering much of the same pricing pressures as their American counterparts.

This potential market rationalisation has been expected for some time but the artificial nature of the bond markets have extended out the rebalancing phase. However, as credit ratings continue to degrade, and firms start to face a steepening yield curve, cash reserves for the smaller producers are starting to run short.

In the long run, the larger explorers and production companies are likely to experience net gains from the market rebalancing. Ultimately, a diverse global portfolio of interests and strong balance sheet is likely to provide larger firms with continued access to debt markets and the required capital to survive the slump.

So in closing, keep a close eye on the oil industry, as things are about to get very interesting as a range of distressed bond holders find nothing but pain when it comes time for coupon payments.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

EUR/USD propped up near 1.0750 ahead of European Retail Sales

EUR/USD churned around 1.0770 to kick off the new trading week, with the pair rising after better-than-expected Purchasing Managers Index figures early Monday before settling into familiar chart territory above 1.0750 ahead of Tuesday’s pan-European Retail Sales figures.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

Ethereum traders show uncertainty following huge whale sale, Robinhood Crypto Wells notice

Ethereum holdings on centralized exchanges continue to decline despite recent whale sales. With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.