Crude Oil’s bounce early this week, had short sellers scrambling from their positions but the reality is that the respite will be short lived. Global prices are forecast to continue their slide in a move that provides a gloomy future outlook for the commodity currencies.

The Australian, Canadian, and New Zealand dollars have all experienced a significant selloff throughout the year and subsequently retreated to levels not seen since the onset of the global financial crisis. In particular, Australia is dealing with a sustained fall of iron ore prices and an economy highly focused upon the mining industry. In comparison, New Zealand and Canada are also experiencing a significant downturn in their major export industries, dairy and oil.

The respective nations are all grappling with economies highly concentrated toward commodity production and exports. The reality is that currencies like the Australian and Canadian Dollar are facing further down-side risk, especially considering the potential for a significant domestic slowdown in China. In fact, forecasting by some analysts has highlighted the risk of a 14% drop to the CAD based on falling energy sector demand.

The other looming risk on the horizon to commodity currencies is a hawkish U.S. Federal Reserve intent on raising interest rates. The negative correlation between the US dollar and the aforementioned currencies is clear as they both start to trend in opposite directions. Subsequently, the U.S. talk of raising rates is fuelling an, already substantial, short bias of currencies reliant upon commodities.

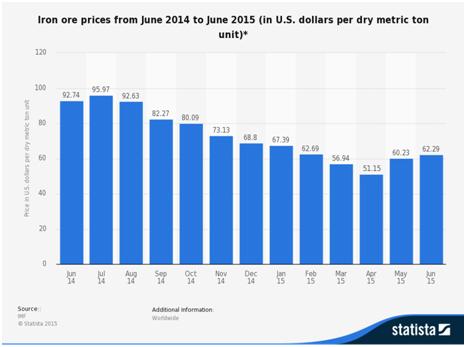

Long term forecasting of commodity prices is also adding to the case for further depreciation of the Canadian and Australian Dollar. In particular, long-run Iron Ore predictions show the commodity still facing additional price declines, in a move that will strongly impact the Australian economy.

The Bloomberg Commodity Index also tells an interesting tale as the key metric fell to a 13 year low recently. The decline in the indicator has mirrored much of the slowing manufacturing activity occurring in mainland China. The index is watched closely by many as the harbinger of contraction within Australia and Canada and many now question whether the commodity dependent countries will experience recession in the early part of 2016.

The reality is that Canada, Australia, and New Zealand have hitched their respective economies to a burgeoning and expanding China. Their respective GDP diversities are limited and they therefore face the very real prospect of contraction within their economies in the medium term.

Ultimately, caution should be the order of the day when positioning for any potential long-side corrections within the commodity currencies. A significant demand slow down, coupled with the possibility of further accommodative monetary policy from their respective central banks, means that the currencies are likely to move in only one direction in the medium term…lower.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

USD/JPY crashes nearly 450 pips to 155.50 on likely Japanese intervention

Having briefly recaptured 160.00, USD/JPY came under intense selling to test 155.00 on what seems like a Japanese FX intervention underway. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD rallies toward 0.6600 on risk flows, hawkish RBA expectations

AUD/USD extends gains toward 0.6600 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.